Intro:

A rebate is a special discount which is paid retroactively to a customer. All rebate related details are defined in a rebate agreement for instance – rebate agreement type, rebate recipient, validity of the agreement, etc.

The rebates are posted statistically to an invoice which means they’re not paid for every invoice that is sent to the customer. It is not paid to the recipient until the end of validity period of the rebate agreement.

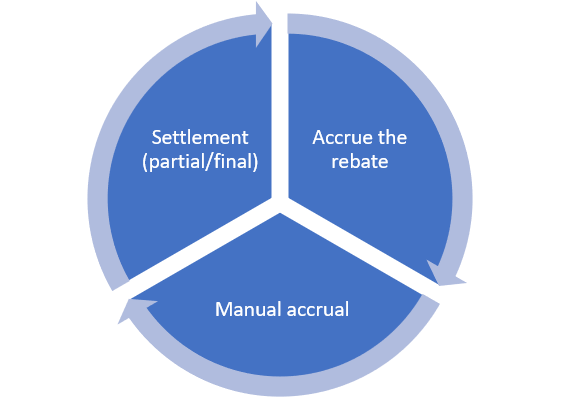

Rebate is accrued automatically by the system or can be posted manually which provides the collective information on the amount of rebate accumulated for a customer. This is finally settled after the end of agreement when a credit is issued to the customer for the total rebate. This flow is represented in figure below:

There are different rebate types based on:

- Material

- Customer

- Customer hierarchy

- Group of materials

Below I would like to touch upon – Rebate based on a customer

Prerequisite for rebate processing:

There are three prerequisite to enable or activate rebate which are at these levels:

- Sales Organisation

- Billing type

- Payer

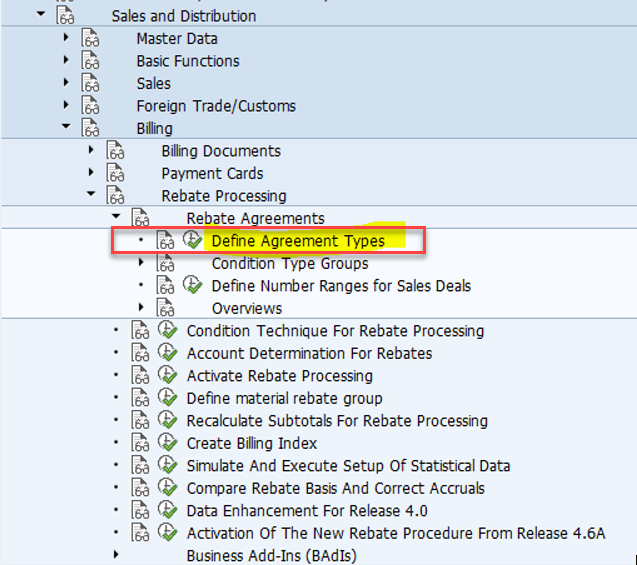

SAP Configuration:

SAP SPRO menu path for Rebate Processing:

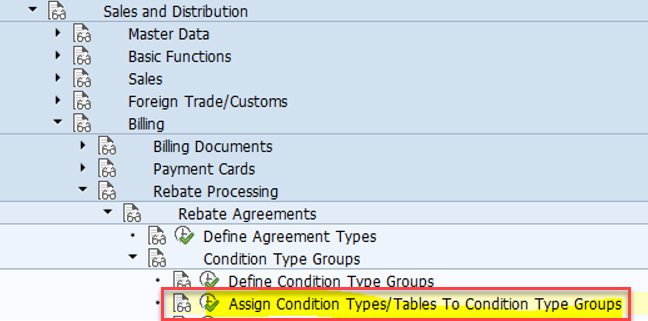

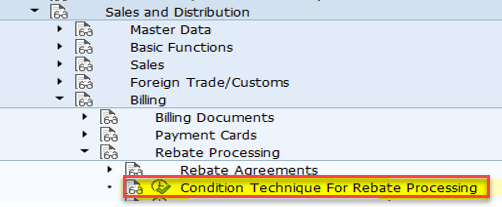

Essentially, most of the configuration for rebate can be found in the below node in SPRO:

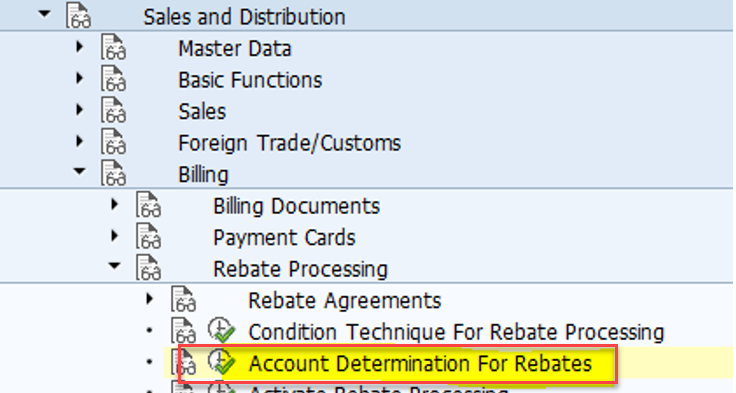

Sales and Distribution – Billing – Rebate Processing

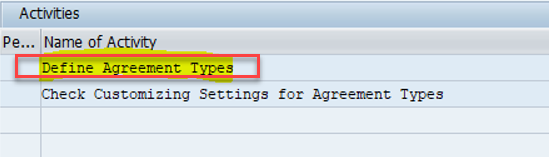

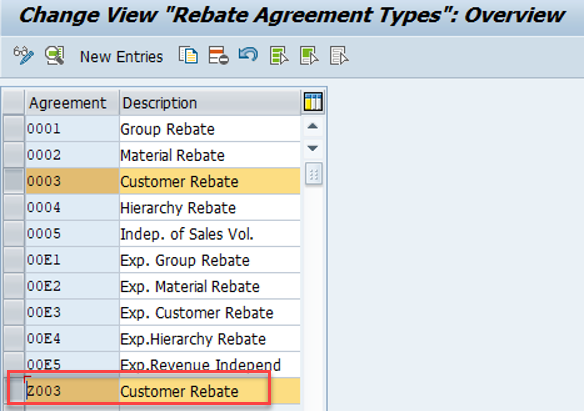

Step 1 – Define Rebate Agreement types

Here, we have copied the standard customer rebate 0003 and created Z003

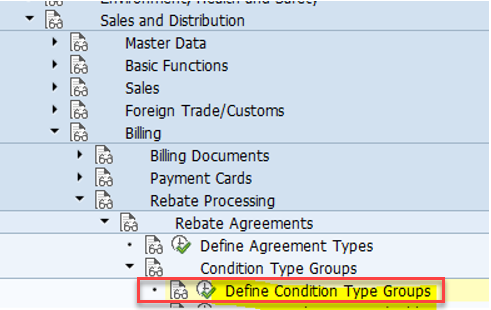

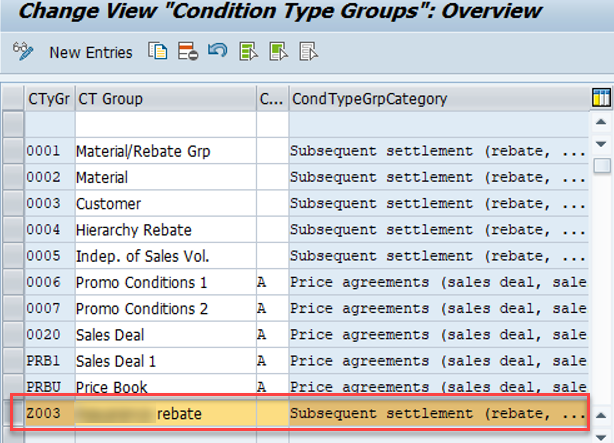

Step 2 – Define Condition type groups

Condition type groups are created to group several different condition types created to calculate the rebate. But in this case, we have created just one condition type

A new condition type group Z003 is created as below

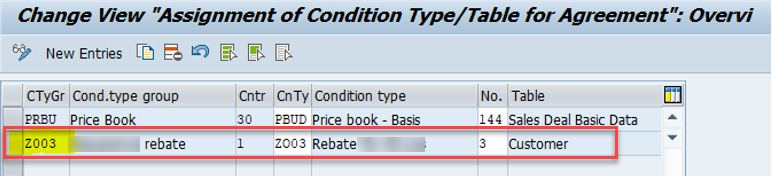

Here, the condition type is assigned to the condition type group created above

Please refer to step 3 where a new condition type Z003 is created. Once created, it is assigned to the condition type group Z003 as shown below

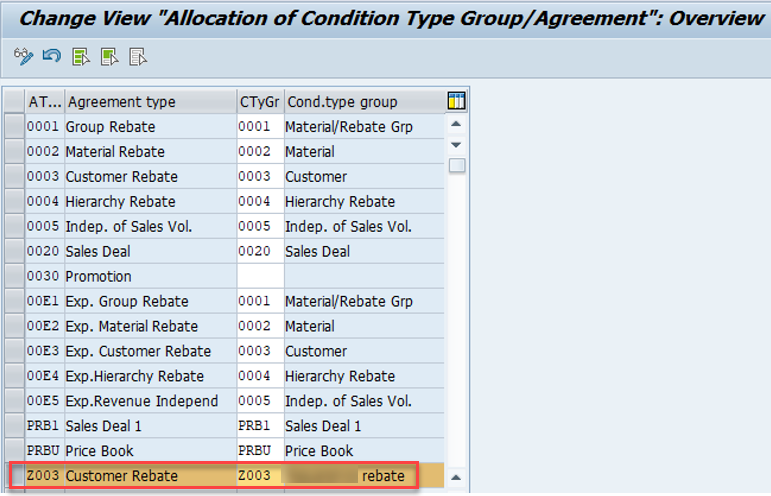

Finally, the condition type group Z003 (created in step 2) is assigned to rebate agreement type Z003 (created in step 1)

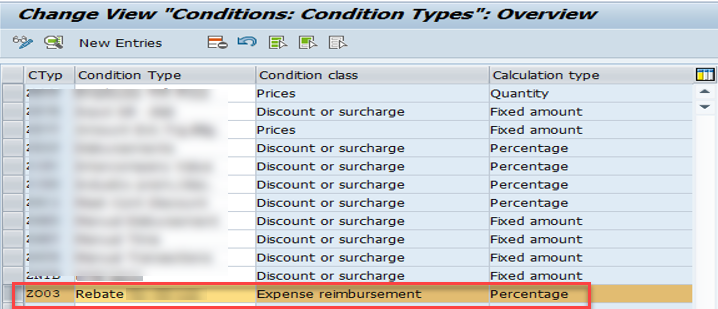

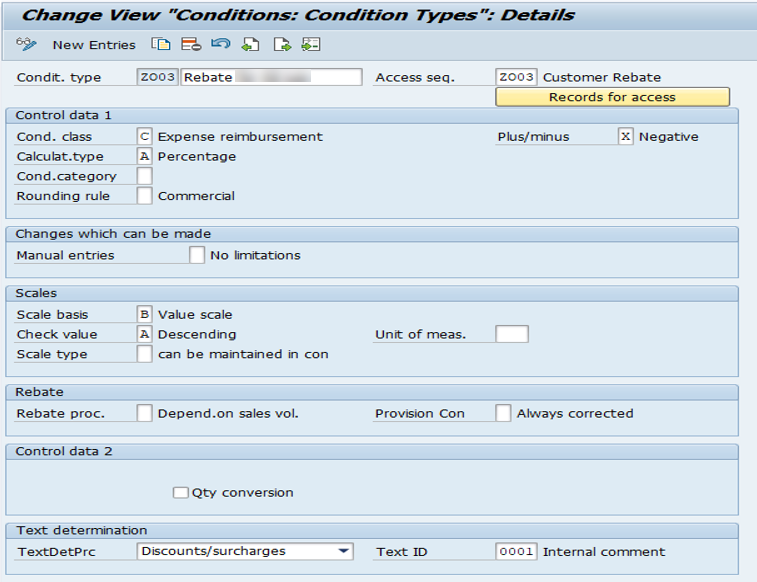

Step 3 – Create new condition types

Z003 is the new condition type created with % calculation

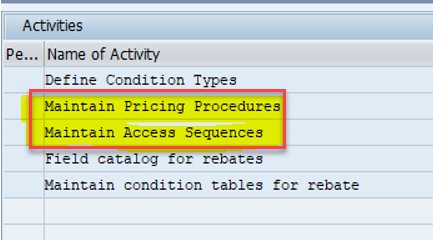

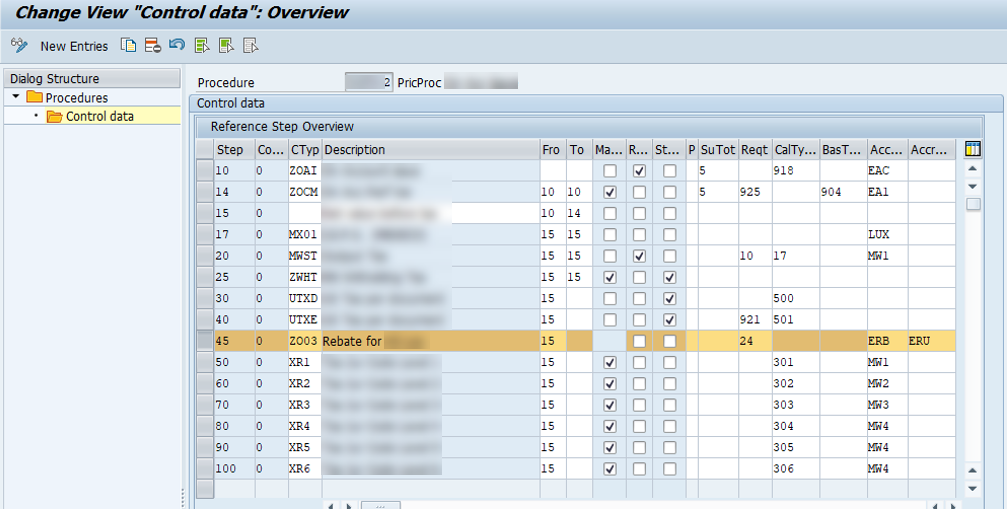

Step 4 – Pricing

An existing pricing procedure is modified to add the newly created condition type Z003

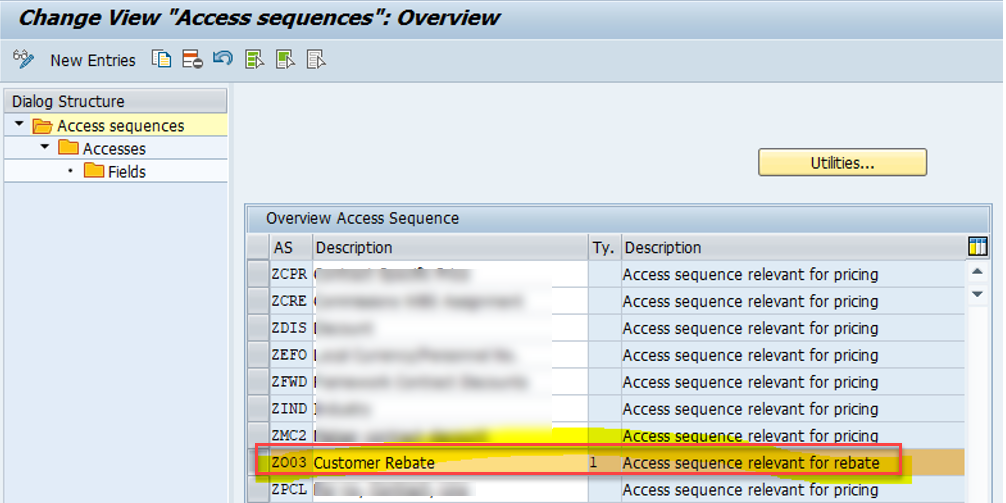

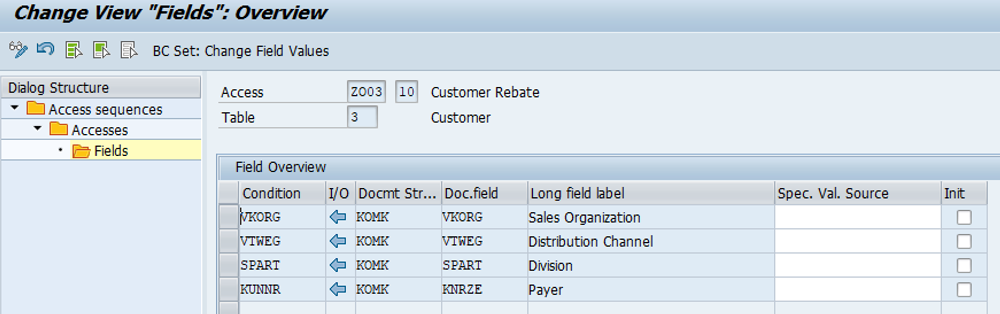

The access sequence Z003 is defined to determine the valid condition record to arrive at a price for rebate calculation

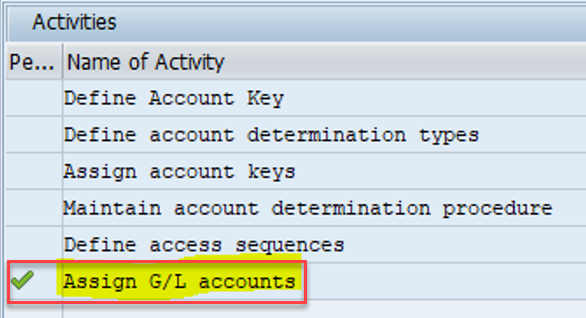

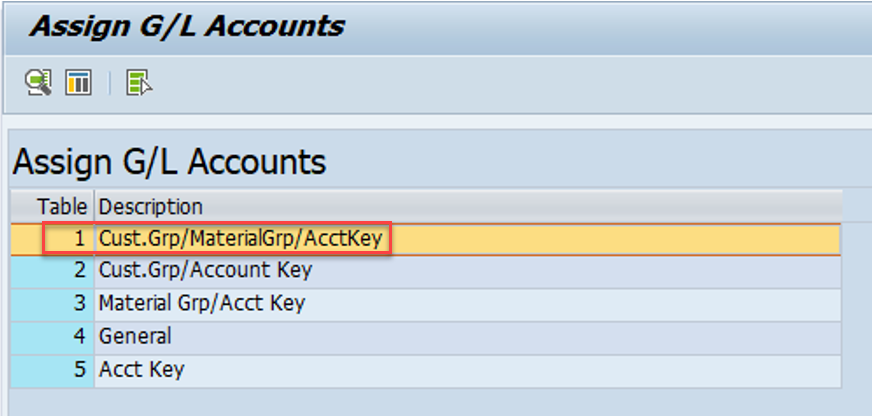

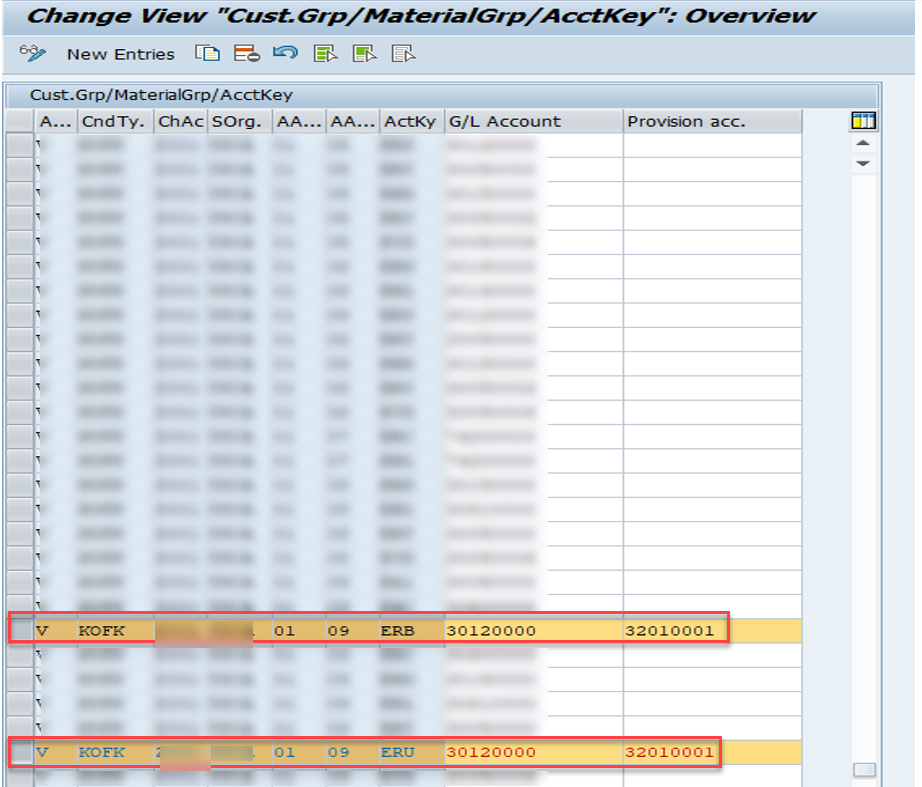

Step 5 – Account determination

Finally, the GL accounts are configured based on Customer Group/Material Group/Account Key combination. This is also called SD-FI integration which is essential in order for the system to determine the GL accounts used to post accounting document based on the billing (invoice)

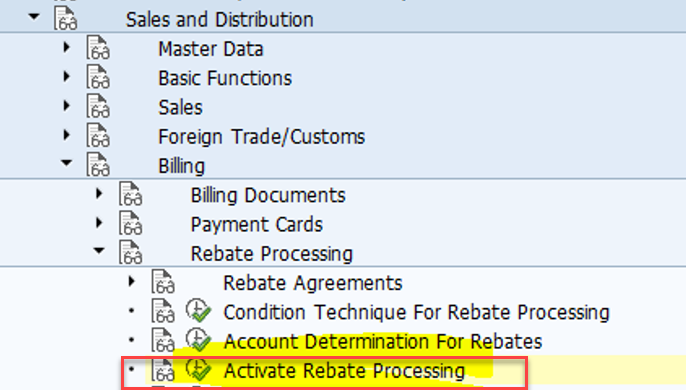

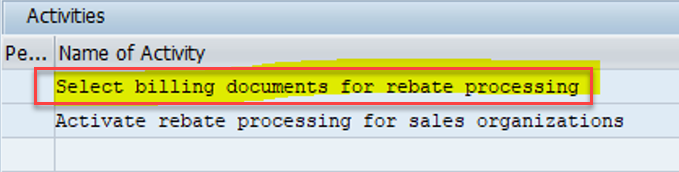

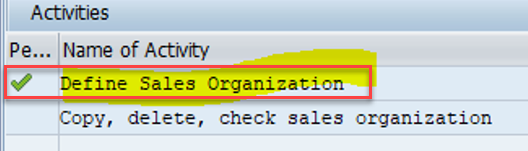

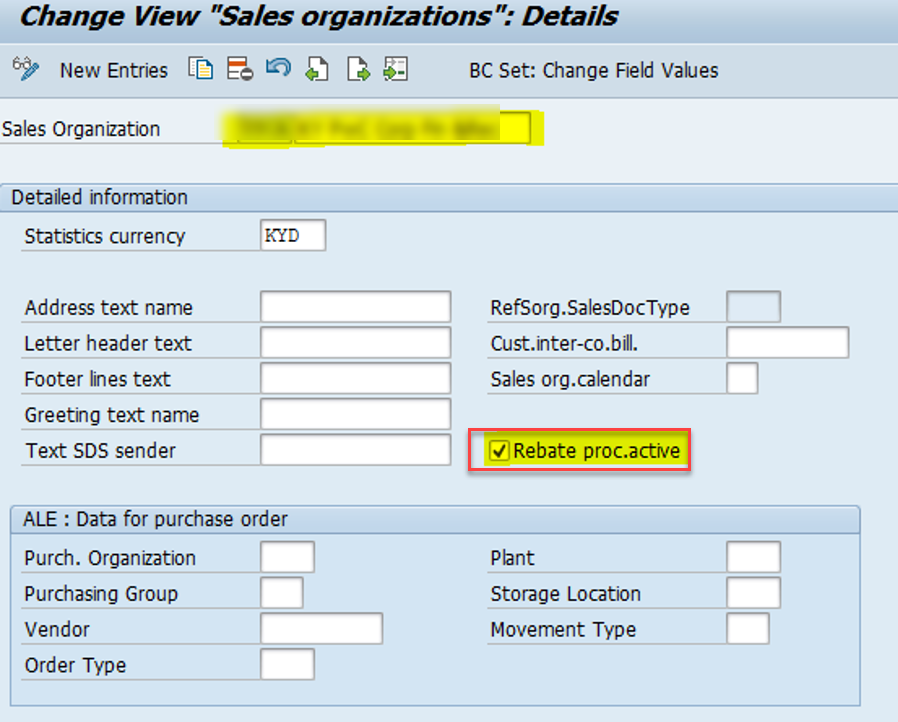

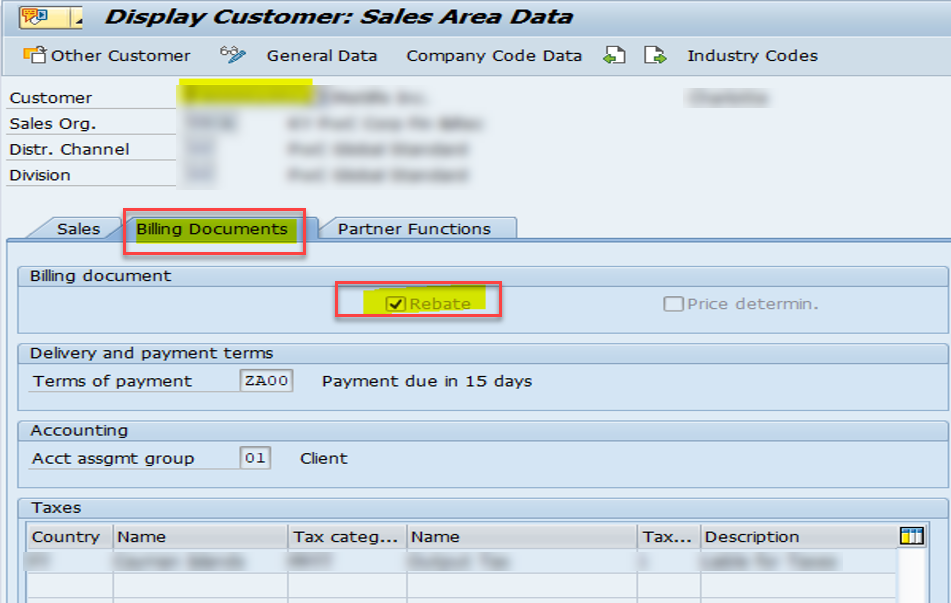

Step 6 – Activate rebate processing

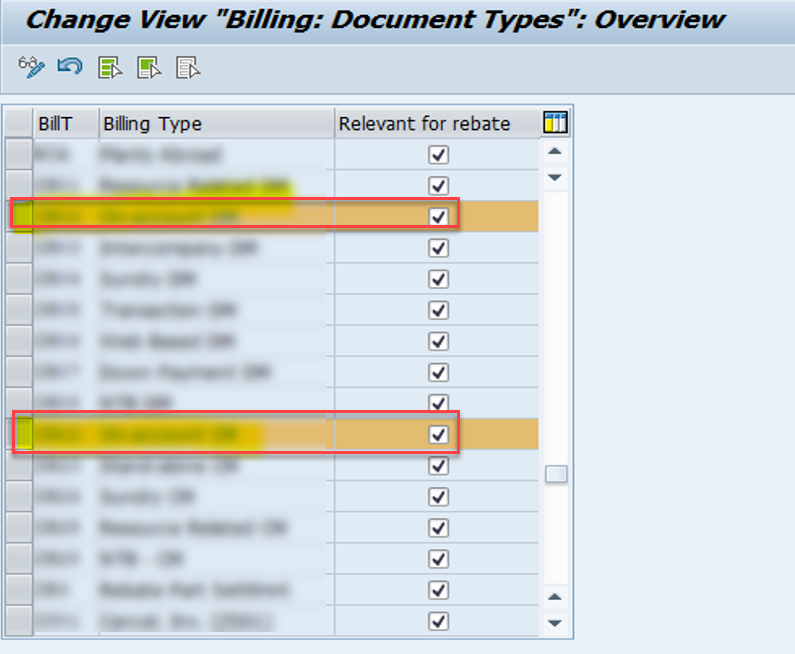

Firstly, rebate is activated for billing document types

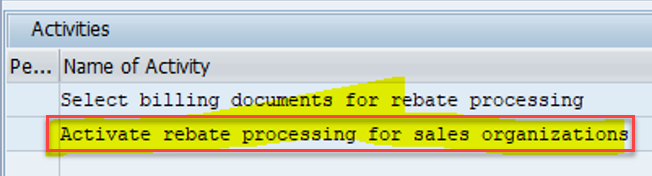

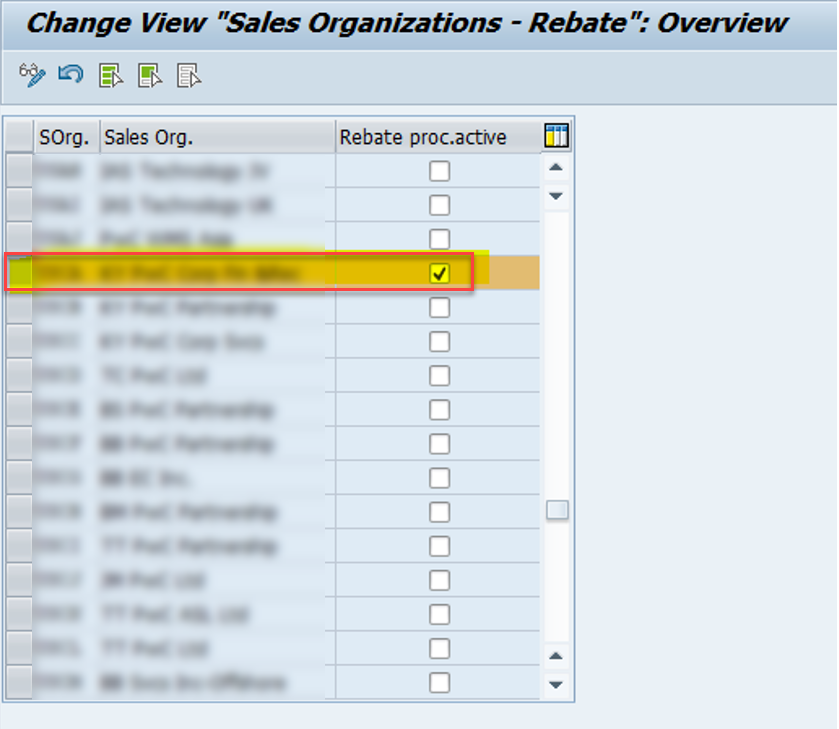

Secondly, rebate is activated for the Sales Organisation

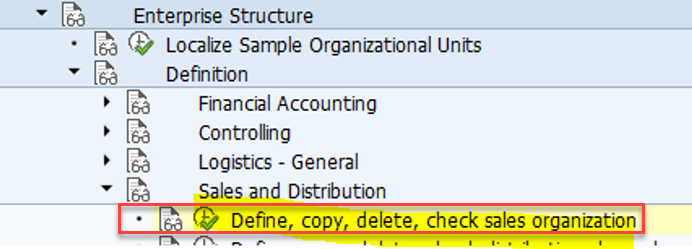

Rebate should also be activated at Sales Organization level within the Enterprise Structure – Definition – Sales and Distribution node in SPRO

And finally, activate rebate for the customer/rebate recipient in the customer master sales area data – Billing documents

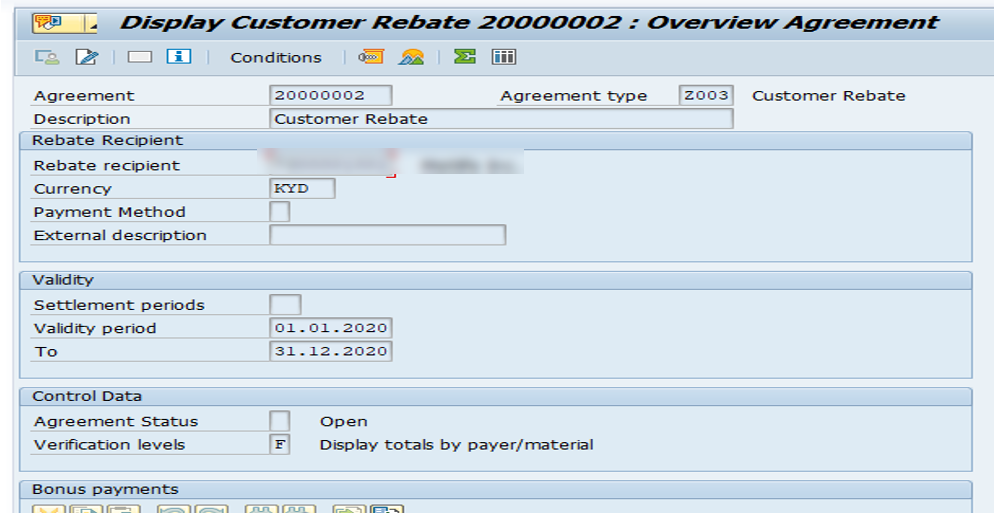

Step 7 – Create Rebate agreement – VBO1

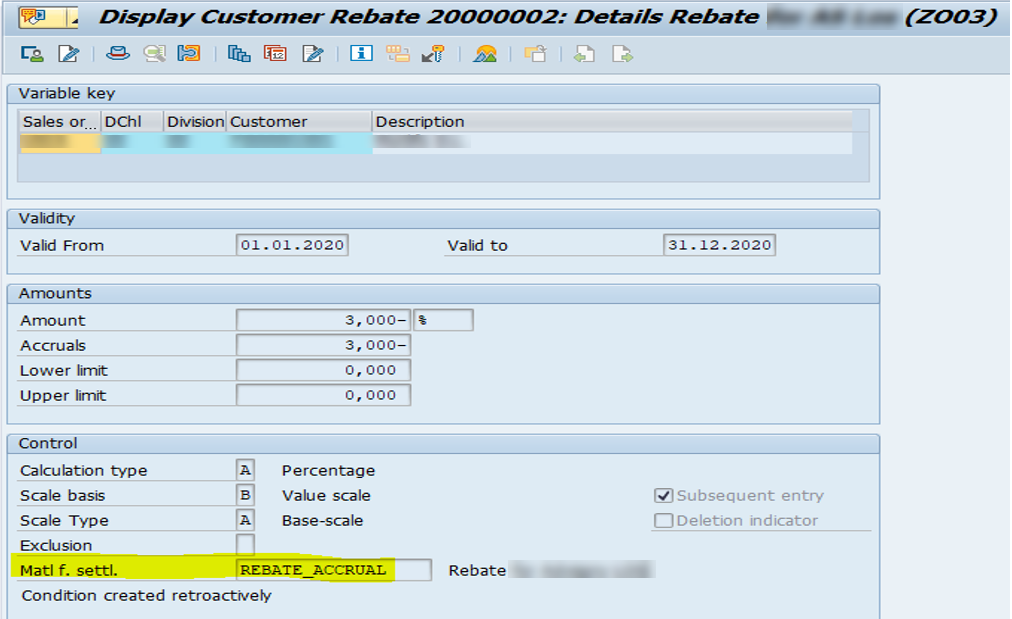

A rebate agreement 20000002 is created for type Z003 (defined in step 1)

Step 8 – Change pricing procedure

Added a new condition type Z003 for 3% rebate and this condition type has been added to the pricing procedure as specified in step 3 and 4

Post transactions:

Below, you will see the set of transactions to reflect how rebate is calculated at invoice level

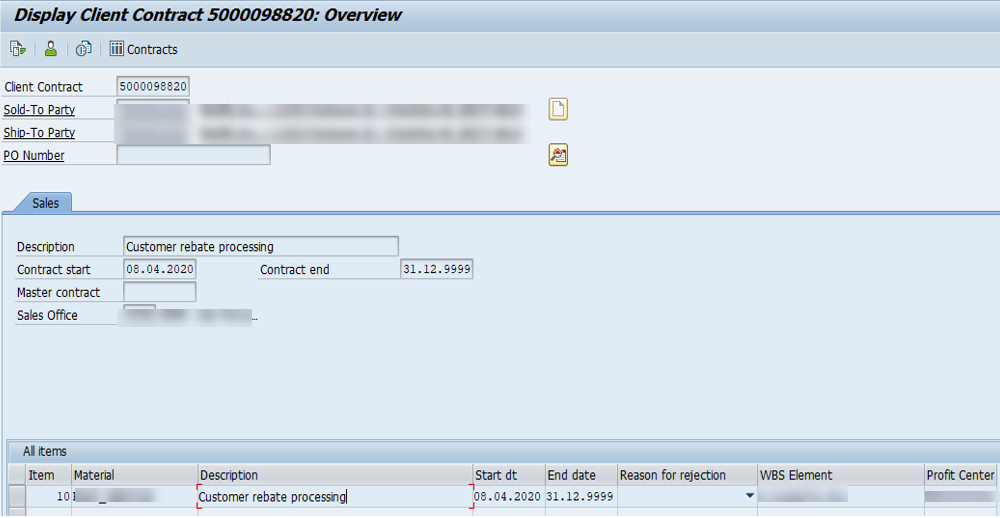

Contract creation: VA43

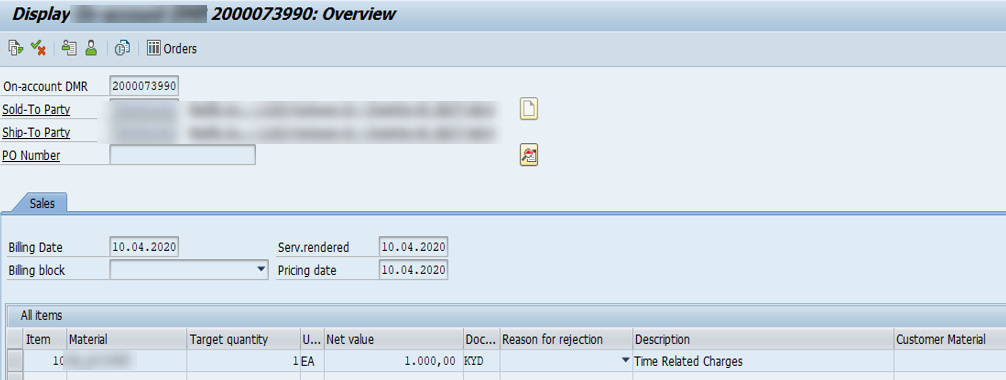

Sales Order creation: VA01

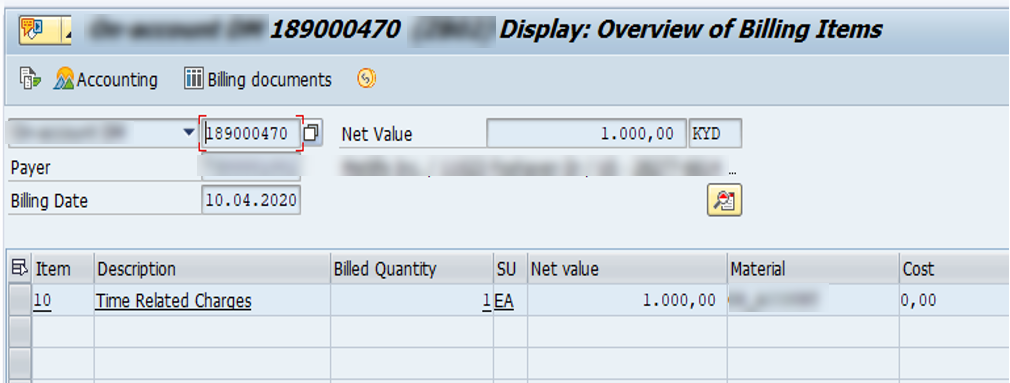

Billing: VF01

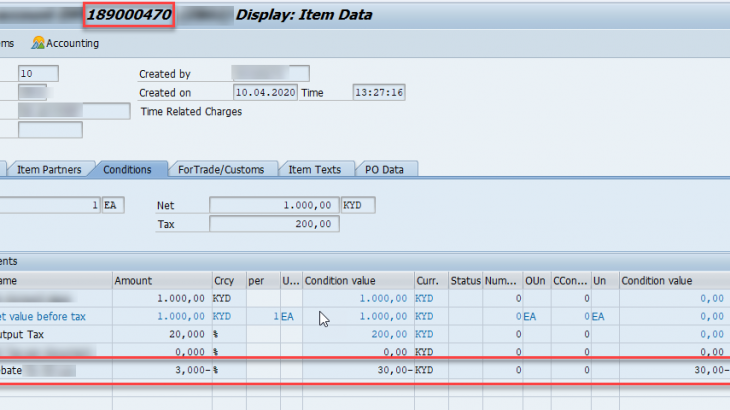

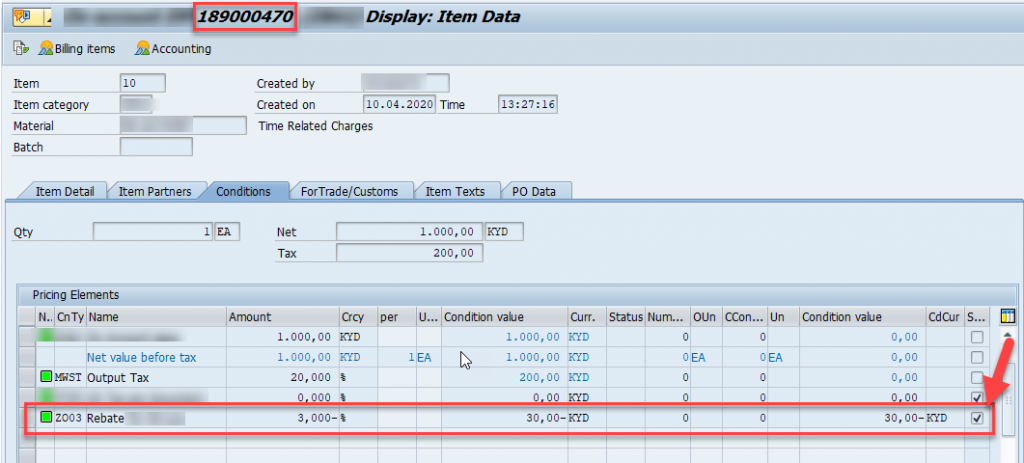

Rebate condition type at invoice level – observe the 3% rebate on the net invoice amount of 1000 is calculated as 30 KYD based on the pricing procedure and the condition type Z003 within. Also, the rebate % is statistical based on the “Stat” checkbox as highlighted below

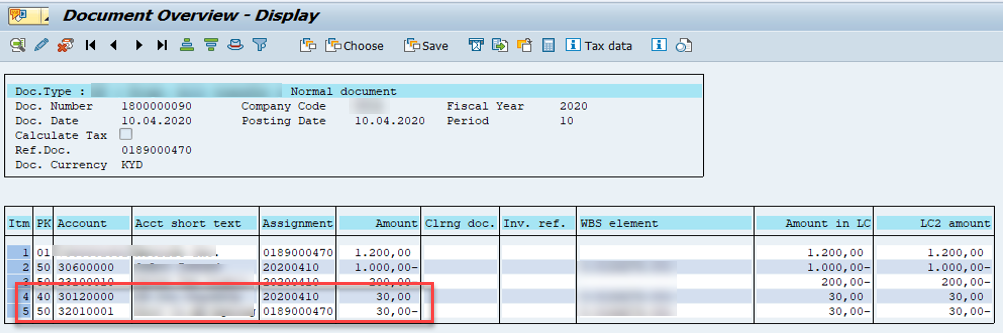

Accounting: FB03

The rebate GL accounts as configured in the account determination (tcode VKOA) generates the below posting where the customer/recipient is debited and revenue account is credited

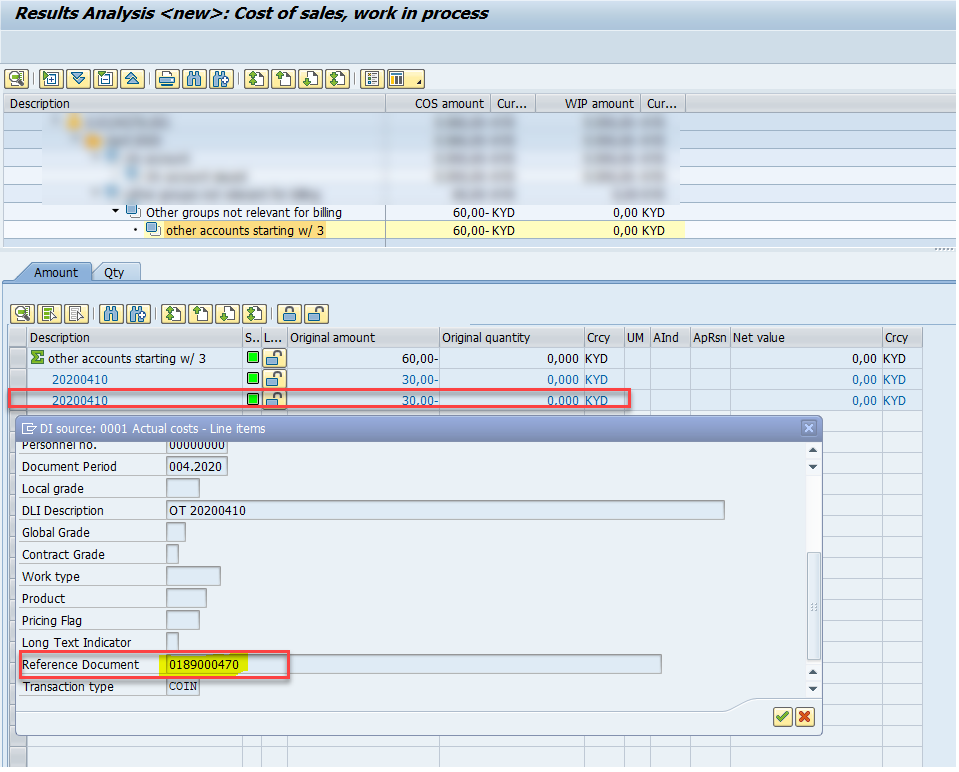

Now calculating the Result Analysis on the WBS element of contract line item:

Tcode – KKA2/KKAJ

You can observe the billing/invoice 0189000470 is considering the rebate line items in the Result Analysis because of the WBS code involved