This blog provides you with a systematic list and benefits of selected innovations in Financial Planning and Analysis, Accounts Receivables, Revenue Accounting and Reporting, Treasury Management, Contract Accounting and Invoicing, Group Reporting and Central Finance.

Financial Planning and Analysis

Margin Analysis

Increased flexibility of profitability reporting based on the universal journal

- Improved flexibility to add additional dimensions for profitability reporting

- More precise COGS split for multiple currencies

- Improved top-down distribution based on the universal allocation

- New report to display margin analysis line items

Benefit

- Enables finer reporting of costs that cannot be directly assigned to products or customers

- Brings better insight for journal entry line items that impact actual costs and margin

Improve process excellence by handling multiple currencies for internal order settlements

- Settlement of internal orders to handle multiple currencies and write data in specific ledgers

Benefit

- Handle multiple currencies for internal order settlements

- Trigger ledger-specific settlement postings

Predictive Accounting

Extend predictive accounting to include documents originating outside of SAP S/4HANA

- Simulation of process steps based on replicated sales documents created in non-SAP S/4HANA software systems

- Separate configuration for simulation procedures

Benefit

- Analyze predictive gross margins for sales documents from any instance of the SAP ERP application

- Integrate third-party sales systems and transfer their predicted economic effects into predictive accounting

- Increase configuration flexibility for predictive accounting, detached from sending applications

Travel-request triggering of predictive postings for SAP S/4HANA

- Posting of travel requests imported from SAP Concur solutions into the predictive extension ledger in SAP S/4HANA

- Subsequent predictive postings on the respective cost object before the actual travel expense is posted

Benefit

- Increased transparency regarding future travel costs

SAP S/4HANA on premise: Integration of SAP Analytics Cloud optimizes business user experience

With the release 2020, SAP S/4HANA on premise integrates SAP Analytics Cloud for an embedded experience for business users. In ever more changing and challenging times, decisions have to be taken faster and they have to be based on up-to-date information. Real-time analytics that tap into the operational data has become indispensable. In addition, business users expect to find the relevant reports and dashboards next to their operational tasks on the same launchpad without the need to log on to other systems. Seamless UI-integration and shared UI paradigms such as intent-based navigation optimize the experience for SAP S/4HANA business users.

Accounts Receivables

Additions in Bank Statement Automation

- Templates for reprocessing rules and key performance indicators

- Automate reprocessing rules in one-step or two-step posting procedure.

- Analyze As: Assignment Number and Payment with Advanced Payment Advice Search

- Share reprocessing rules

- Edit journal entries while simulating a posting by selecting the Simulate and Edit button

Posting of contract accounting documents into accounts receivable or accounts payable:

- Ability to post documents with the new clearing restriction in contract accounts receivable and payable (FI-CA)

- New mass activity that selects documents with the new clearing restriction

- Clearing of documents with the new clearing reason in FI-CA

- Transfer of the invoice document number to accounts receivable (FI-AR) or accounts payable (FI-AP) as a reference number

- Posting of the document in FI-AR or FI-AP

Benefit of enabling periodic transfers of postings from FI-CA to FI-AR or FI-AP to:

- Allow customers who have been using FI-AR or FI-AP to gradually scale up use of FI-CA until it eventually becomes the only subledger in use

- Allow customers using FI-AR as their receivables sub-ledger to use convergent invoicing up to the invoicing process for parts of their business, and post invoices from convergent invoicing to FI-AR or to FI-AP through the transfer from FI-CA

Revenue Accounting and Reporting

Enhancements for Optimized Contract Management:

- Create or change manual performance obligations using the Fiori app Manage Revenue Contracts

- Review contracts with conflicts and resolve the conflicts using the Conflicted Revenue Contracts Worklist Fiori app

- Support for compound groups and BoMs (Bill-of-Material)

- Support cost of fulfillment and acquisition cost

- Integrate with costing-based profitability analysis (CO-PA)

- Cancel a performance obligation using the finalization date

- Enable fulfillment by proof of delivery, release order and acceptance date from SAP Sales and Distribution

- Enable consumption-based fulfillments from Convergent Accounting and Invoicing

- Migrate your existing revenue contracts to the Optimized Contract Management

- Extend contract management and inbound processing with key-user extensibility features

- Display all documents relevant for a performance obligation using the Fiori app Document Flow – Performance Obligations

- View the change history for revenue contracts using the Fiori app Display Change History

- Additional analytical Fiori apps for Revenue Explanation and Allocated Amount Explanation

Optimized Inbound Processing for the integration with SAP Sales and Distribution, Convergent Accounting and Invoicing and 3rd party applications:

- Process revenue accounting events for order creation and update, fulfillments, cost and invoices near-real-time to reduce the need for batch jobs

- Process erroneous and partially processed RAIs with the Fiori app Manage Postponed Revenue Accounting Items

- Use SOAP APIs for consumption with external components integrated with the SAP Application Interface Framework (AIF)

Enhanced disclosure support for Revenue Accounting:

- Contract balance

- Remaining performance obligations – total open revenue

- Remaining performance obligations – to be recognized revenue

- Revenue catch-up

- Contract balance movement

Benefit

- Streamline integration between revenue recognition and operational business processes

- Enable compliance with the converged U.S. GAAP and IFRS revenue standard

Treasury Management

Debt and Investment Management

Increase straight through processing in treasury transaction management

- Adjustments for Risk-Free Reference Rates aka LIBOR transition

- Hedge Management of Balance Sheet FX Risk

- Expanded coverage of legislations in foreign currency hedge management and accounting for US-GAAP

- Trading Platform Integration:

- Further enhancement for Intercompany Trade

- Processing of Cash Trade Request for Money Market

- Processing of Hedge Request for Balance Sheet Exposure

- Further enhancement for Intercompany Trade

Benefit

- Automatic calculation of the risk free reference interest rates for most interest instruments according to the benchmark regulation reform

- Straight through processing for the compliance with international accounting regulations for foreign exchange transactions including FX hedge accounting

- Automation of intercompany dealing for foreign exchange and money market deals

- Straight through processing for money market deals from cash management to trading platform

- Support for headquarters-subsidiary scenarios that have different functional currencies in the headquarters and subsidiaries

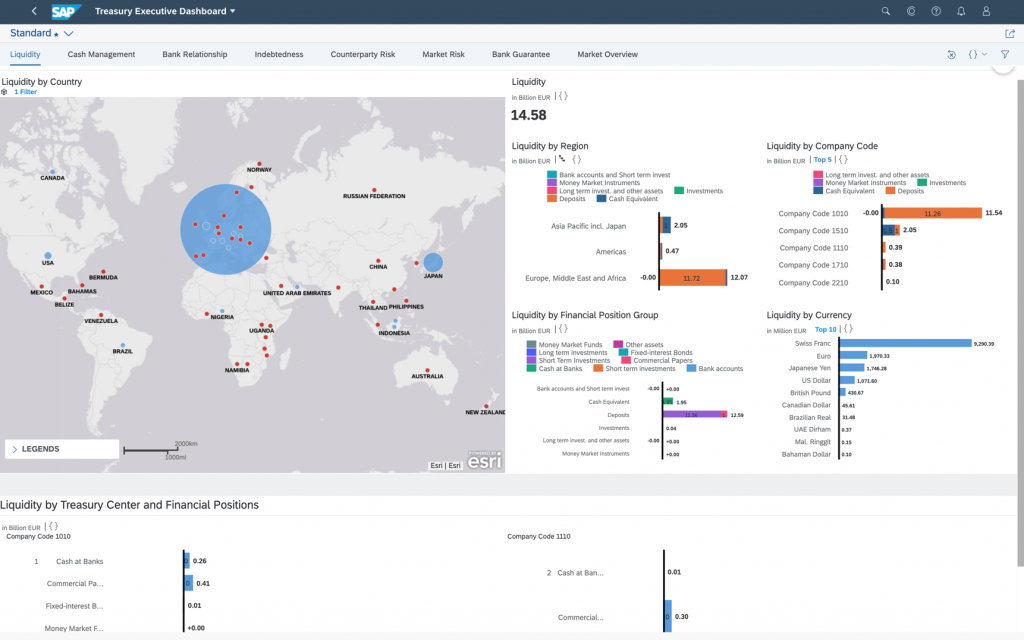

Treasury Management Analytics

Highlight financial positions and risks with treasury analytics. Create a treasury dashboard to provide insights into treasury operations for treasury executives and include the following key-performance indicators:

- Cash balances

- Market trends

- Debt and investment positions

- FX risks

- Credit risks

Benefit

Treasury management – treasury analytics foundation:

- Bring treasury to the next generation enabling native SAP S/4HANA software technologies

- Provide treasury reporting data from cash management, treasury, and risk management and further improve alignment of treasury applications with the overall SAP S/4HANA reporting strategy

Financial Accounting with Treasury Management

Reduce use of general ledger accounts as bank accounts by simplifying bank relationship-management processes

- Simplify your payment processes by connecting new house bank accounts to a new type of G/L account, which is a bank reconciliation account

- Assign a G/L account with this new G/L account type to more than one house bank account and, thereby, significantly reduce the number of G/L accounts needed for your payment processes by creating fewer sets of bank reconciliation accounts and clearing accounts and using them for several house bank accounts

- Cash position report can still be displayed per bank accounts

Benefit

- Reduced number of G/L accounts by reusing the same sets of bank reconciliation accounts and clearing accounts for house bank connectivity

- Detailed representation of the bank account lifecycle in bank account management

- Simplified chart of account maintenance

- Easier payment configuration, including harmonized configuration of self-initiated payments

- Increase the treasury operation efficiency due to much less need to wait for new G/L accounts when opening new bank accounts

Cash and Liquidity Management

Enhancement for Cash concentration, bank transfer, and cash trade request

- Set the Single Payment indicator to create separate payment documents for your payment requests in Manage Cash Concentration, Make Bank Transfers, and Make Bank Transfers – Create with Template.

- Enable instruction key in bank transfer

- When the cash pool’s header account distributes cash to sub accounts, the header account can use different payment method for different sub accounts

- Create cash trade requests for the new instrument category Money Market: Fixed Term Deposit/Loan. In addition, partial fulfillment is now supported in cash trade requests.

Benefit

- Improve the efficiency of cash operation

- Better support for complex cash pools

Enhancement to Bank Account Management Workflow

- Enable the editing function and change history for workflow processes based on the flexible workflows

- In the Manage Bank Accounts app, you can now give payment approvers the right to approve all payments irrespective of the amount by setting the ”Unlimited Approval” indicator.

Benefit

- The workflow process could be more flexible, because the end users can do approval as well as input further information in bank account management in the steps

- More intuitive setting for unlimited approval instead of inputting a very big amount

Payments and Bank Communications

Enable sanction screening out of a central payment factory

- Block engagement with sanctioned parties for all payments irrespective of the initiating system

- Make payments to approved third parties only

- Leverage automated system-based screening that keeps compliance expenses at a minimum

Benefit

- Blocking of sanctioned parties through automation of watchlist screening for all payment flows of a group (SAP and non-SAP)

- Reduced compliance costs

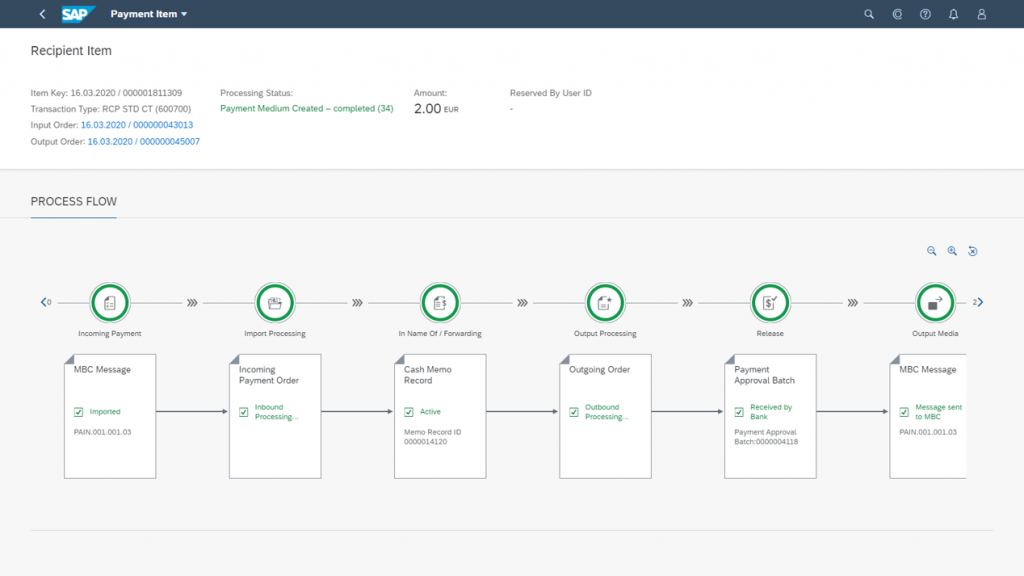

Flexible setup of a payment factory – user experience

- Incoming payment format mapping using a dedicated SAP Fiori app to map formats, like a proprietary CSV to ISO20022

- Partial rejections of payment batches using approve bank payments, including notifications to the participating subsidiary

- Revised user experience and navigation options from an newSAP Fiori app “Manage Payments”

- Simplification to define payment routing with SAP Fiori app “Manage Payments”

- Status monitoring using ISO status codes, including a history of the status

Benefit

- Flexibility and simplicity thanks to a centralized setup for payments

- Simpler integration of any source into the processes of the payment factory by mapping external formats to ISO20022 structures with an SAP Fiori app

- Ability to finalize tasks faster

- More-accurate information

Contract Accounting and Invoicing

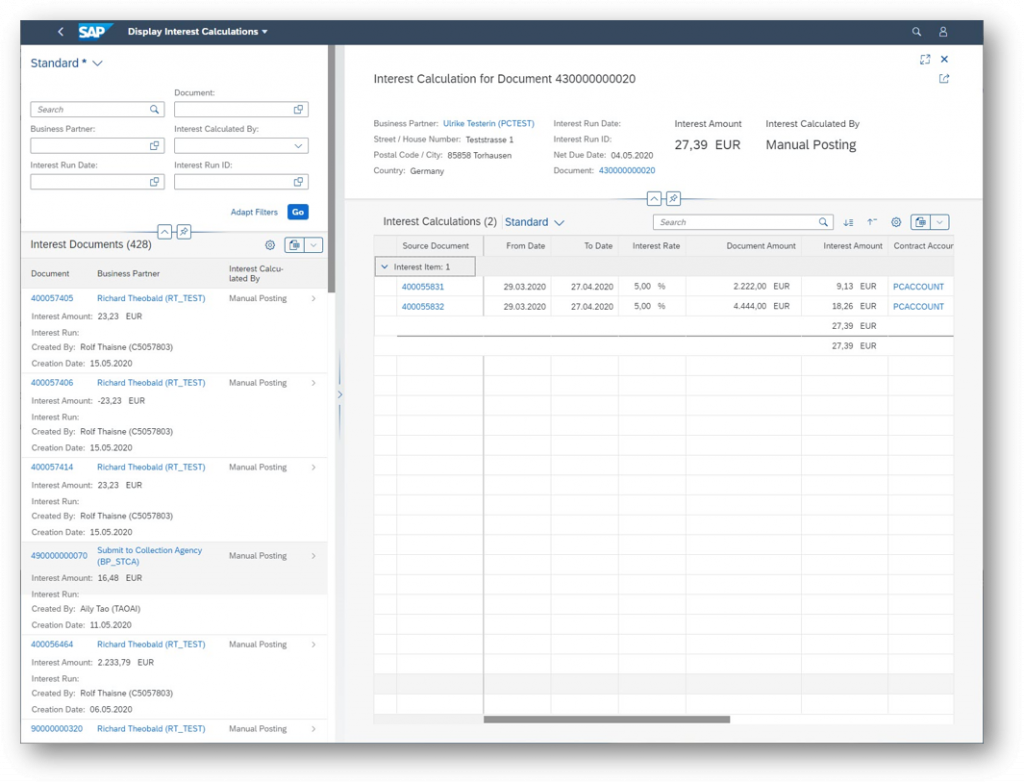

Contract Accounting

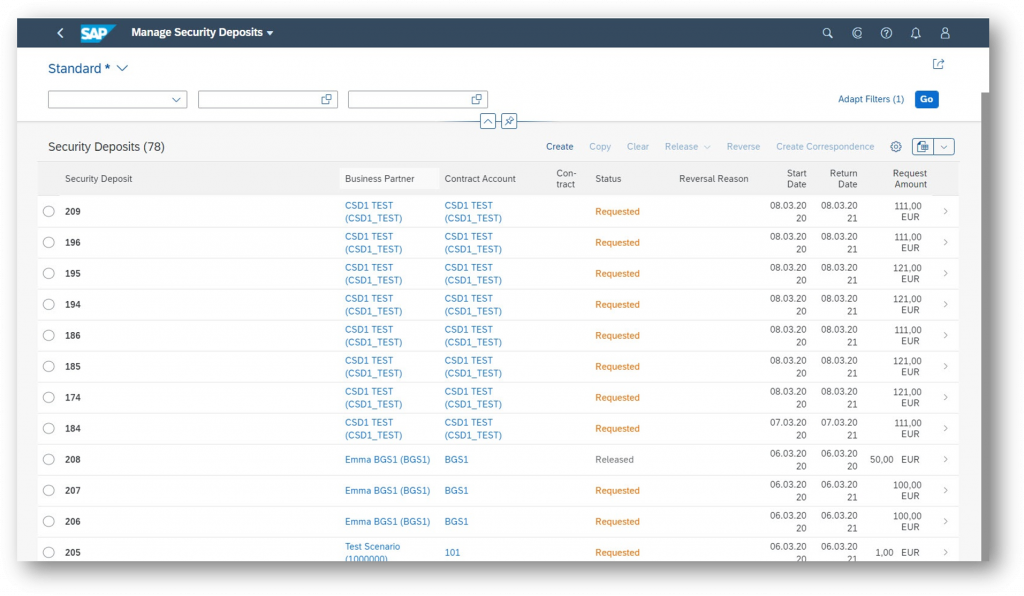

SAP Fiori apps for various processes in contract accounting

- Manage Security Deposits

- Display Interest Calculations

- Manage Reconciliation Key

- Reverse Document

- Manage Creditworthiness

- Display Business Transactions

- Transfer Business Partner Items

- Monitor Master Data Distribution – to SAP Convergent Charging

Benefit

- Improve usability in various processes of contract accounting with new SAP Fiori apps

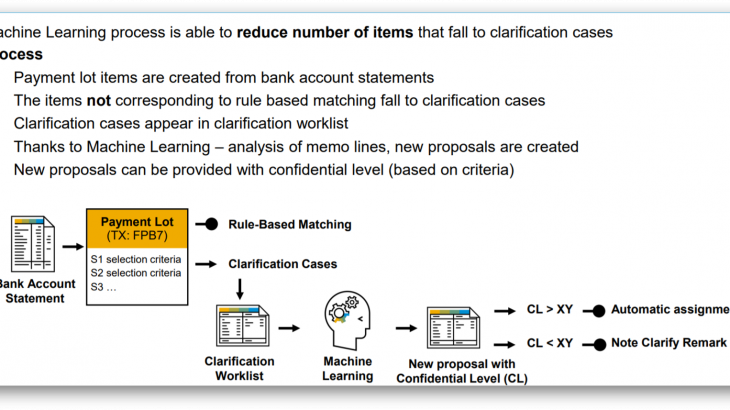

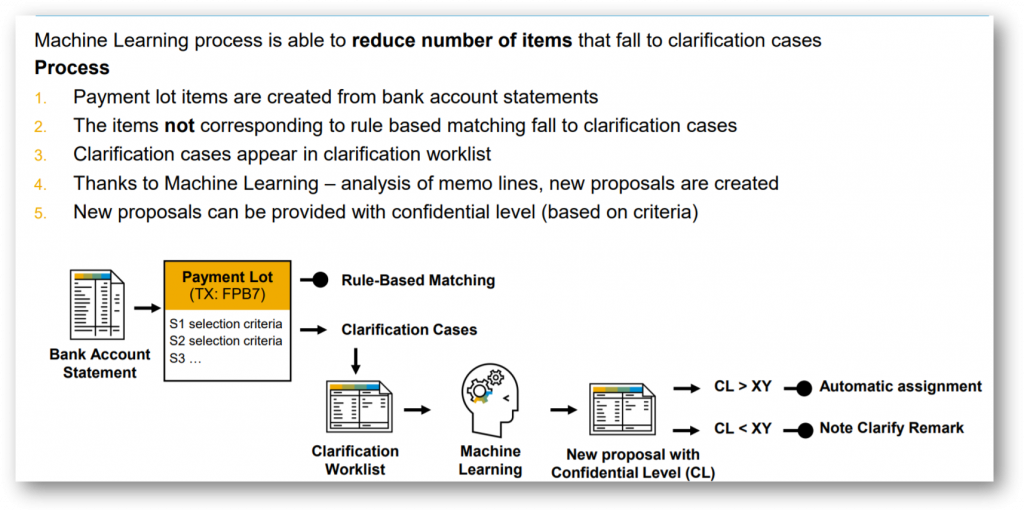

Payment clarification with machine learning–based SAP Cash Application, add-on for contract accounting:

The SAP Cash Application automatically matches incoming payments with defined selection type and correct selection value. It boosts efficiency of the traditionally very labor-intensive clearing process, being executed with nearly no user interaction. The application takes advantage of machine learning to enable an effortless setup and to increase automatic matching rates.

- Contract accounting processes incoming payment data with a high degree of automation achieved by applying configuration options defined in the system configuration for Clearing Control. If exceptions occur during automatic processing, the system creates clarification cases for manual follow up activities.

- To reduce the number of clarification cases and improve the overall service quality, you can integrate with SAP Cash Application, add-on for contract accounting.

Benefit

- Increased payment-matching margin resulting in:

- Improved time to revenue

- Reduced number of days sales are outstanding (DSO)

- Improved time to revenue

- Reduced manual efforts and associated resources required for unmatched items

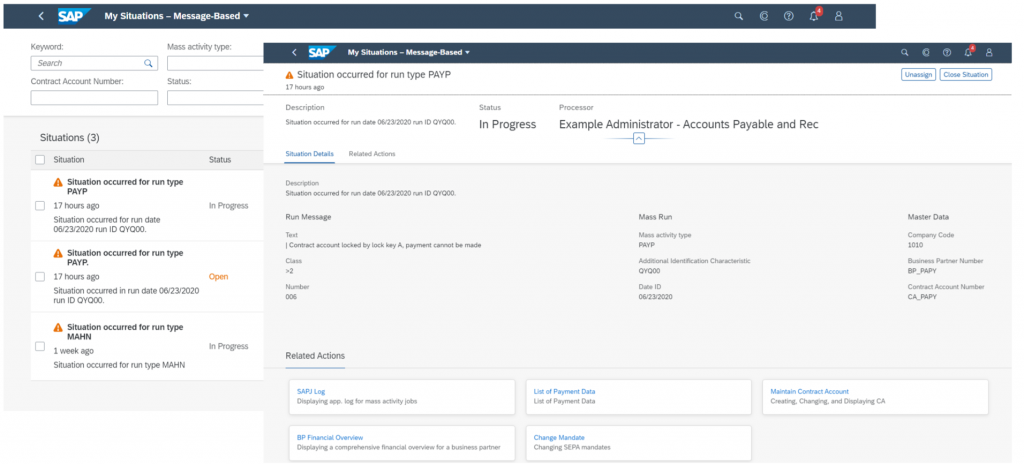

Drive improved quality and speed of contract accounting with monitoring and alerts for user-friendly follow-up:

Contract Accounting has appr. 150 background jobs (so called mass activities) already available. All of them write information into the log: errors, warnings, success messages, follow-up information. The situation handling framework has been integrated and adopted to offer “message based situations” with which one can create customizable situations for errors of background processes

- Contract accounting processes high volume data in an highly automated way via scheduled mass activities.

- You can use situation handling to inform users about issues that occurred during the processing of such mass activities and enable them to quickly solve these issues by pre-defined actions.

- Situations are triggered when the error rate or run time exceed preconfigured limits or when business critical messages occur during mass processing.

Benefit

- Automatic consolidation of critical issues during mass processing in an intelligent and comprehensive cockpit

- Monitor situations in a user-friendly way and solve them quickly by pre-defined follow up actions, preventing customer issues resulting in service calls

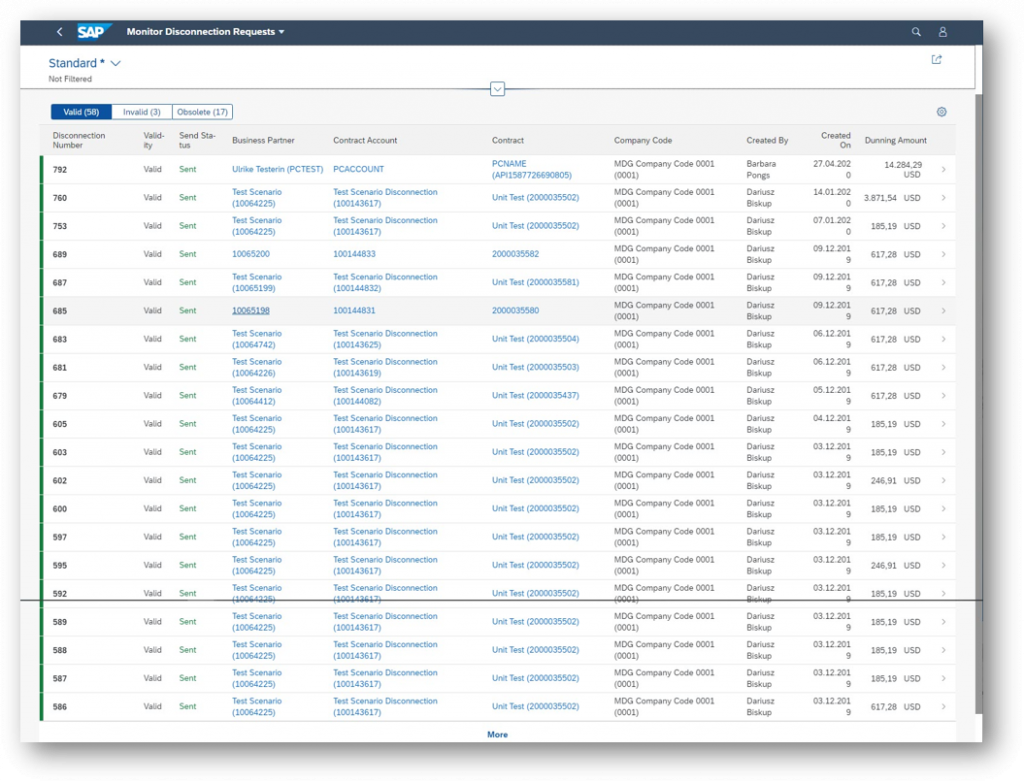

Enable management of disconnection and reconnection processes in contract accounting through user-friendly SAP Fiori apps:

The Monitor Disconnection Requests app enables you to follow up on disconnection requests wether they are sent correctly or already invalidated. With this now the entire process is provided to trigger disconnection of services from dunning of overdue items or vice versa trigger service reconnection upon posted payments to items involved in service disconnections.

- For business partners who do not pay open receivables in time, triggering of disconnection of service from the financial system, with the ability to initiate reconnection of service once the disconnected business partner has reached a settlement through adequate payment

- SAP Fiori app for sending disconnection and reconnection requests, which are regularly forwarded to the external system handling the technical service disconnection and reconnection

- SAP Fiori app to create reconnection requests, which are triggered when disconnected business partners have made satisfactory payment arrangements; app comparison of the payments made against the overdue receivables that led to service disconnection

Benefit

- Enable management of disconnection and reconnection processes in contract accounting through user-friendly SAP Fiori apps

Convergent Invoicing

Maintain the master data ID for dependent items in convergent invoicing:

With this app, you can maintain master data IDs for dependent items. Master data IDs enable you to infer the relevant master data for creating a dependent item. You specify at least a business partner and/or contract account for each master data ID.

- Maintain master data IDs for dependent items with the new SAP Fiori app

- Leverage master data IDs to infer the relevant master data for creating a dependent item

- Specify at least one business partner or contract account for each master data ID

Benefit

- Provide transparency for original and dependent billable items by referencing the master data objects billing content is linked to

Aggregation capabilities for billing and invoicing large resellers such as cloud service providers:

Business-to-business-to-consumer (B2B2C) billing scenario: Business partner / contract account master data e.g. for CSPs (cloud service provider) for billing can now be used to reduce the number of billing documents created per BIT (billable item) load by routing the different master data of sub-contracts of a CSP to the same master data for billing. Additional aggregation layer over the the master data for billing reduces the number of line items in billing documents and subsequent invoicing/posting documents. Itemization of the consumed transactions to keep the information on the subcontracts.

- Business-to-business-to-consumer (B2B2C) billing scenario:

Use of business-partner and contract-account master data, such as for cloud service providers (CSPs), for billing to:- Route the different master data of subcontracts of a CSP to the same master data for billing

- Thereby reduce the number of billing documents created per BIT (billable item) load

- Route the different master data of subcontracts of a CSP to the same master data for billing

- Additional aggregation layer over the master data for billing to reduce the number of line items in billing documents and subsequent invoicing and posting documents

- Itemization of the consumed transactions to keep the information on the subcontracts

Benefit

- Enable large resellers to invoice with a reduced data footprint in downstream processes up to the general ledger without losing subcontract information on the transactional level

Upload billing content into convergent invoicing for further processing:

With this app, you can import billable items for Convergent Invoicing from an external source file.

- Upload billing content into convergent invoicing for further processing

Benefit

- Improved uploading of billing content into convergent invoicing for further processing in billable item management, billing, and invoicing

Manage clarification cases resulting from exceptions in the billing and invoicing processes in convergent invoicing:

With this app, you can search for, display, process, and complete clarification cases for Convergent Invoicing.

- New SAP Fiori app to manage clarification cases resulting from exceptions in the billing and invoicing processes in convergent invoicing

Benefit

- Improved management of clarification cases resulting from exceptions in the billing and invoicing processes in convergent invoicing

Support for compliance with legal requirements in contract accounting and convergent invoicing

- Consumption-based revenue recognition with amount-based fulfillments in SAP Revenue Accounting and Reporting

- “Convergent invoicing” functionality for Germany in the SAP Document Compliance solution for Pan-European Public Procurement OnLine (PEPPOL)

Benefit

- Enable customer compliance to legal rules in revenue recognition, invoicing, and tax calculation

Reduce manual interactions and operational costs for customers by providing OData services for end-customer self-service

- OData services that can be exposed, for instance, in a Web portal, to enable end-customer self-services for contract-account and invoice display

- Visibility of key invoice and contract information for customer-facing applications through two first OData services:

- Display an invoice list for a business partner in contract accounting

- Display a payment list for a business partner in contract accounting

- Display an invoice list for a business partner in contract accounting

Benefit

- Reduce manual interactions and operational costs

- Drive improvements in customer satisfaction

- Reduce costs of customer service

Group Reporting

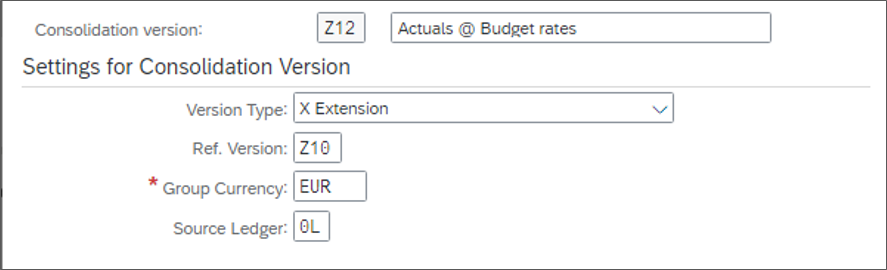

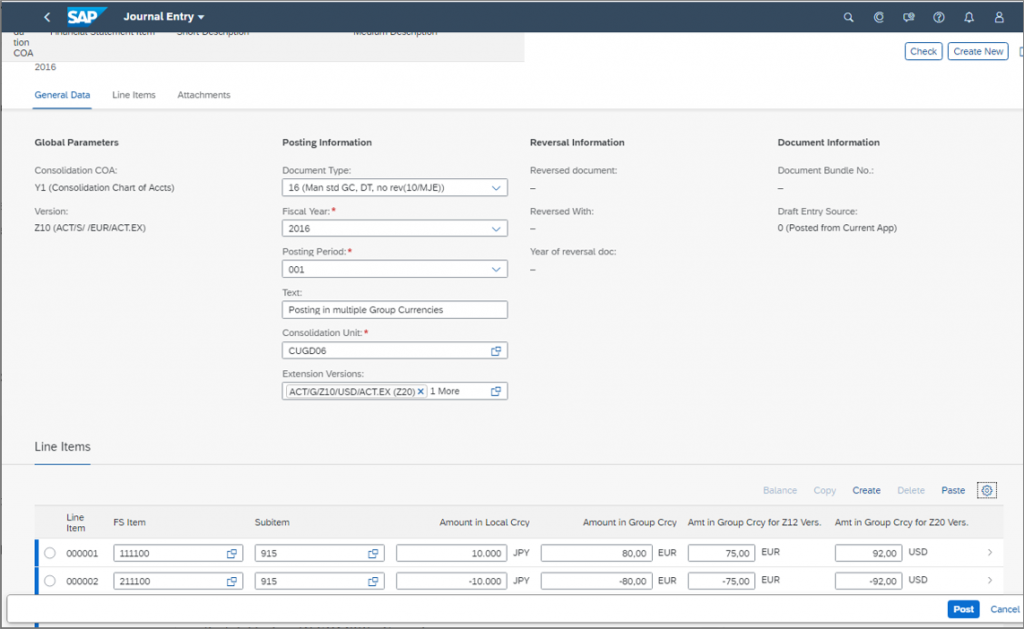

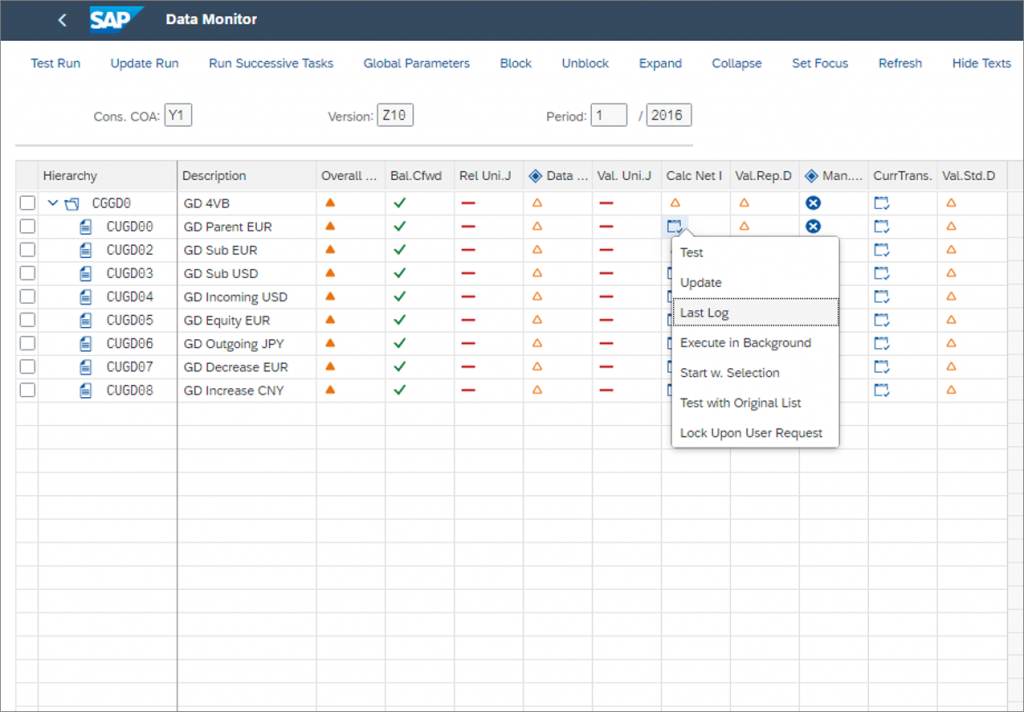

Generate multiple group currencies in a single closing process

Enable the accountant to:

- Configure multiple extension versions to the main standard version which can each carry an additional group currency or additional translation

- Produce these multiple group currencies or translations in a single closing process while processing the standard version in data and consolidation monitor

- Allow posting of manual journals in several group currencies at the same time, keeping the multiple group currency values in columns of the same bundled journal entry

Benefit

- Increase efficiency and automation when working with multiple group currencies or multiple currency translations such as for translation at constant currency rates for comparison reporting

Increase efficiency in consolidation of investments and data collection:

Consolidation of Investments (C/I), and Preparation for Consolidation Group Changes post the adjustments required when a merger happens in a consolidation group. In a merger, there are two consolidation units involved: the ceding unit (disappears during the merger) and the absorbing unit which takes over the balance sheet of the ceding unit. Horizontal merger (both units share the same direct investor) and vertical merger (absorbing unit is the direct investor of the ceding unit) are supported.

- Improved collection of control data for consolidation of investments:

- Additional option to maintain “consolidation of investment control data” in the SAP Group Reporting Data Collection solution

- Additional option to maintain “consolidation of investment control data” in the SAP Group Reporting Data Collection solution

- Support for additional activities:

- Total transfer of an investment between parents

- Handling of a merger

- Total transfer of an investment between parents

Benefit

- Automate postings to reduce manual efforts and improve compliance

- Streamline collaboration across the organization for financial closing

- Enhanced preparation, handling and automation of merger related postings

Improve data quality by flexible field validation and substitution during journal entry

- Define field inputs, type validation, and substitution rules

- Integrate validation and substitution with accounting documents posting

- Define closing tasks for data validation and substitution

- Define corporate validation and substitution rules integrated into source-side accounting documents posting

- Follow-up with the document validation error detected in task execution

- Substitute and derivate the additional field value

Benefit

- Readily define validation and substitution rules for business users

- Enhance data information through substitution and derivation

- Propose correction proposals to help people in quick error corrections

- Leverage one validation, substitution solution for company and corporate finance solutions

Central Finance

Financial Accounting

Financial planning and analysis (FP&A) in central finance – document splitting in central finance

- Enable document splitting in the central finance software system if document splitting is inactive in the source SAP software system

Benefit

- More-detailed analysis through inheriting attributes (such as profit centers) from other document line items or related documents from previous business processes by enabling document splitting in central finance

Central finance – third party interface with the ability to document changes

- Inclusion of replicating document changes from non-SAP systems, through the third-party staging area

- Updating of the corresponding document accordingly in the central finance system

- Extended content for the solution extension by Magnitude

Benefit

- Up-to-date reporting on financial documents from non-SAP systems

Better decision support based on additional parallel currencies

- Tool support for converting existing journal entries to add new currencies that were not previously used

Benefit

- Enables harmonized group reporting without the need to move journal entries to a data warehouse

- Supports legal changes if additional currency, such as functional currency, must be added

Financial Reporting

Central finance – additional financial reporting scenarios

- Central management reporting

- Profit-center reporting on profit and loss and balance sheet using document splitting for profit centers

Benefit

- Gain better insights by enabling consistent reporting across entities in the central software system

- Steer the company better by being able to analyze expenses, revenue, and balance sheet items for profit centers

Financial planning and analysis (FP&A) in central finance: central budgeting and availability control (for internal orders)

- Plan and release budgets centrally for replicated internal orders

- Enable activity control in the source systems to check against a centrally planned budget

- Allow several processes in the different source systems to consume a common budget

Benefit

- Harmonize, centralize, and streamline the budgeting process

- Leverage better budget control by allowing several processes in the different source systems to consume a common budget

Third-party interface in central finance – multiple ledgers

- Replication of documents from a non-SAP source system into a dedicated ledger group or into all ledgers using a third-party interface

Benefit

- Fulfill reporting requirements for several accounting principles using different ledgers