Starting with brief over-view about the process of Lease accounting.

Leased asset remains property of the lessor. They are special form of rented asset.This blog covers how Lessee can handle Leased asset in FI-AA.

This configuration is from the point of view of Lessee. There are two type of leasing.

- Capital Lease

- Operating Lease

Capital lease is shown in balance sheet and operating lease is treated as expense and not shown in balance sheet. Configuration steps are same for both, the difference arrive while settling the asset. Configuration is covered in this blog.

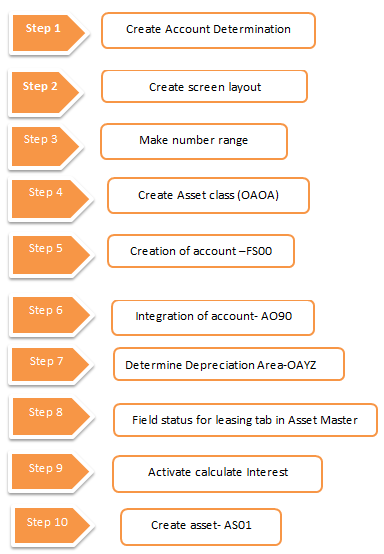

1. Configuration

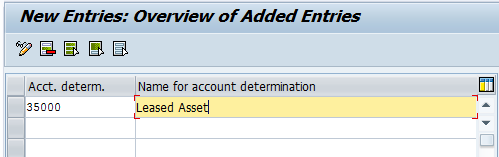

1.1 Create Account Determination

SPRO – Financial Accounting (NEW)- Asset Accounting – organization Structure-Asset Classes-Specify Accounting Determination

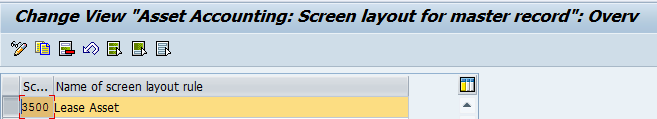

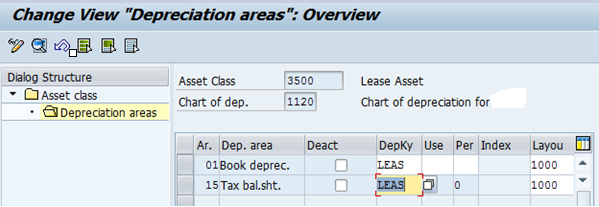

1.2 Create screen layout

SPRO – Financial Accounting (NEW)- Asset Accounting – organization Structure-Asset Classes- create Screen Layout

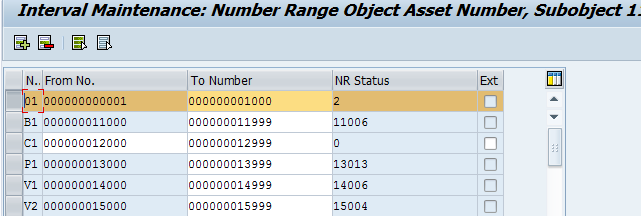

1.3 Make number range

SPRO- Financial Accounting (NEW)- Asset Accounting – organization Structure-Asset Classes-define number range interval (AS08)

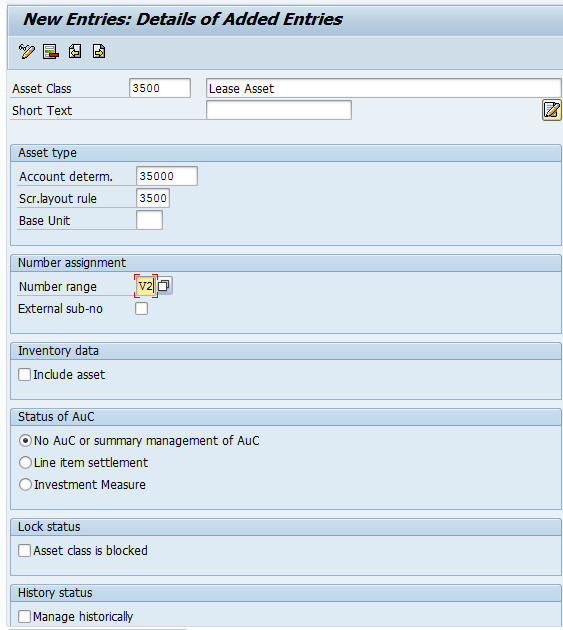

1.4 Create Asset class (OAOA)

SPRO- Financial Accounting (NEW)- Asset Accounting – Organisation Structure-Asset Classes-Define Asset Class

Make new Asset class and assign account determination, number range and screen layout

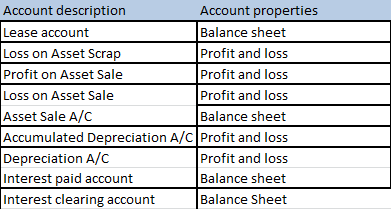

1.5 Creation of account –FS00

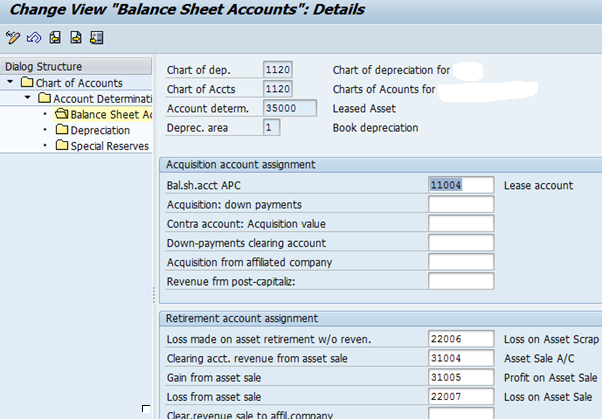

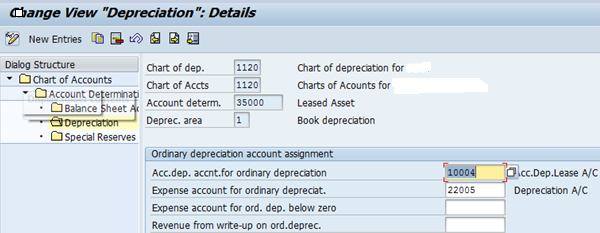

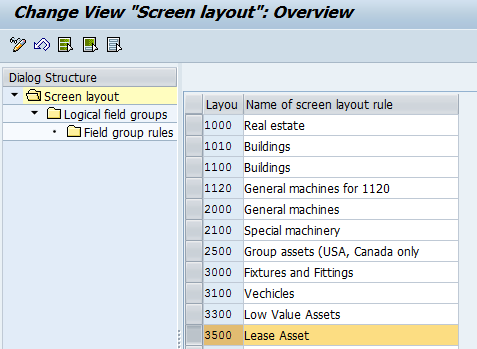

1.6 Integration of account (AO90)

SPRO-Financial Asset-Asset Accounting-integration with GL account- Assign GL Account

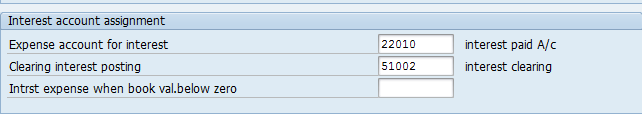

1.7 Determine Depreciation Area (OAYZ)

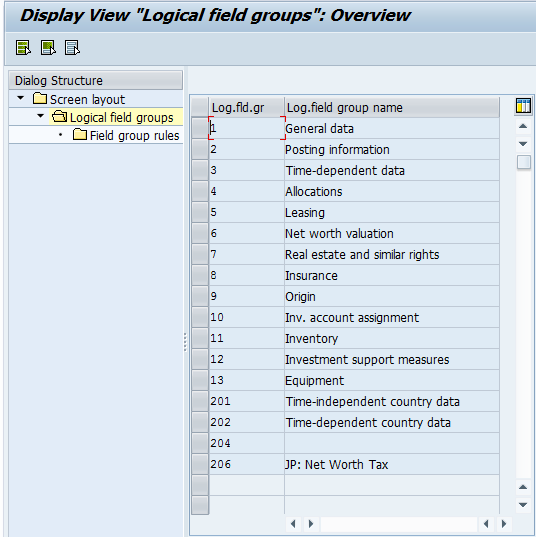

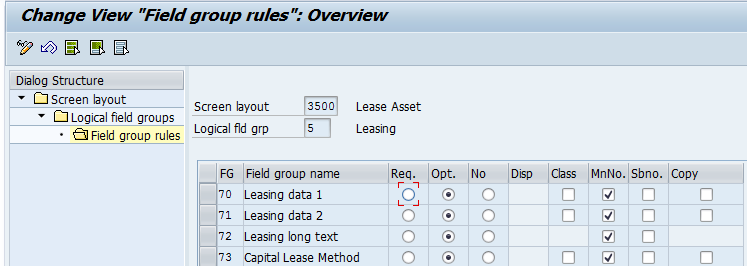

1.8 Field status for leasing tab in Asset Master

SPRO-Financial Asset-Asset Accounting-Master data- Screen layout- Define Screen layout for Asset master

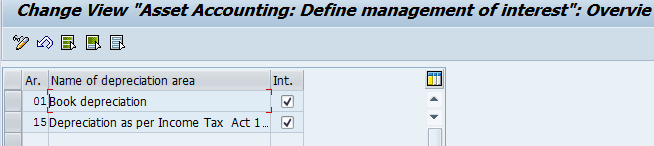

2. Activate interest calculation

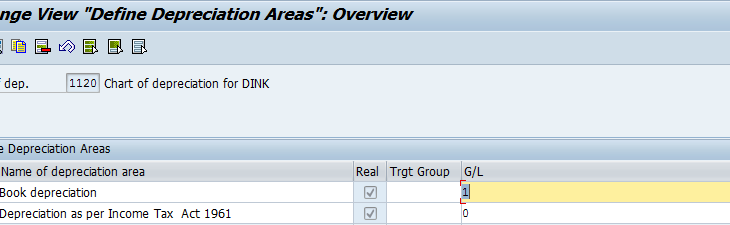

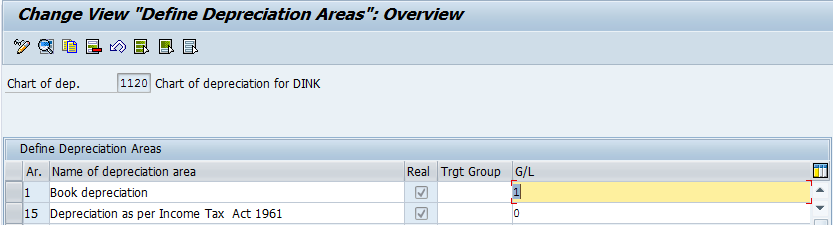

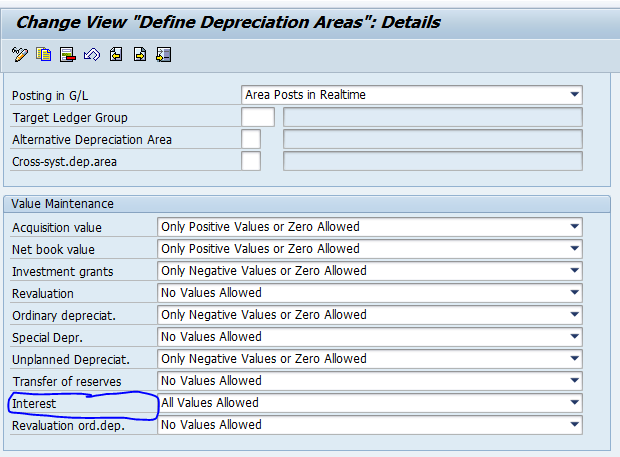

2.1 Depreciation area

Asset Accounting – Integration with the General Ledger – Define How Depreciation Areas Post to General Ledger

2.2 Depreciation Area Posting

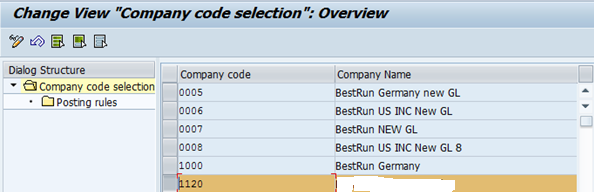

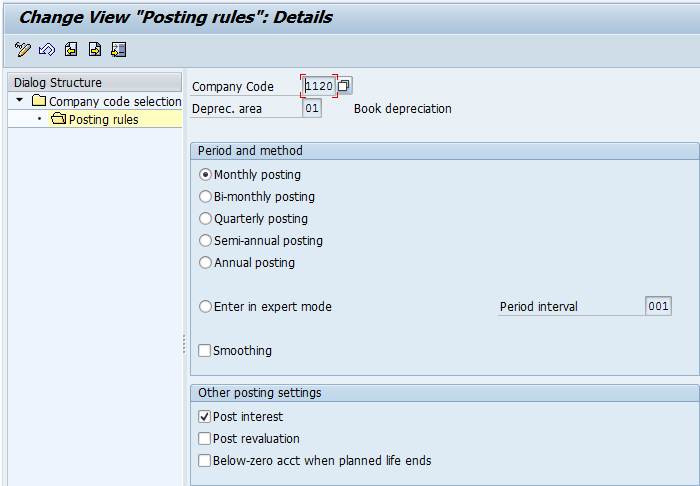

Asset Accounting – Integration with the General Ledger – Post depreciation to the General Ledger – Specify Intervals and Posting Rules

2.3 Specify Allowed Depreciation Types for Depreciation Areas- OABZ

Asset Accounting (Lean Implementation) – Organizational structures – Depreciation Areas – Specify Allowed Depreciation Types for Depreciation Areas

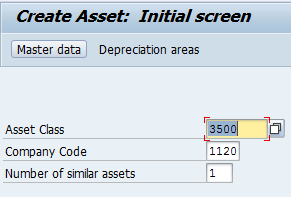

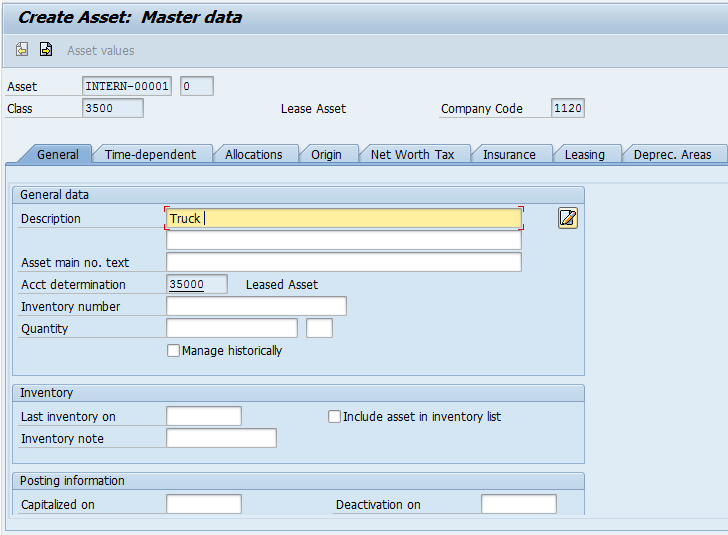

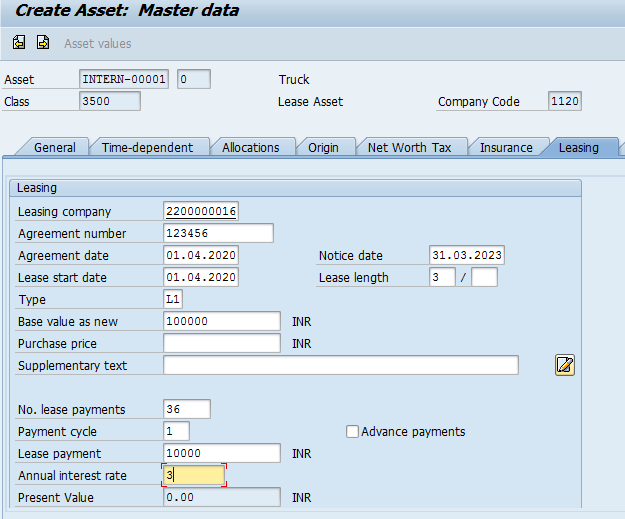

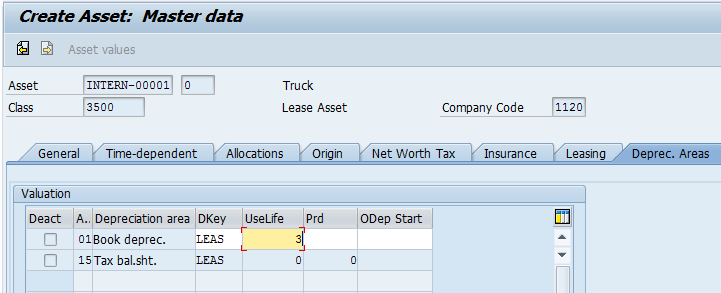

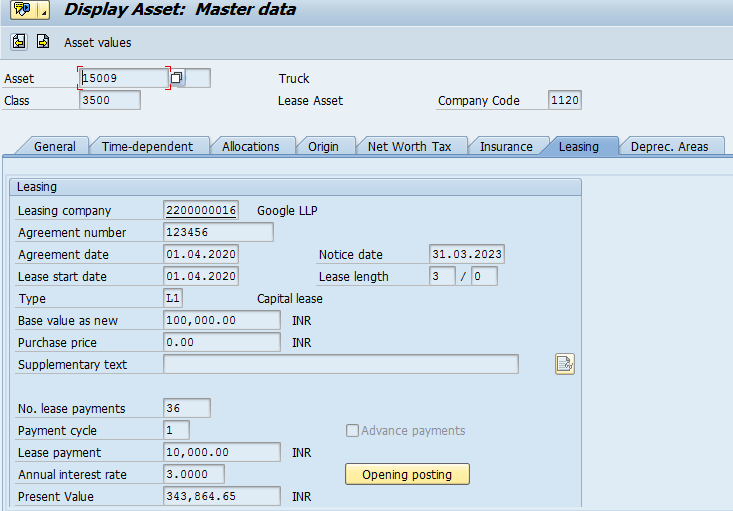

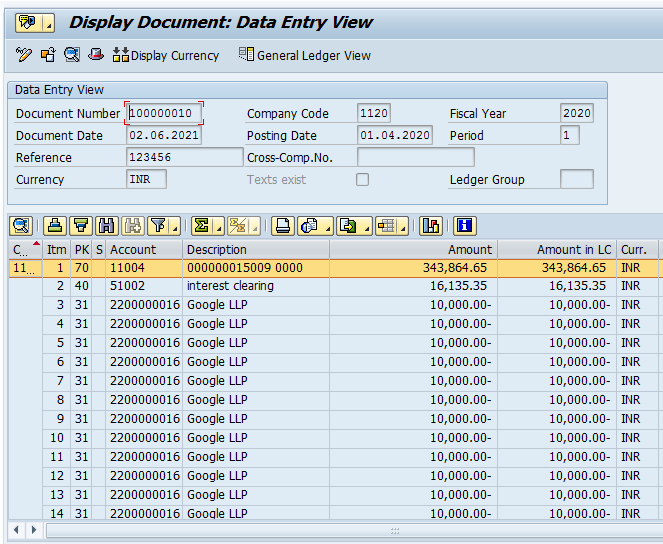

3. Creation of Asset Master data and Acquisition process

This is the Brief process of Lease Accounting in FI-AA.