Introduction:

The purpose of intercompany reconciliation is to facilitate the organization for group level reporting. Today, the graph of industries with their subsidies are increasing on global level resulting, the huge amount of transactions are being generated between a subsidiary and it’s parent company or between two parent companies or between two subsidies of a parent company.

Group accountant can control the documents of accounting transactions daily, weekly and periodically between the group of companies through ICR. It can be possible to get the data from SAP or from the external system i.e. if any related company is using any other ERP.

ICR tool on the level of company or partner company in SAP.

The biggest challenge is to reconcile the receivable and payable data between the intercompany trading partners because of the massive load of transactions, which is obviously very time consuming and a challenging work.

ICR can be run at any time especially when an accountant does month end closing or year end closing activities. It may help to avoid the pressure and the results are generated as per the desired configurational parameters.

Trading Partner:

This is the term which we use for the business partner with in the group of companies or from any other group of companies with whom we do business or generating any sort of payable and receivable.

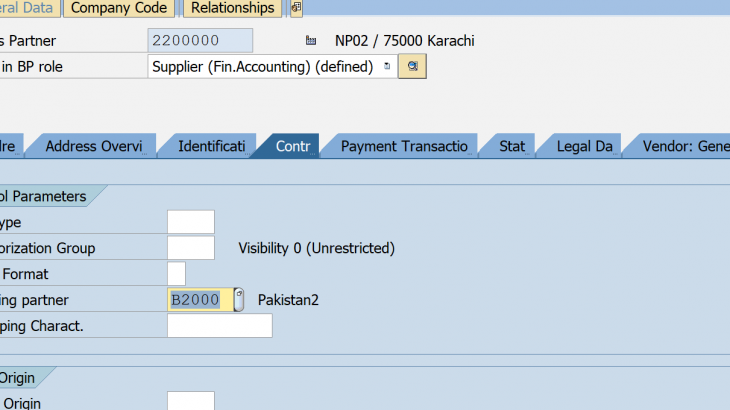

Trading partner is maintained in field VBUND in the Master Data of a Business Partner. For example;

Beneficiaries of Intercompany Reconciliation:

- The accountants from one legal entity who are generating payables and receivables to the other legal entity with in the group of companies or have same trading partner.

- The accountants from the legal entity who are generating payables and receivables to the other legal entity of different group of companies or we can say they have different trading partners.

- Group accountant; who should have a true picture of companies with in the group or out of the group.

- Parent company can manage it globally to check the results.

- Subsidiary company can also get the advantage of it that how many documents are unreconciled with their parent company.

Processes of ICR:

- Process 001 (GL Open Items) We use it when company posted most of it intercompany receivables and payables on GL accounts.

- Process 002 (GL Accounts) We use this process for GL accounts which are not open item managed or for Profit and Loss accounts.

- Process 003 (Customer/Vendor Open Items) We use this when company posts most intercompany receivables and payables in customer and vendor accounts.

Scenarios:

Different group of companies have different scenarios as per their business needs and requirement, but here we discuss some of the most common scenarios which take time in reconciliation.

Below we will see how ICR makes our life easy by taking process 003 as our example, because most of the intercompany transactions are based on customers and vendors accounts.

Scenarios are defined here:

- ICR b/w different company codes with in a same group of companies or same trading partner.

- ICR b/w company codes of different group of companies or different trading partners.

Now please check the scenario and it’s configurational step to perform ICR;

Scenario 1:

ICR b/w different company codes with in the group of companies or same trading partner.

We have two company codes NP02 and BU01 of a same trading partner B1000 or from same group of companies.

These company codes have a relation of customer and vendor with each other. So, Accounting transactions will be;

In case of Sales:

NP02 sells to BU01 and records;

BU01 Dr xxx

Sales Cr xxx

at the same time BU01 records the purchases

Purchases Dr xxx

NP02 Cr xxx

Entries in System:

BU01

and the same time the accountant from NP02 will book the receivable against BU01.

At the end of period, the both documents are open items as BU01 hasn’t paid to NP02 yet.

Now the group accountant wants to know the NP02 receivable against BU01, so the accountant will run process in three steps :

- FBICS3 to select the documents

- FBICA3 to assign the documents automatically

- FBICR3 to assign the documents manually i.e. reconciliation

First of all we run the T-code FBICS3 to select of the documents by defining the parameters:

Upon execution the ICR tool will select the documents for assignment in two different company codes.

In the above picture we can see that two documents are selected and transferred for automatic assignments in ICR, for a same trading partner.

In the second step we run the t-code FBICA3 for automatic assignments b/w company codes in ICR

After the execution system will automatically assign the matched documents by matching the reference fields, which we defined in customizing

In above picture it is seen that two records are matched automatically, but if anything is not assigned then we assign it manually

In the 3rd step we check the assigned documents and assign manually, if anything is left using the T-code FBICR3

Execute it

In the above picture we can see that two of our above documents are now assigned with the group account document number. So , the group accountant can easily get the reconciliation and some of the documents are now showing for manual reconciliation.

Scenario 2:

ICR b/w company code of different group of companies or different trading partners.

In the second scenario we are considering two company codes; BU01 from company B1000 and NP02 is from company B2000 so the pattern of accounting entries would be the same here, which we already discussed above. But we will check how the reconciliation would be done.

But in Business partner we will change the trading partner in the master data by assuming that the customer 4200003 is of company code NP02, which belongs to company B1000.

Similarly, we we will change the trading partner in the master data for Vendor in company code BU01.

In the case in BU01; NP02 is the vendor of BU01 so the trading partner would be B2000.

Accounting Entries in NP02

Accounting Entries in BU01

Now we the process b/w different trading partners would be run and assigned .The t-code would be same but the selection parameters would be like for e.g. FBICS3 (Select Document)

After the execution all the documents from different trading partner are selected.

In the above picture it is shown that documents from trading partners are selected to be assigned in the next step, which in FBICA3 i.e. automatic assignment.

After the execution of T-code, assignments would be done.

In the above picture; 4 documents are assigned automatically to B1000/B2000 but one document will be assigned manually using t-code FBICR3

After the execution of the above parameters we can view the assigned and unassigned documents

Note: in our scenario the data would be mapped through the reference field i.e. INV#922 in the field above, accountant from both the companies would input the same number to reconcile the data.