Introduction

This blog post continues a series of Controlling related topics, which circle around showcasing new functionalities in SAP S/4HANA Cloud, comparing functionalities between SAP S/4HANA Cloud and SAP S/4HANA (on premise), as well as general topics to be considered from Management reporting/Controlling point of view when implement SAP S/4HANA.

Focus of this blog posting is on the functionality of Top-down Distribution, which is available in both SAP S/4HANA Cloud and SAP S/4HANA (on premise) and is part of the Universal Allocation.

- It is a powerful tool to distribute costs and revenue

- If you are new or interested in SAPs Universal allocation

Top-Down Distribution vs. Allocations

Top-down distribution is a functionality within Margin Analysis, in which revenue or costs can be distributed from an aggregated level to a more granular level, to enable a more detailed profitability analysis. This makes sense for those costs that can only be captured at a higher level e.g. a freight invoice that does not specify the products carried.

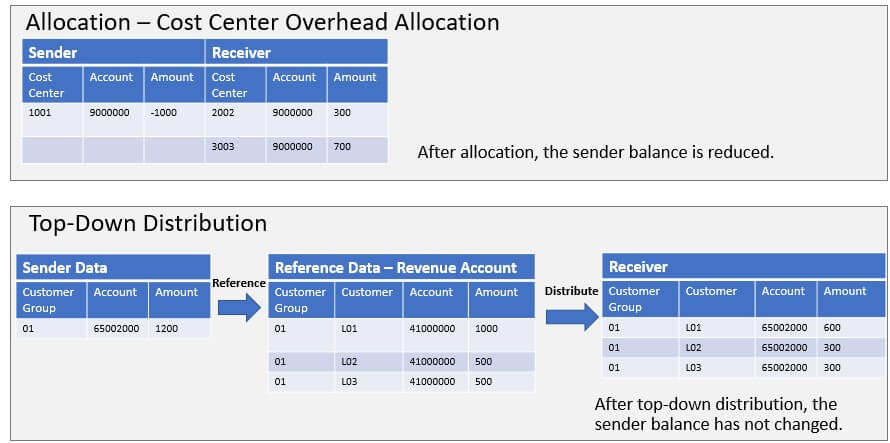

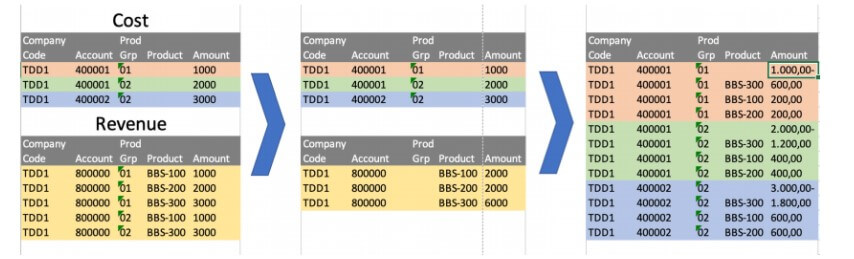

Top-down distribution differs from allocations in the way that it does not change the amount on the sending object, it only distributes it to a more granular level (Comparing to allocations, where the sender is typically reduced with certain amount). An example is shown in figure 1, comparing and Overhead Allocation with top-down distribution.

Common examples of when to use top-down distributions are e.g. freight invoices, insurance expenses, advertising costs, or other items which are booked on an aggregated level (e.g. product group or customer group) and could be distributed to a more granular, e.g. using revenue postings as “reference”.

In case the original posting is not posted on a profitability segment (e.g. customer group), but only on cost center. Then, before doing the top-down distribution you can run an allocation to margin analysis (from cost center to profitability characteristic dimension), after which you can perform the top-down distribution. This approach can also be used to reduce number of records. It is also worth noticing that you cannot perform top-down distribution for attributed profitability segments.

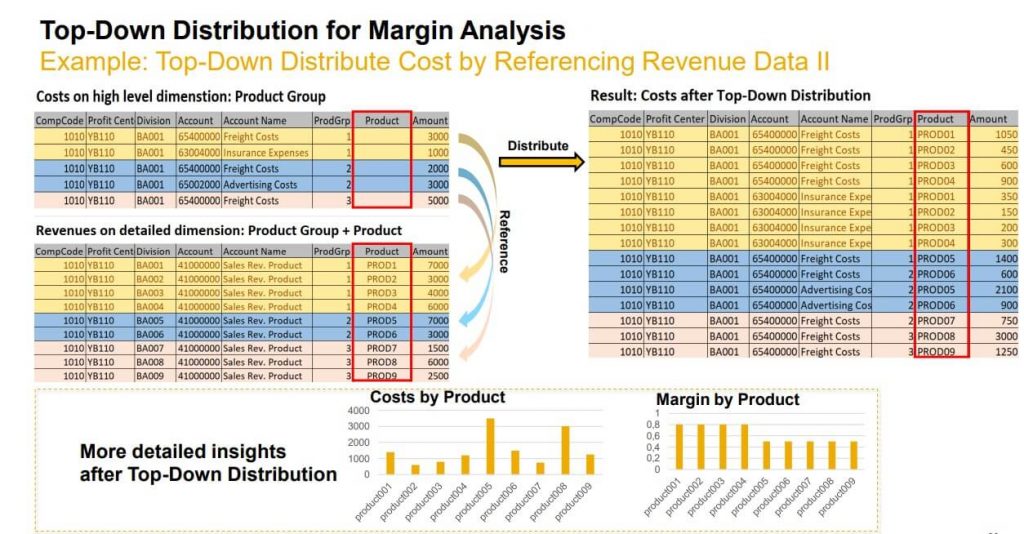

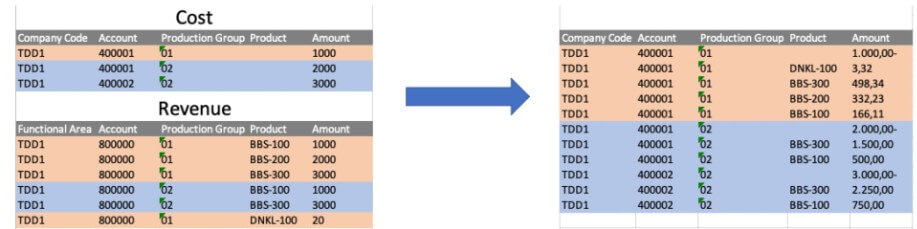

Figure 2 shows an example where freight and insurance costs are initial booked on a product group level (without product information), and then distributed to product level with top-down distribution. Top-Down Distribution is done with reference to the revenue accounts for which postings have been captured on product level (and by product group). This allows the system to distribute the product group values (higher level) to the products (more granular).

Some further key highlights:

- Top-down distributions can be done for actual values, but the reference values can also be planned values (or quantities).

- Meaning that the allocated cost, can be based on plan quantities or amounts (e.g., if the actuals are not yet available).

- Meaning that the allocated cost, can be based on plan quantities or amounts (e.g., if the actuals are not yet available).

- The distributed amount and the reference postings do not need to be within same period interval but can be in different periods.

- g., sale of the products where in January, while the freight costs to be distributed are in February.

- g., sale of the products where in January, while the freight costs to be distributed are in February.

- Top-down distribution, supports Cumulative amounts

- You can define which characteristics are to be distributed (this is done when defining the template)

- In case you are using SAP Situation handling

- Top-down distribution supports situation handling via standard situation template FIN_ALLOCATION_RUN_WARNING_ERROR. For additional information, refer to SAP Best practice scope item Situation Handling (31N).

System example

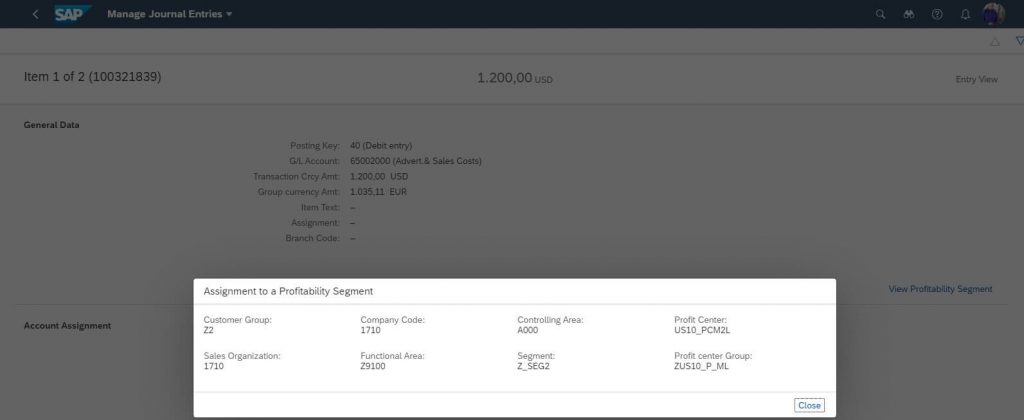

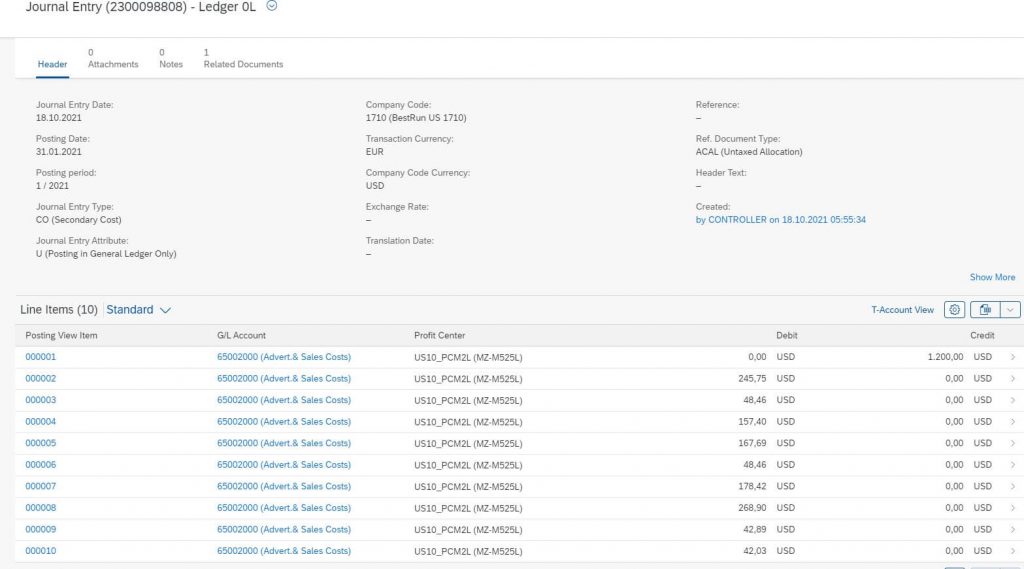

In this system example there are advertising and sales costs which are initially posted on customer group level (figure 3 showing the posting from Manage Journal Entries Fiori), which I would like to allocate to customer level, using revenue amounts as reference. This system example is from an SAP S/4HANA (on premise) 2020.

Creating the cycle

Before the top-down distribution can be executed, a cycle needs to be created, which contains the rules for the top-down distribution. Creating the cycle can be considered as a yearly activity, but it might need updates on certain interval (e.g. if underlying master data or postings change).

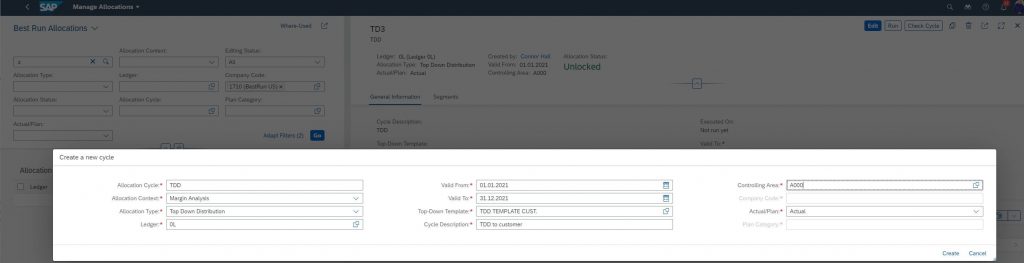

When opening the Manage Allocations fiori and clicking on “create” you can select Margin analysis and top-down distribution. When you select the allocation type “Top Down distribution” you always need to select a template to be used (Figure 4 below shows a template that can be used to allocate to customer level).

In SAP S/4HANA Cloud you have three ready-made templates (Distribution by customer, By product, and by customer and product). In SAP S/4HANA (on premise) you can select to use the best practice SAP Best Practices Margin Analysis J55 or then you can configure the template(s) to be used (this is a one-time configuration and is quick to do). If you are in SAP S/4HANA (on premise), without the best practice, you should check also that your CO transaction type is assigned to a number range (AAAT – Univ.Allocation Top Dw. Dist).

Defining a Template

This section will show how to create an own template in SAP S/4HANA (on premise), to better understand how it impacts the top-down distribution results. This is an activity can be considered as a one-time activity (or seldomly to be done), but might need to be reviewed when you have new use cases for top-down distributions.

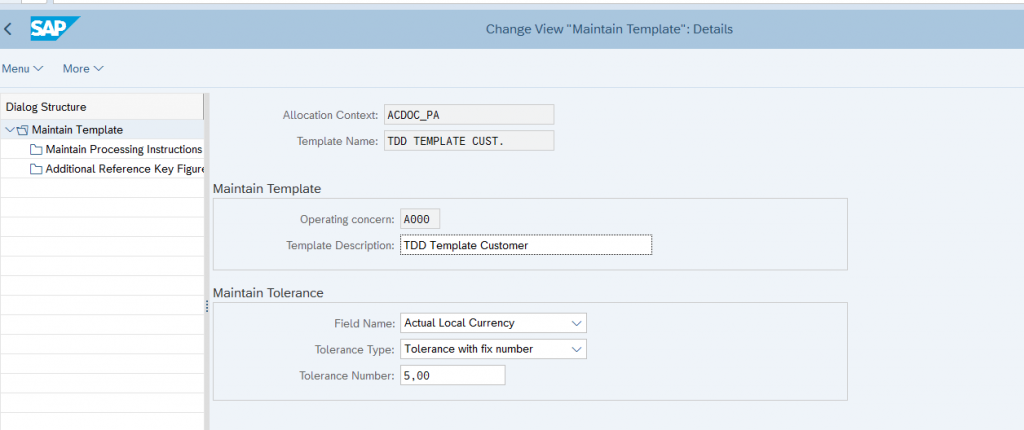

When creating a template, you need to start by giving it a description and optionally adding a tolerance limit (figure 5 below). By adding a tolerance limit, you can reduce the data volume caused by the distribution, which can improve performance. Also, it might not always be very value-adding to distribute a 0,01 value.

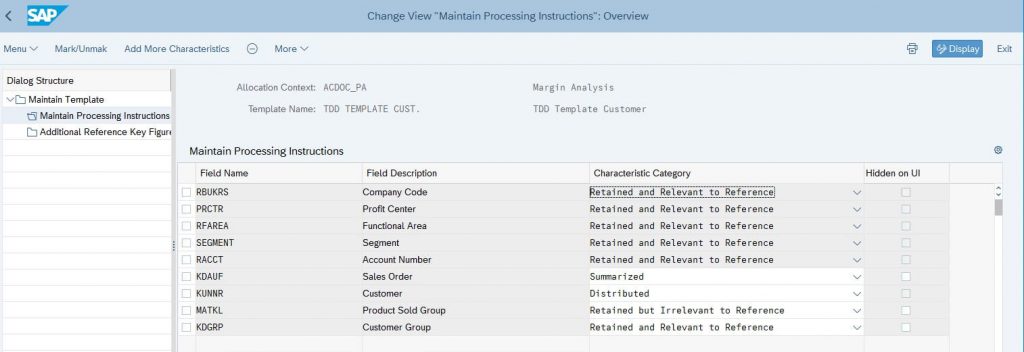

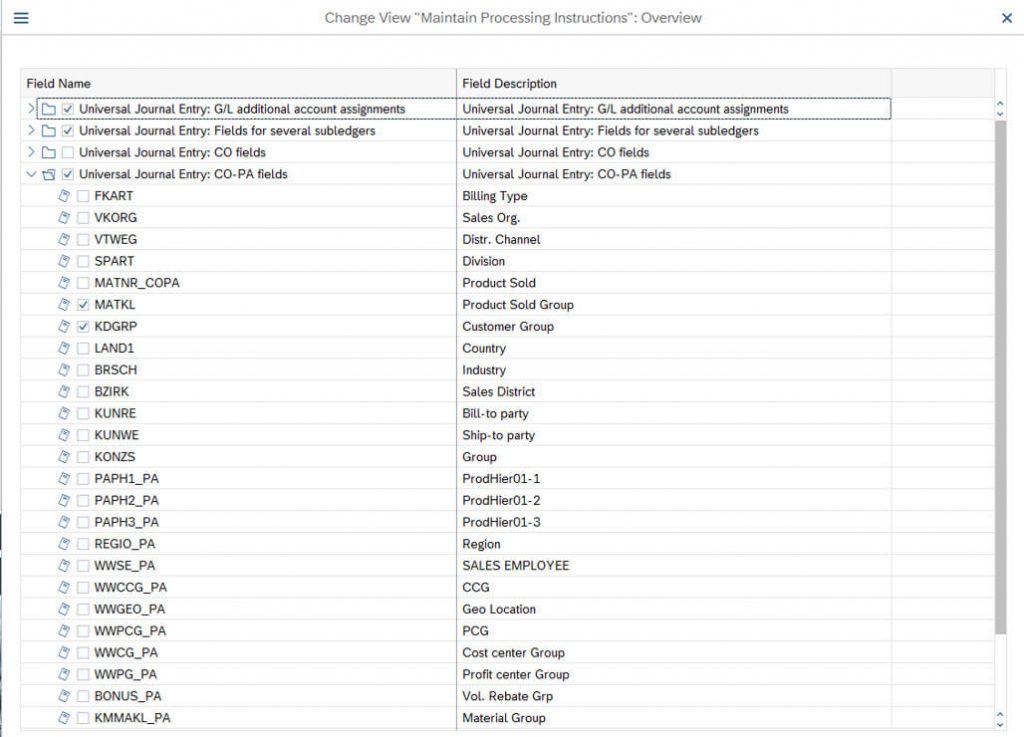

The main part of the template creation includes maintaining the fields/dimensions we want to use in the distribution (figure 6 below).

The Characteristic category defines how different fields are handled in the top-down distribution. This is an important step, as it affects the allocation results.

- Distributed:

- This Characteristic set as this category is the detailed dimension you want to do the distribution.

- Retained and relevant for reference

- Characteristic set as this category is used for sender data and reference data selection.

- During distribution, this field is used to link sender data to corresponding reference data.

- In the distribution result, the value of this field is retained as it is in sender.

- Retained but Irrelevant to Reference

- Characteristic set as this category is used for sender data and reference data selection.

- During distribution, this field is not used to link sender data to the corresponding reference data.

- After distribution, the value in this field is retained in the distribution result as it is in the sender.

- You should choose this category if you want more characteristic values retained in the distribution result

- Summarized

- Characteristic set as this category is used for sender data and reference data selection.

- After sender data and reference data are selected, the value in this field is cleaned up. So, the corresponding sender data and reference data will be summarized.

- In the distribution result, the value of this field will be empty. However, if the derivation logic is defined, the value will be filled from derivation.

Therefor it is worth noticing that the more fields you maintain as retained, the more data volume your top-down distribution will require. Also, you will need to maintain reference mapping “Retained and relevant for reference”, e.g. to map cost account and revenue accounts (which can require more maintenance efforts to keep the cycle up-to date).

There is also possibility to add further fields for the template (e.g. if you have created your own profitability characteristic/dimension, which you want to use in the distribution, as shown in figure 9).

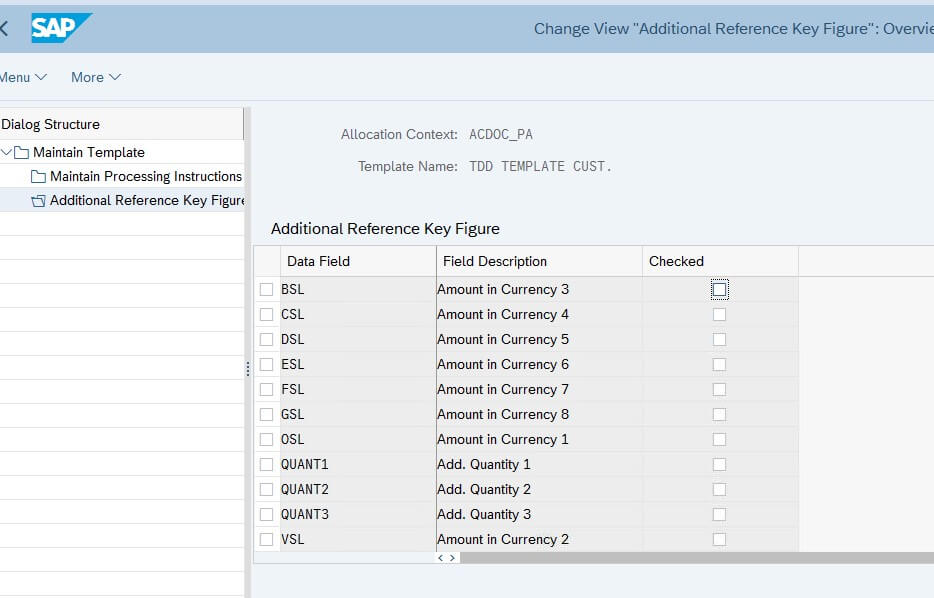

Additional amount and quantity fields can be used for additional key figure reference. However, it is important that all accounting document line items should have the same unit of measurement for the chosen key figure.

Creating the segment for the cycle continued.

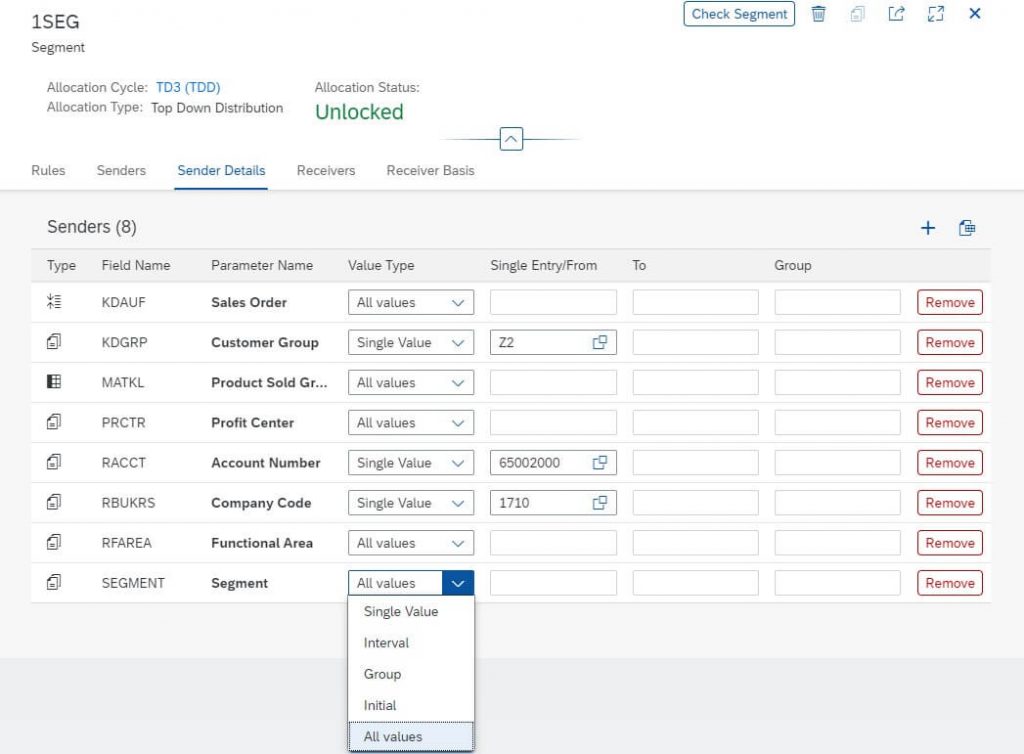

The next step is creating the segment for the cycle – In this case the segment sender is customer and initial values. The sender details are what identifies which documents should be distributed to more granular level.

- Figure 11 shows the selection of account number, company code and customer group, that have been used to select the specific cost posting to be distributed – but these can be maintained and changed according to your specific needs.

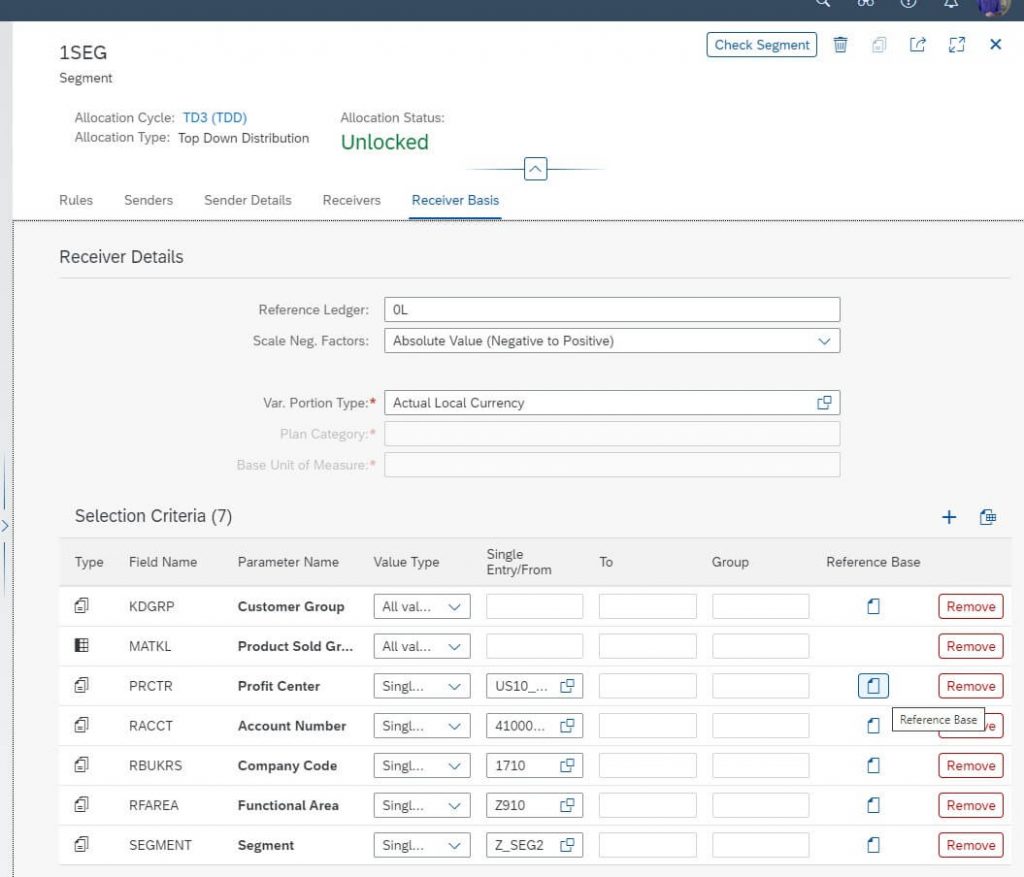

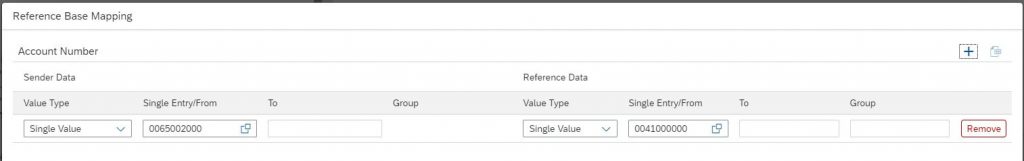

In the receiver Basis you need to maintain the values for selecting the receiver (Figure 12), as well as reference base mappings, for fields where senders and receiver values need to be mapped (e.g. account in below example, shown in figure 13).

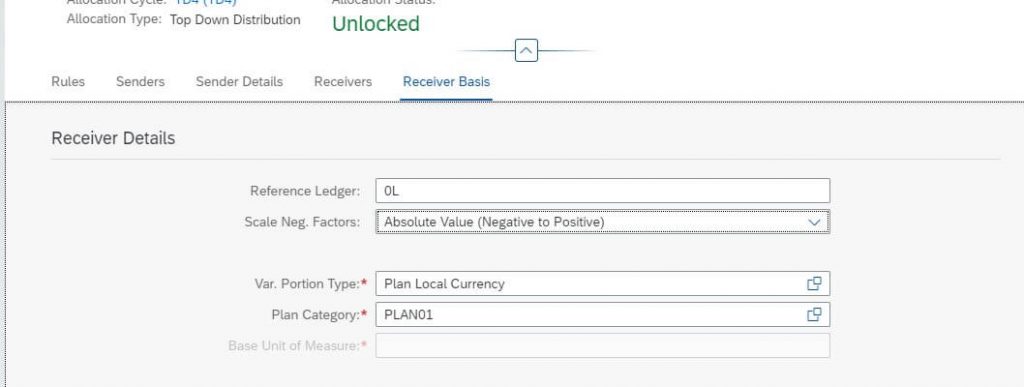

If so wished, it would be possible to select reference data based on plan values or quantities, instead of actuals which can be useful in certain cases (figure 14).

Executing the Cycle

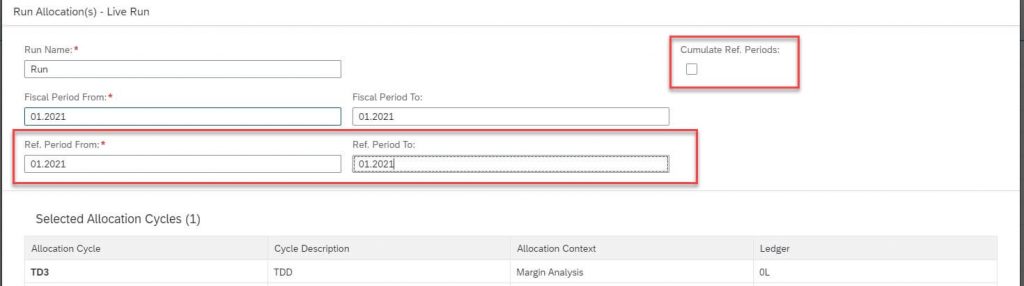

Once the cycle is created it can be run by pressing the “Run” button in the “Manage allocations” Fiori or going to the “Run Allocations” Fiori. If your cycle doesn’t change too much, then this is the only activity you would need to run on a regular basis. You can also schedule the run of these cycles.

The interesting part here, is that you can select the reference period, e.g. if the reference posting are from different periods. You can also select to cumulate the reference periods.

Viewing results

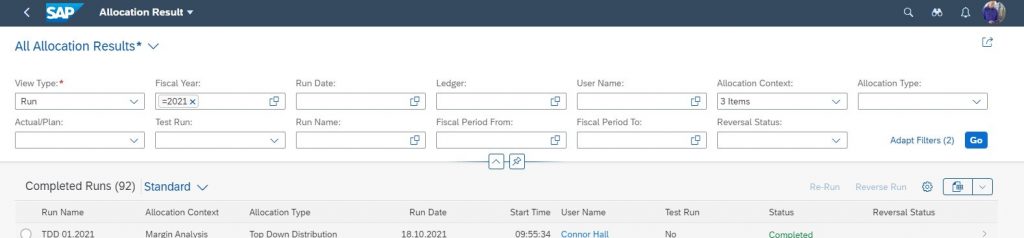

To view the results, we can use the “Allocation Results” Fiori app.

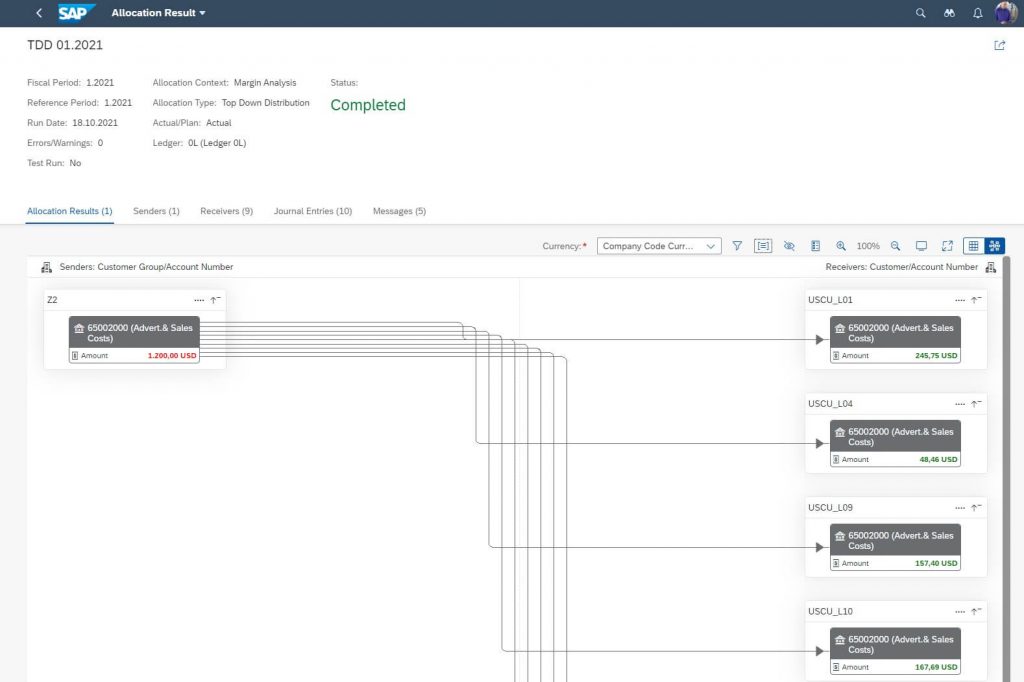

The top-down distribution can be viewed by network graph to visualize the results, as shown in figure 17.

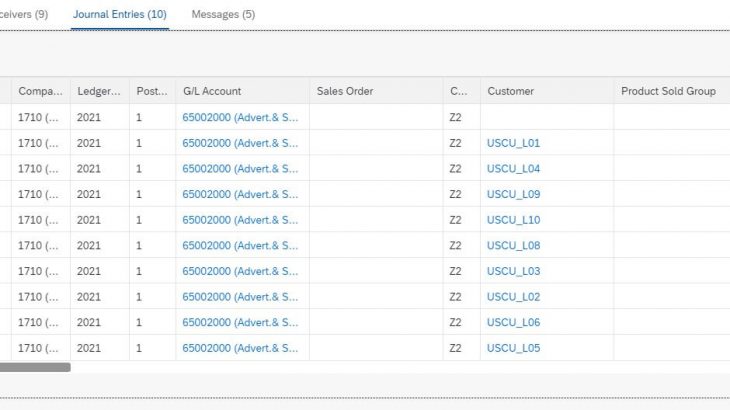

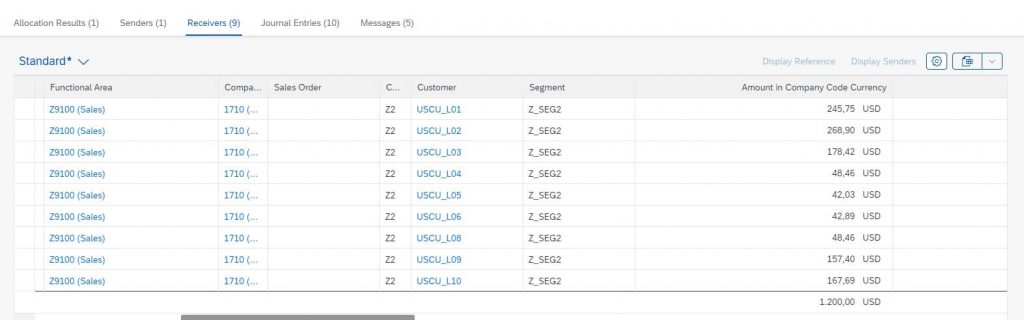

You can also select to view only Receivers and the journal entries that occur from the top-down distribution.

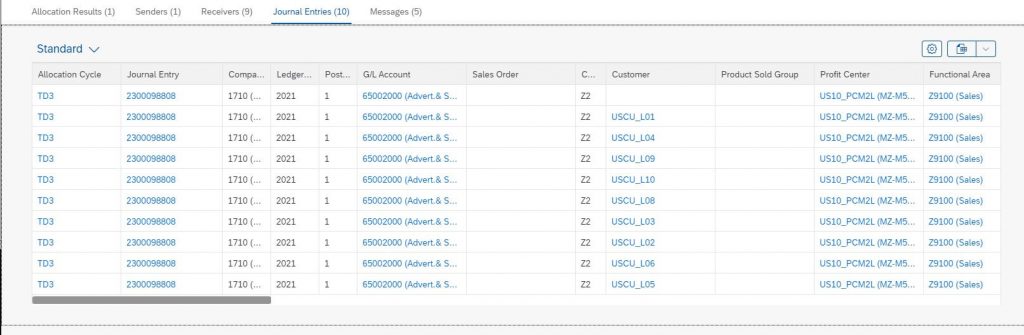

You can also drill down to the journal entry itself, below is the journal entry of the top-down distribution in this example.

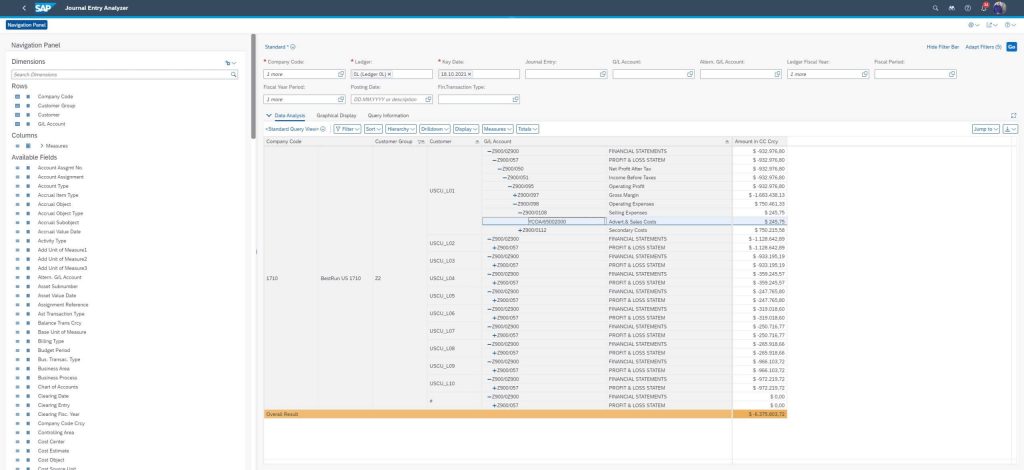

As actuals are updated in the universal journal, you can also view it in the details from multiple different reports. Below an example using the “Journal Entry Analyzer” fiori report to look at the customer profitability.

News for release SAP S/4HANA (on premise) 2021 which relate to top-down distribution:

With the SAP S/4HANA (on premise) 2021 release a new functionality of Calculate records is available – When using the Top-Down Distribution allocation type, you can use the Calculate Records button to calculate the theoretical data volume that will be created when you run the allocation cycle.