In this blog entry, we will focus on one particular benefit type being supported in SAP SF EC Global Benefits: insurance. Insurances are a big part of enterprises the employee’s perk package that help attract and retain clients but to this date, there are very few references or blog on SAP SF Insurances. Therefore, I’m hoping to fill some of this gap with this entry.

Also Read: SAP SF EC Certification Preparation Guide

The insurance benefit type is very flexible and can cover the typical insurance uses cases such as:

- Life

- Health care

- Dental care

- Short Term Leave (STD)

- Long Term Leave (LTD)

- Accidental Death and mutilation

- Travel

- And more

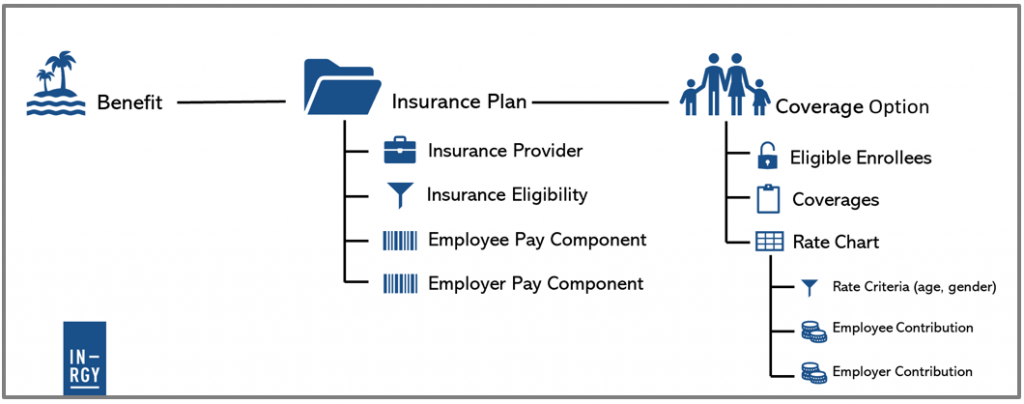

Insurance objects

There are a lot of objects to understand when configuring insurances in global benefits. The picture below is an overview of all the main objects and how they are connected together. In this section, we will do a brief overview of every object and show how it looks configured in SAP SuccesFactors Global Benefits.

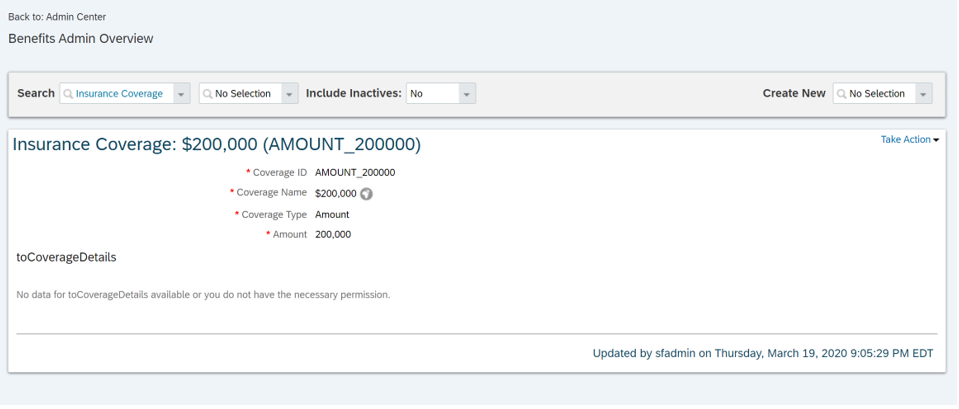

Insurance Coverage

Insurance coverage is the inclusion of an insurance policy or the amount available to meet liabilities. There are 4 coverage options within SAP SuccessFactors:

- Amount:

The coverage amount is a specific amount of coverage. For example, a basic life insurance of 100,000$.

Example of amount coverage:

- Percentage:

The coverage amount is a percentage of a pay component group or a pay component within Employee Central. The final amount of the coverage therefore varies for each employee. For example, LTD insurance of 70% of the weekly salary.

Percentage coverage type allows to specify a minimum or a maximum coverage amount. For example, LTD insurance of 70% of the weekly salary with a maximum of 2,000$.

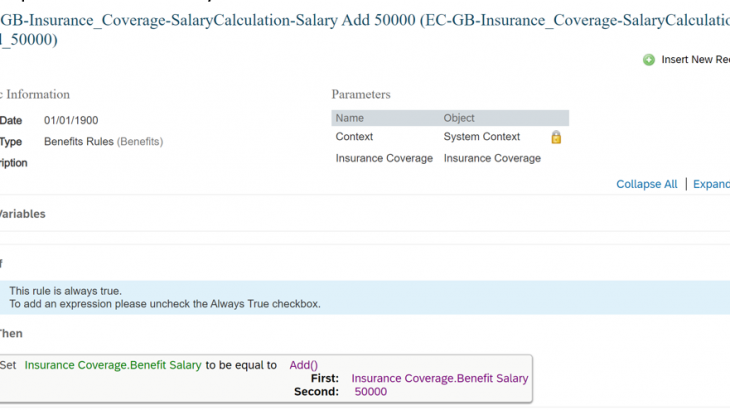

There is also the possibility to apply Benefit Salary calculation rule or a Coverage Rounding rule to the coverage. Benefit Salary Calculation rule makes it possible to “adjust the salary” before the calculation of the % (e.i. 70% of the weekly salary + $500) while the Coverage Rounding rule “adjust the coverage amount” after the % calculation (e.i. 70% of the monthly salary rounded up to the nearest thousand).

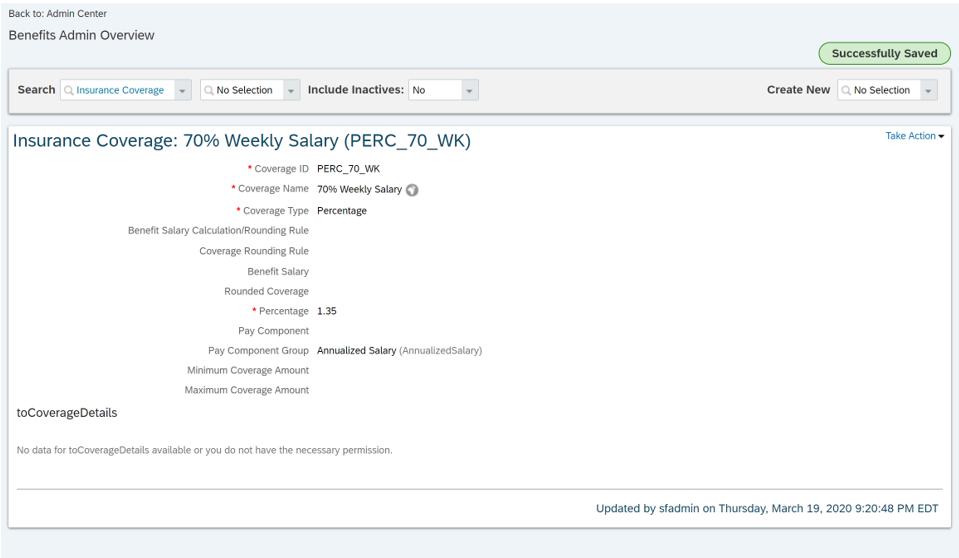

Example of percentage coverage:

- Factor

The coverage amount is a multiply quantity of a pay component group or a pay component within Employee Central. For example, AD&D insurance of 2.5 times the employee’s annual salary. Just like percentage, factor can have a maximum and a minimum and salary & coverage calculation rules.

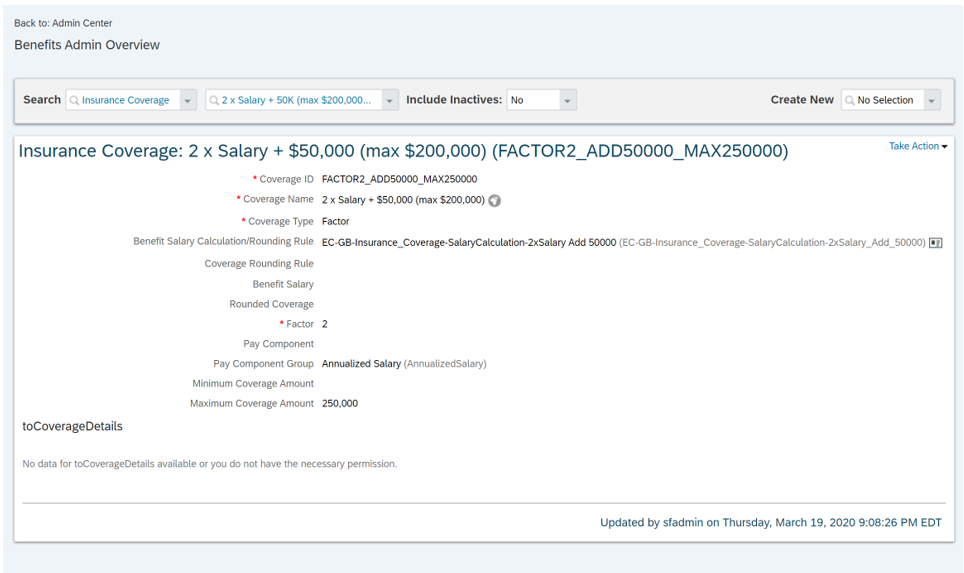

Example of factor coverage:

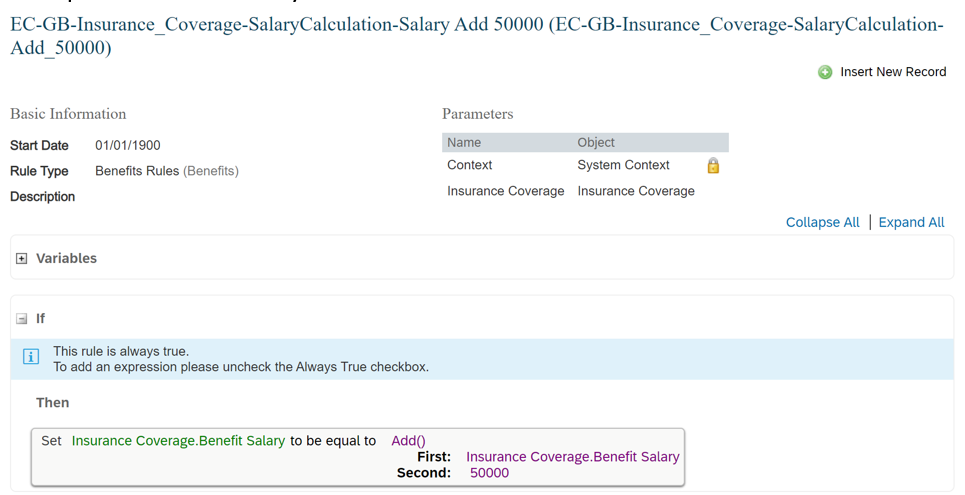

Example of benefit salary calculation rule:

- Other

Anything else can fall into this category. For example, Family Medical Care coverage.

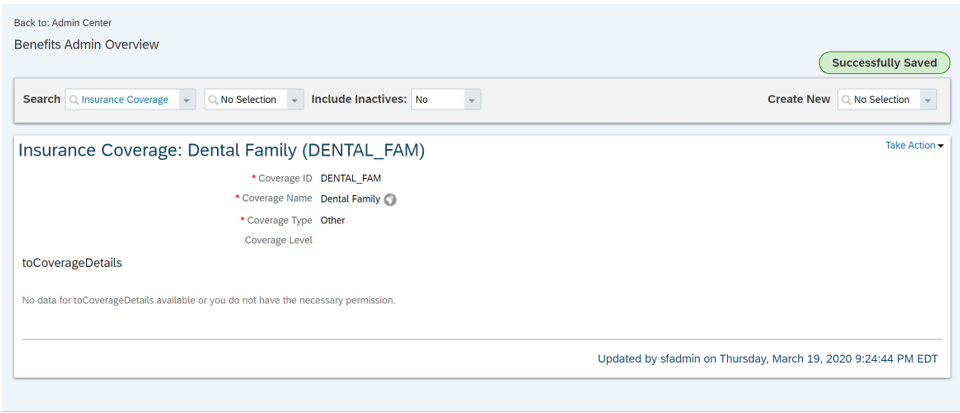

Example of other coverage:

Eligible Enrollee Options

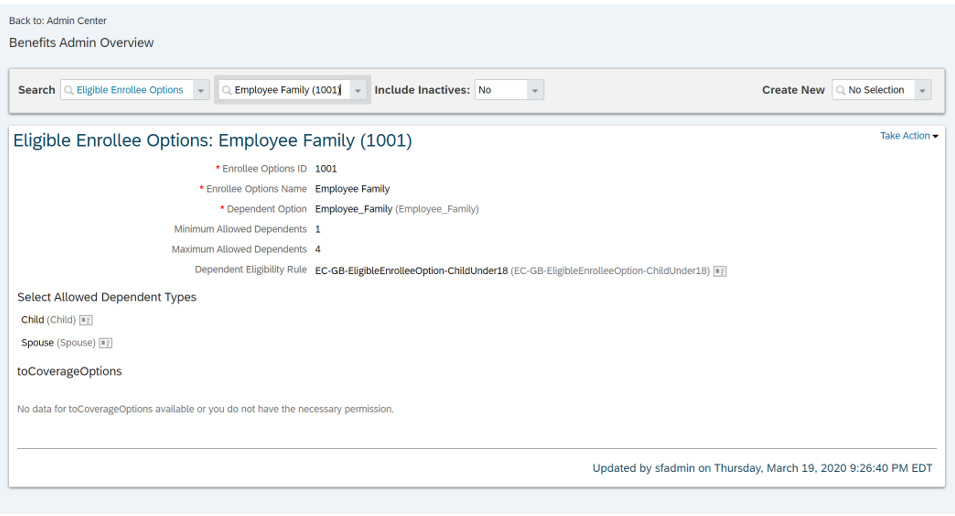

Eligible enrollee options define which dependents are eligible for an insurance. This object will be used within the insurance plan object configuration. Once all set-up, when the employee will try to add dependent to a benefit insurance enrollment, the system will check if the dependent is eligible based on the eligible enrollee option object, if not the system will throw an error pop-up message.

In the eligible enrollee option, we will define which dependent relationship type (from the personRelationshipType picklist of the dependent portlet) can be added when enrolling to an insurance, if there is a maximum or a minimum number of dependent to be added when enrolling and a rule to validate the dependent is eligible. For example, you can specify that if the employee enroll to an Employee and Family eligible enrollee option for an insurance, the employee must enroll at least 1 dependents in the benefit enrollment and only Spouse or Children under 18 years old are allowed to get the benefits.

Example of other eligible enrollee options:

Example of eligible enrollee options rule:

Note that right now, the Eligible Enrollee Option name is not translatable field and appears in the Benefit Overview screen.

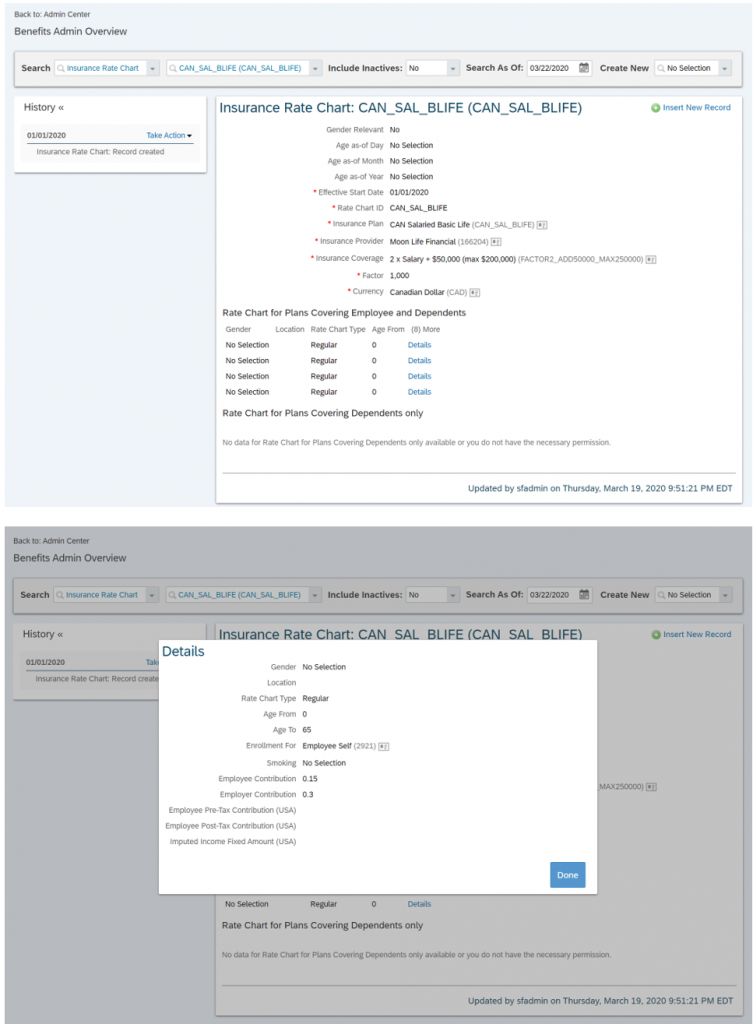

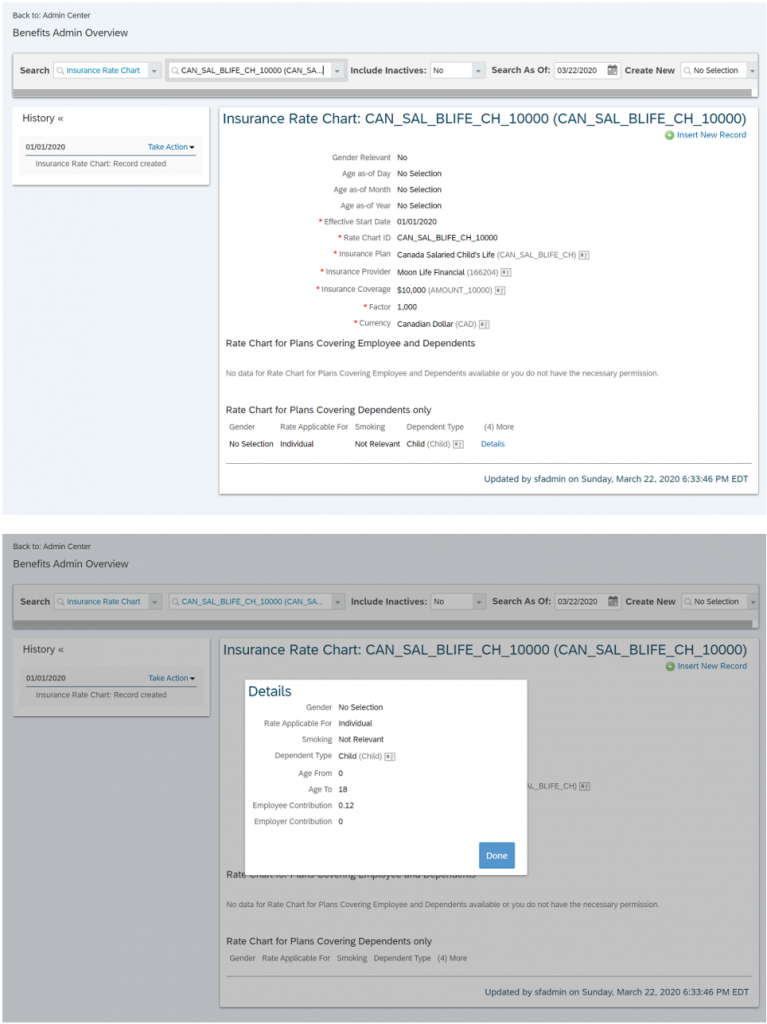

Rate Chart

Rate chart is used to determine the premium and employee and the employer will pay for a specific coverage within an insurance and the factor used in the calculation.

A rate chart can be for an Employee & Dependents or for Dependent Only.

Employee & Dependent rate chart calculates the premium before employees adds (or don’t if employees only insurance) eligible dependents when enrolling to the insurance. Criteria that can be used in defining the rate chart premium are Age, Smoker, Employee’s Location and Gender of the employee. Currently, it is not possible to add more custom criteria.

Example of rate chart for Employee & dependents:

Dependent Only rate chart calculates the premium after enrolling a dependent to an insurance. It can calculate premium per dependents or per group of dependents (e.i. child life insurance where the employee pays the premium for each child he enrolls versus child life insurance where the employee pays the premium 1 time regardless of how many children he has and all are covered). Criteria that can be used in defining the rate chart are Age, Smoker, Dependent Type and Gender of the dependent. Currently, it is not possible to add more custom criteria.

Example of rate chart for dependents only:

There is also the option to specify at what time to evaluate the employee’s / dependent’s age when calculating the premium which is either a specific day and month of the enrollment year or the enrollment effective year.

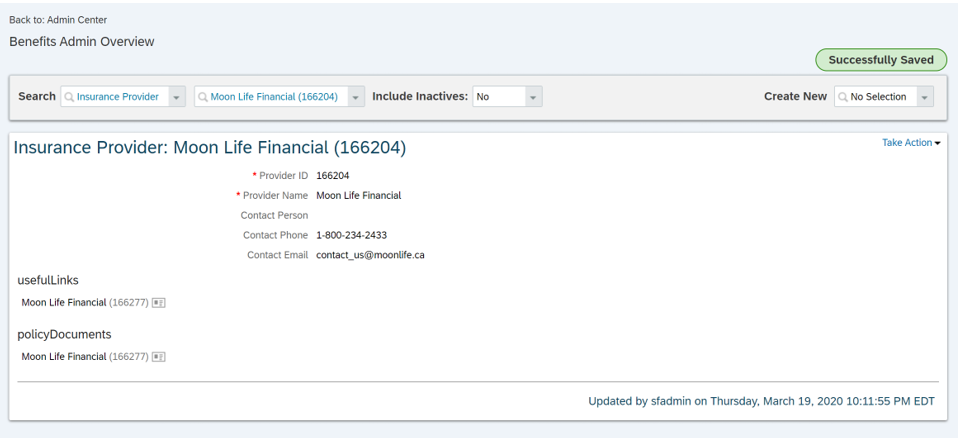

Insurance Provider

Insurance provider object identify the insurance provider, their contact information and allows to add a link or a document describing the provider

Example of insurance provider:

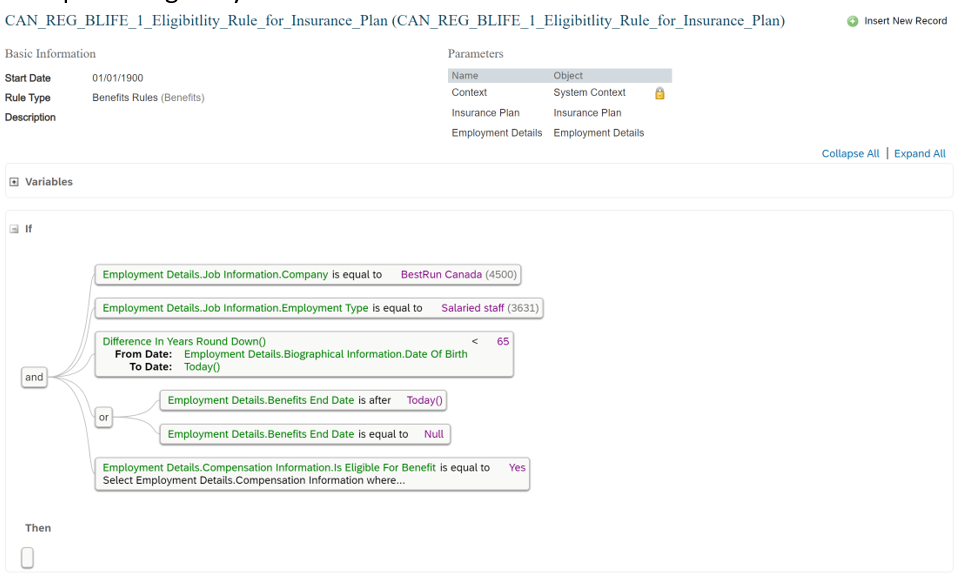

Insurance Plan Eligibility Rule

Insurance eligibility rule defines which employee is eligible to a specific insurance plan. Rule uses the SuccessFactors rule engine.

Example of eligibility rule:

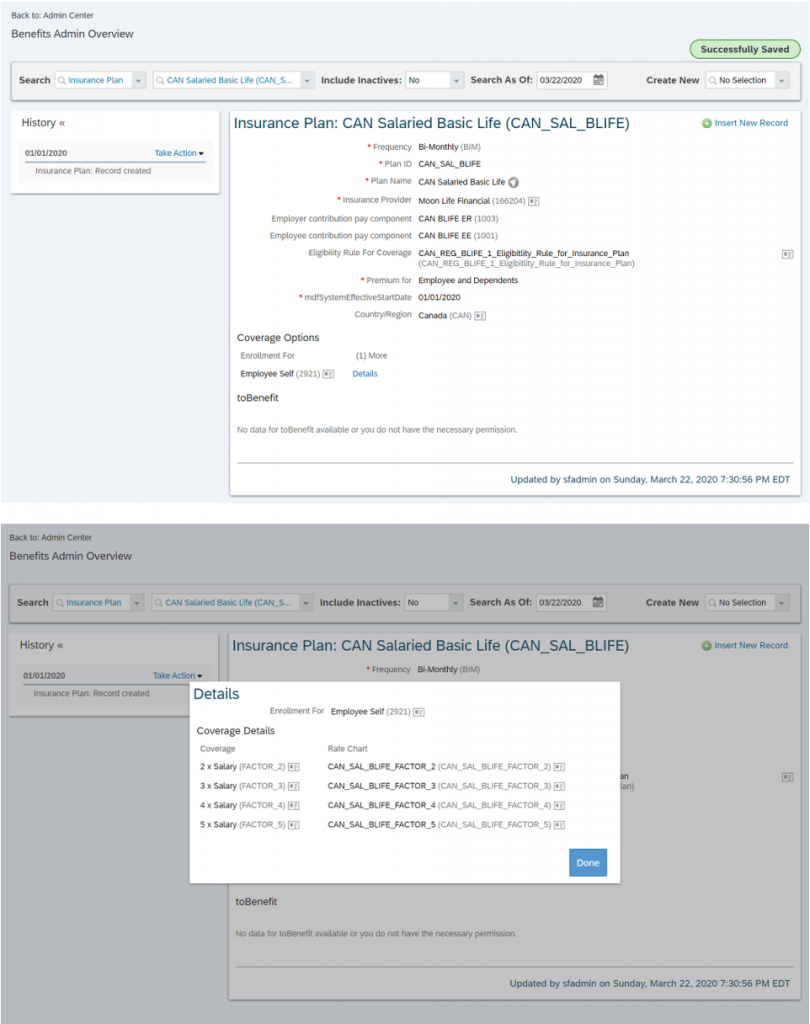

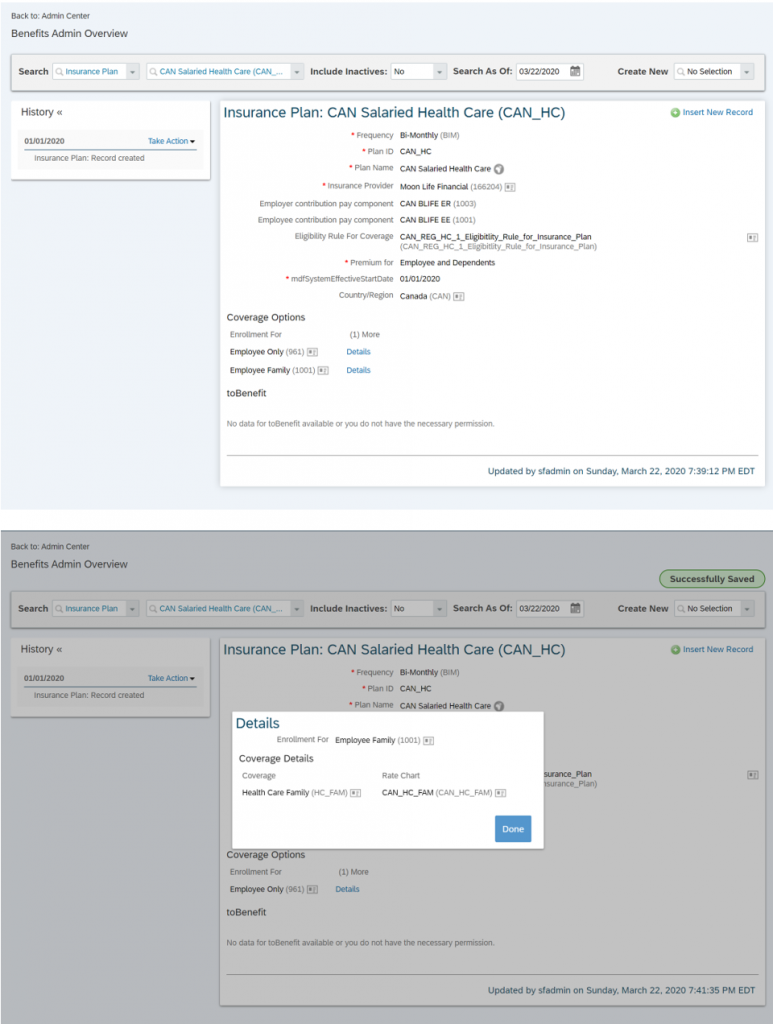

Insurance Plan

Insurance plan is where all objects described so far connects together. The insurance plan specifies the provider, the eligibility rule, the pay components to be used for the employee & employer premiums, the coverage options and the rate charts to be used for a specific insurance.

Example of a basic life insurance plan:

Example of a health care insurance plan:

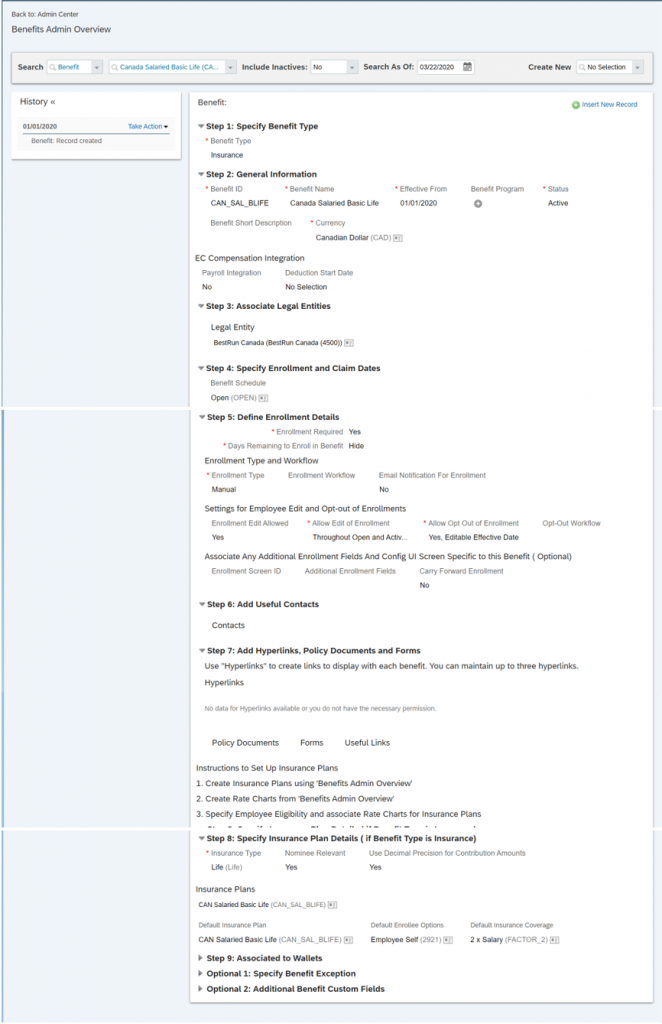

Benefit

Finally, once the set-up of the insurance plans is done, we need to create a benefit object to encapsulate all of it and make it available to employees. The benefit object will specify the benefit name (that will be displayed in the employee people profile benefits tiles and the employee benefit overview screen; note that currently this field is not translatable), the benefit schedules (that specify the benefit enrollment period), if there is payroll integration for the benefit (to the EC deduction portlet for the employee contribution only), whether the employee will enroll manually during the enrollment period or automatically through the auto-enrollment job (auto-enrollment job enrolls the employee the day he becomes eligible for the benefit and un-enrolled the employee if he’s not eligible anymore), the benefit screen (config UI) that will be used when the employee enrolls to or edit the benefit enrollment, it also specifies some benefit permissions and workflows to be used when enrolling.

Also, there is some insurance specific fields in the benefit object such as if the insurance is nominee relevant (does it require the employee to identify beneficiary for the insurance when enrolling), the insurance plans that are available in the benefits and the default insurance option (when enrolling manually, the enrolling screen will default the insurance, coverage option and coverage field to the default option; when enrolling with the auto-enrollment job, this is the insurance, coverage option and coverage that the employee will be enrolled to. Note: currently, it is only possible to specify one default option per benefits).

Insurance Structure Example

Now that we understand the objects and the structure, let see some example of potential configuration of specific insurances. There is a lot that can come into account when deciding how to configure specific client benefits (will it be a new coverage option within an insurance plan? a second insurance? If we have multiple insurance plans should we put the plans in same benefit? or different benefits?). It really depends on the different requirements, but I hope to highlight some good use cases in this section.

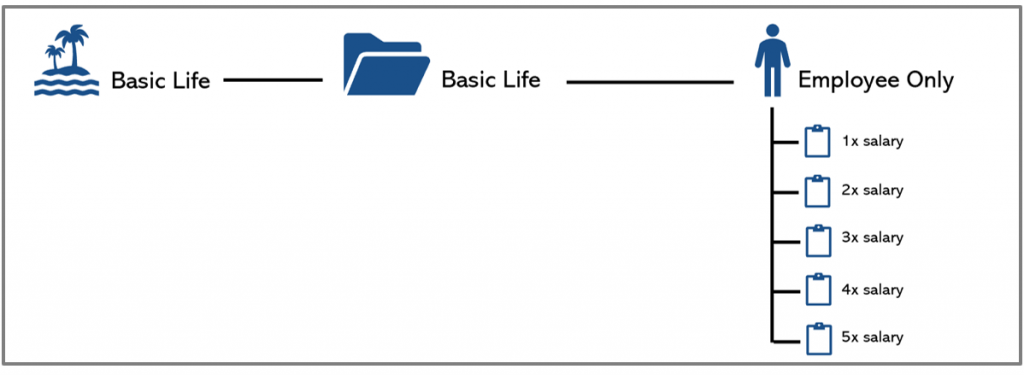

Basic Life Insurance

Use case: All employees are eligible to basic life. During enrollment period, employees can choose between coverage from 1 time their salary to 5 times their salary.

This a simple straight forward case. We would build one insurance plan containing the five coverage options (from 1 to 5 times the salary) and 1 benefit for the plan.

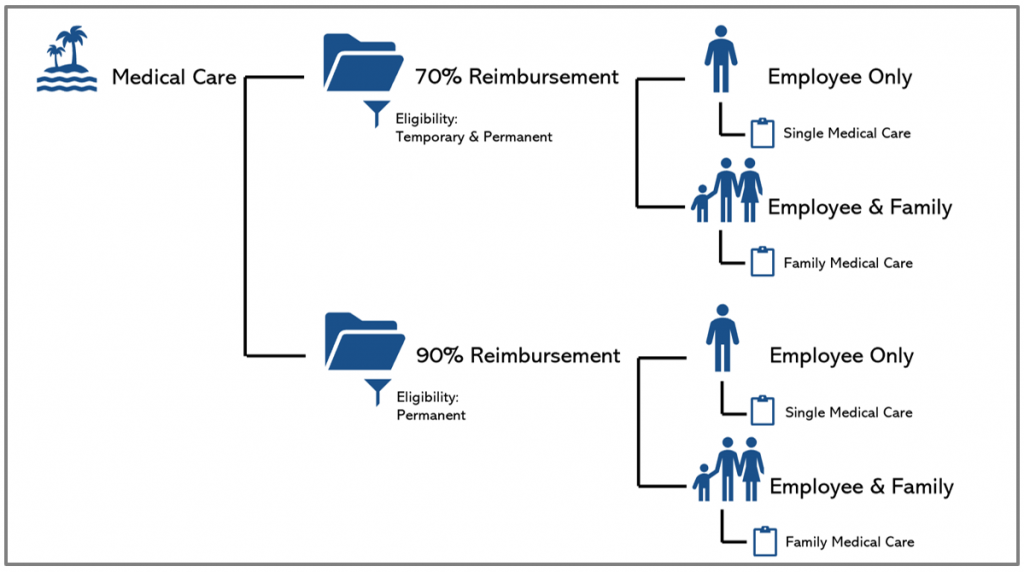

Medical Care Insurance

Use case: Employee can choose between single or family medical care coverage. All employees (permanent and temporary) are eligible to the 70% reimbursement of medical fee option. Only permanent employee can choose the 90% reimbursement of medical fee option.

This is a bit more complex case. Since the eligibility of the 70% and 90% reimbursement plan is different, we would need to create two insurance plans each with a different eligibility rule. Each plan would be grouped together under one single benefit object and each plan would have both single and family coverage options.

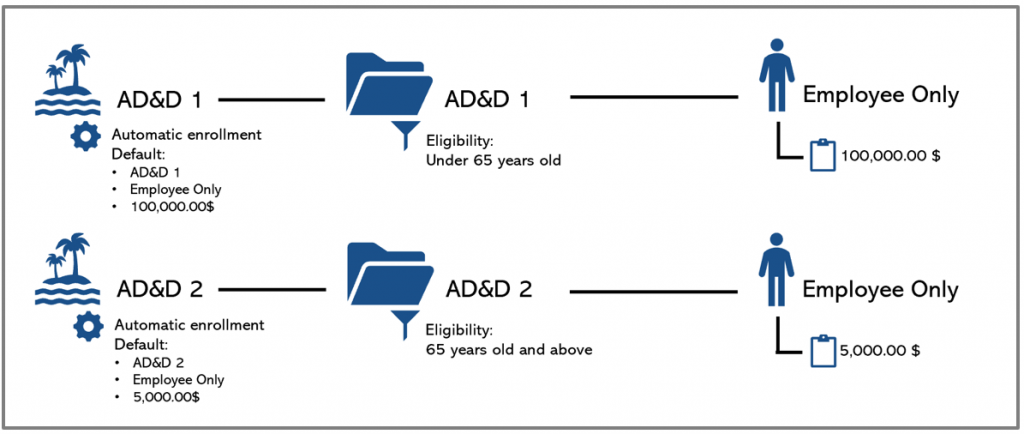

Mandatory basic accidental death and mutilation (AD&D)

Use case: All employees must have AD&D insurance. Employee under 65 years old are covered for 100,000.00$ while this amount is reduced to 5,000.00$ when the employee is turning 65 years old.

Since we want to use the auto-enrollment job (automatically enrolled when eligible) and in the benefit object, we can only specify 1 default insurance plan, coverage option and coverage per benefit, we need to create two different benefits each with a different default option. Each benefit would have their own insurance plan, with different eligibility rules and coverage options/