Check Calculation Procedure SAP

The following tutorials guides you how to check calculation procedure in SAP step by step

IMG Path :- SPRO > IMG > Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Check Calculation Procedure

The standard system comes with two tax calculation procedures.

- TAXINN – Condition Based

- TAXINJ – Formula Based

TAXINN :- TAXINN supports only condition based excise determination

TAXINJ :- TAXINJ support the condition based and as well as formula based excise determination

The difference between TAXINN and TAXINJ procedure is, TAXINN is a condition based and we have to maintain condition records for each condition type and TAXINJ is a formula based for which we maintain a tax code by using FTXP

Tax calculation procedure configuration process :- Tax procedure can be defined by coping existing procedure or by defining new entries

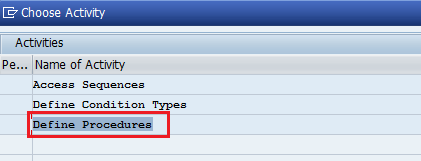

Select “Define procedure”

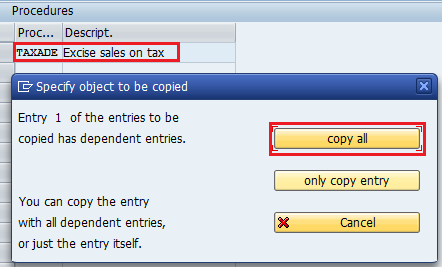

Select TAXINJ and click on copy as icon,

Update your new tax procedure key and press enter

Then select “copy all” , all the entries from TAXINJ copied to new tax procedure TAXADE

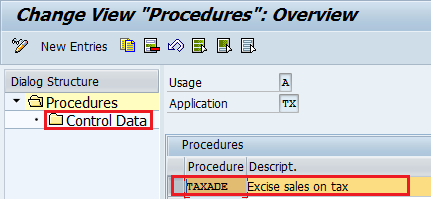

Select Tax procedure and double click on control data

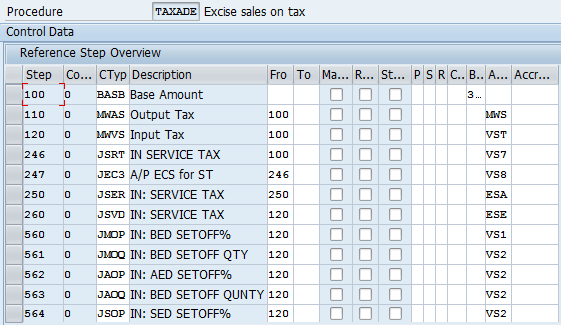

Next control data overview screen , check all condition type, add new conditional as per company requirement.

Click on save icon to save the configured data. Successfully you defined new procedure.