A. Introduction:

In this blog post, I would like to share my knowledge on the different scenarios related to fund transfer between our company bank accounts. After completion of the blog post reading, you will understand the bank to bank transfer process with in the company code, between the company codes(Co.Codes belongs to same country) and between the company codes (Co.Codes belongs to multiple countries). I assume that reader know how to create a house bank setup and Automatic payment program(FBZP) configuration.

B. B2B Process Overview:

Bank to Bank transfer is nothing but transferring the funds from one Bank to another Bank. It is also called book transfer. We have different types of transfers

• Intra-Company transfer

• Inter Company Transfer

Intra-Company Transfer:

Intra-Company Transfer means transferring funds between two House banks of same Company code or between bank accounts of the same house bank. In general fund transfer is needed to meet the day to day cash and liquidity requirements. It is not possible to transfer funds between multiple currencies.

Inter Company Transfer:

Inter Company Transfer means transferring the funds between the bank accounts of the two company codes. The two company codes belong to same country or it may belongs to multiple countries. There is an additional configuration step in case of bank to bank transfer between company codes belongs to different countries.

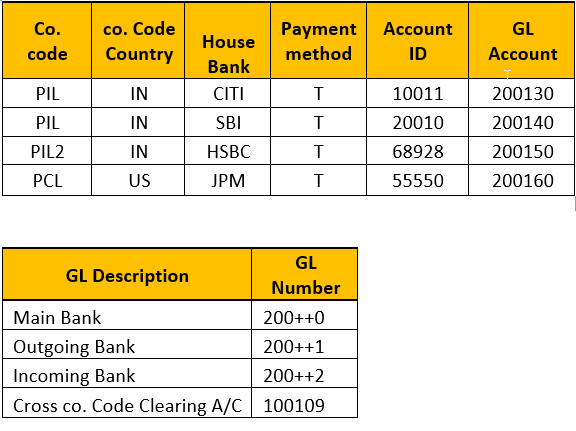

I would like to give a summary about the configuration followed in this document. I’m going to use Bank G/L’s: Main bank- 200++0, Outgoing bank- 200++1, Incoming bank- 200++2 and cross company code clearing account 100109. It is technical clearing account.

In this Blog Post, I am going to show you the the below scenarios.

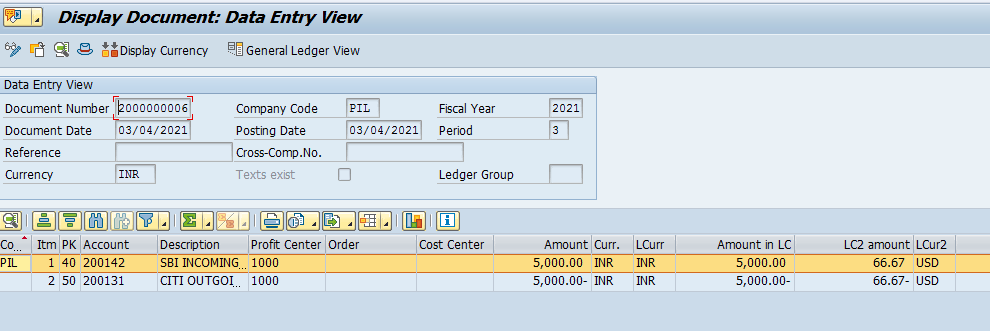

- CITI Bank to SBI Bank (With in Company code – ‘ PIL’ Company code)

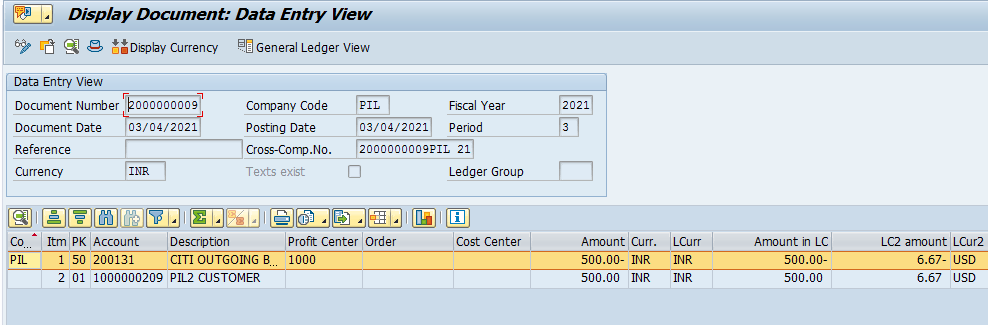

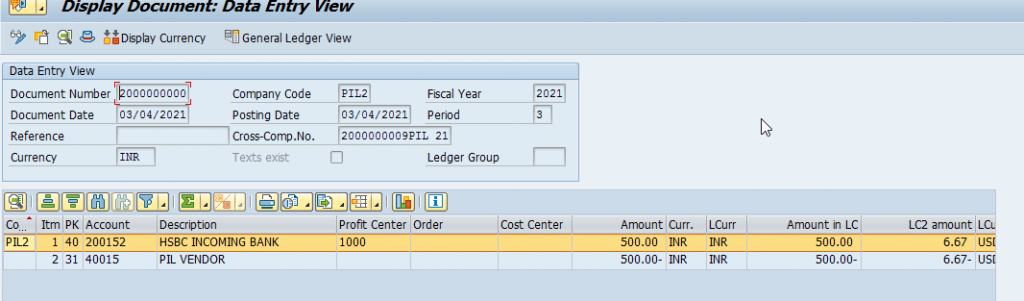

- CITI Bank to HSBC Bank ( between Company codes- PIL to PIL2)

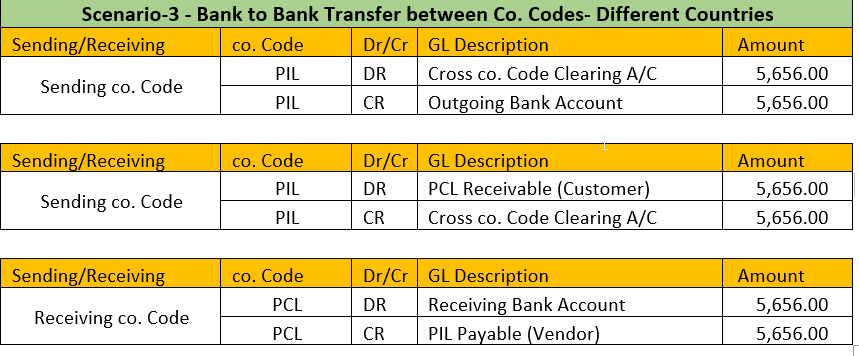

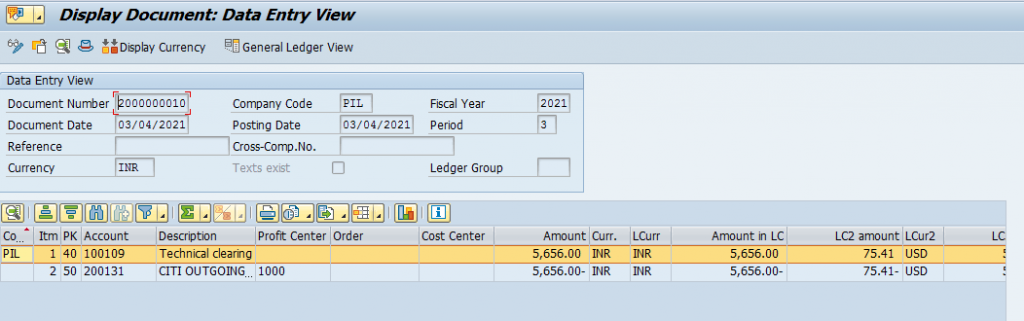

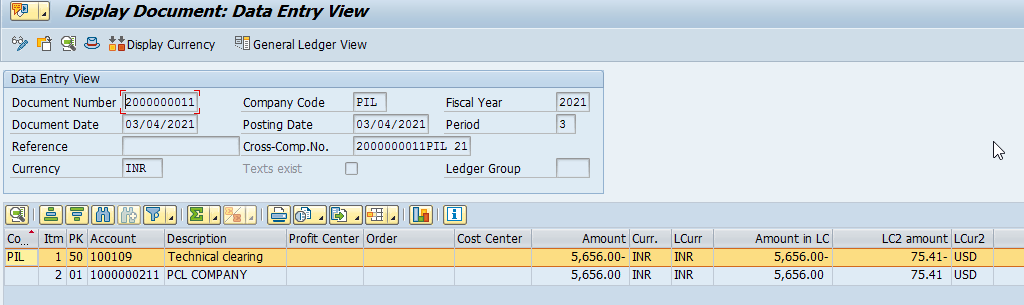

- CITI Bank to JPM Bank (Between Company codes and Between country – PIL to PCL)

Key Data Structure (KDS)

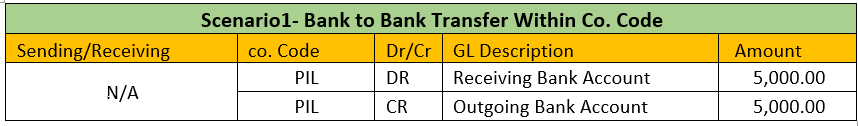

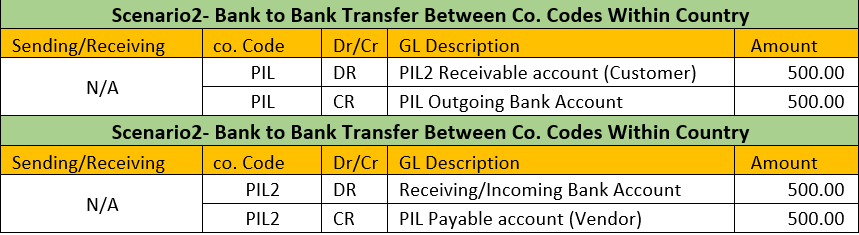

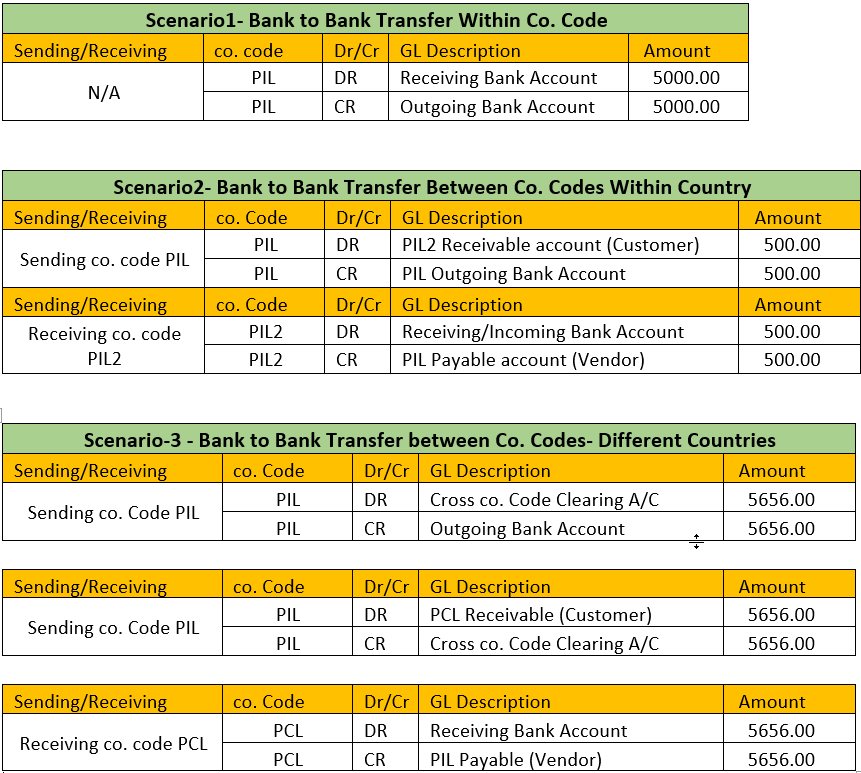

Business Process Scenarios and Accounting Impact

Note:

Please make sure to configure the House bank set up, Automatic payment program (APP) configuration (FBZP), Inter-company configuration (OBYA) and Create Bank G/L accounts (FS00) for your company codes before doing B2B Configuration and End-user steps.

C. Configuration:

1) Define Number ranges for payment requests:

SPRO – SAP Reference IMG – Financial accounting- Bank Accounting- Business Transactions -Payment Transactions – Payment Request – Define Number ranges for payment requests

Number ranges already predefined by SAP. If it is not available for some reason, you can create your own number ranges.

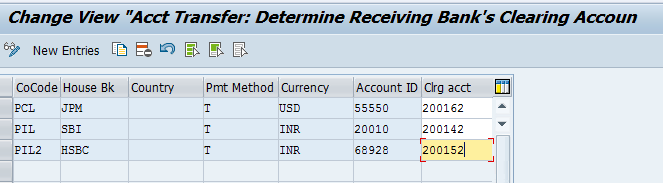

2) Define clearing accounts for Receiving Bank for acct. Transfer

SPRO- Financial accounting – Bank Accounting – Business Transactions – Payment Transactions- Payment Request- Define clearing accounts for Receiving Bank for acct. Transfer

Click on new Entries and Define the receiving bank G/L accounts. I have defined the settings for all the three scenarios

enter your company codes, House Banks (Receiving banks), Payment method, currency, account id and clearing account (Receiving bank’s sub account) then Save.

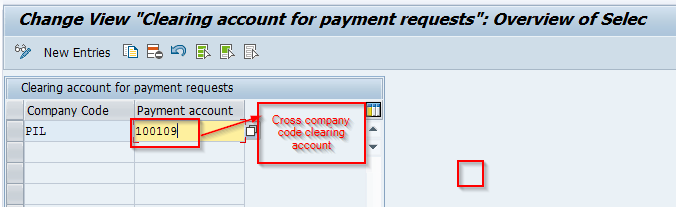

3) Define clearing accounts for cross country bank account transfers

SPRO – SAP Reference IMG – Financial accounting – Bank Accounting- Business Transactions -Payment Transactions – Payment Request – Define clearing accounts for cross country bank account transfers

Click on new entries

Enter the Technical clearing account/ Cross company code clearing account against to your Sending/paying code and then save.

Note:

It is not relevant to any bank. This step is only applicable if you are transferring funds between company codes and are belongs to two different countries like India and USA.

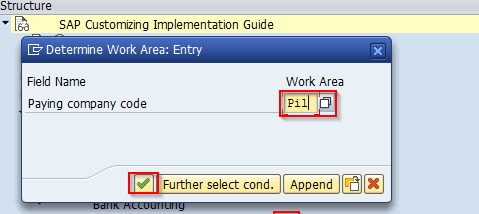

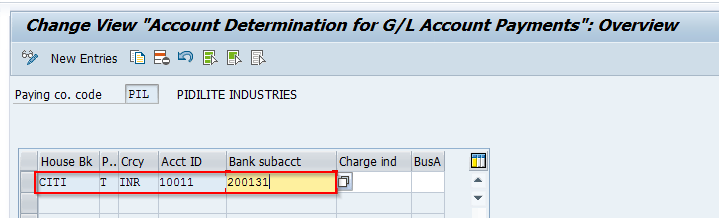

4) Define Account Determination or Clearing Accounts for Company Code:

SPRO – SAP Reference IMG – Financial accounting – Bank Accounting – Business Transactions – Payment Transaction – Payment Request – Payment Handling – Bank clearing account determination – Define Account Determination

Enter Paying company code, click on enter.

Click on new entries and Enter paying company code House bank, payment method, account ID, and Bank subaccount. Then save.

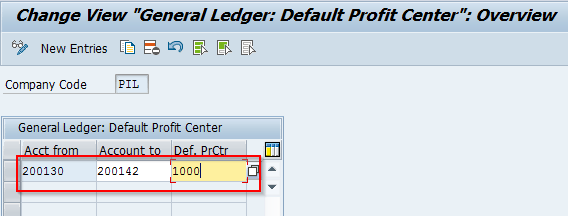

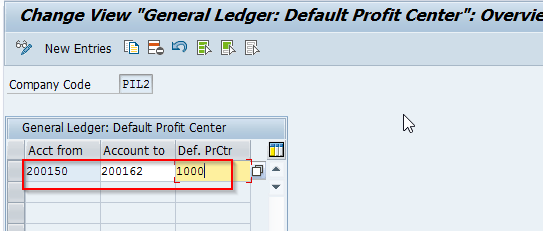

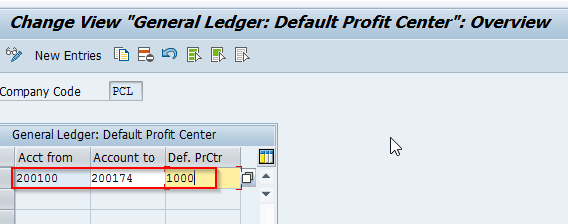

5) Assign Default profit center for Bank G/L accounts – FAGL3KEH:

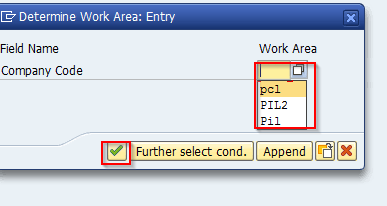

Select your company code and click on enter. It is required if you activate document splitting characteristics by profit center and made it as mandatory.

D. End-User Steps:

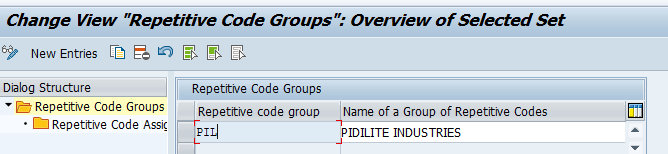

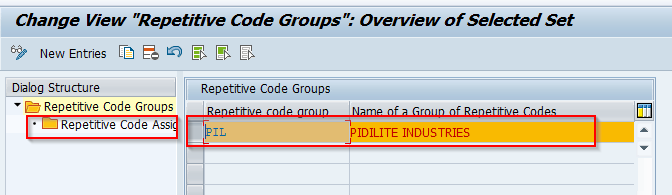

1) Create Repetitive Code Groups (T.Code-FIRPGR):

Click on new entries

Enter your own name under Repetitive code group and enter the description for that and save.

Note: It is not mandatory, Repetitive code group is used to group the Repetitive codes and it is used at the time of B2B transfer process to minimize the Repetitive codes information

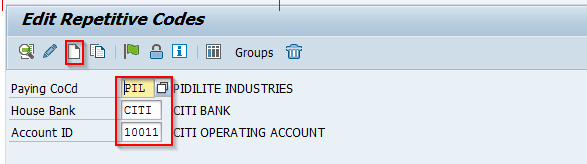

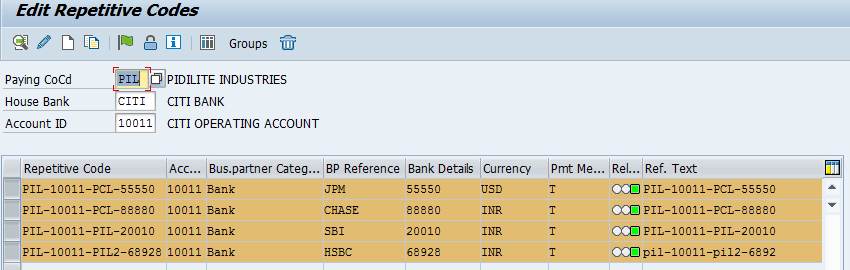

2) Create Repetitive Code (T.Code-OT81):

Accounting – Financial accounting – Banks – Master data – Repetitive codes (OT81):

Enter Paying company code, House Bank & Account ID information and click on Create button

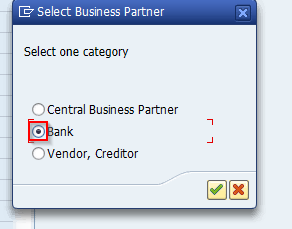

Select Bank Radio button and click on enter

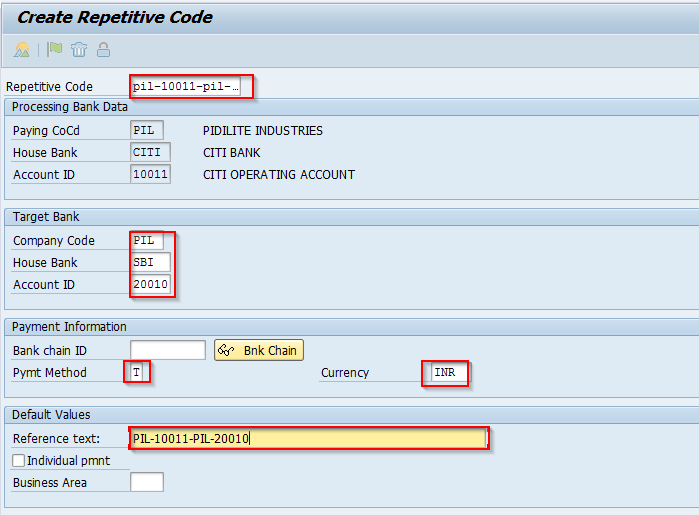

Enter Repetitive code, enter the Target or Receiving company code Bank details, payment method, currency and Reference text and save.

Note: Reference text will update in the Accounting document

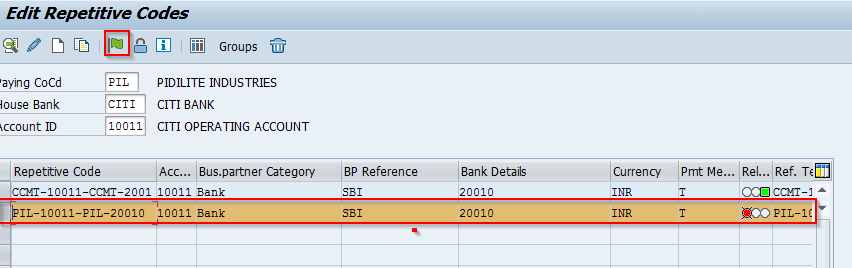

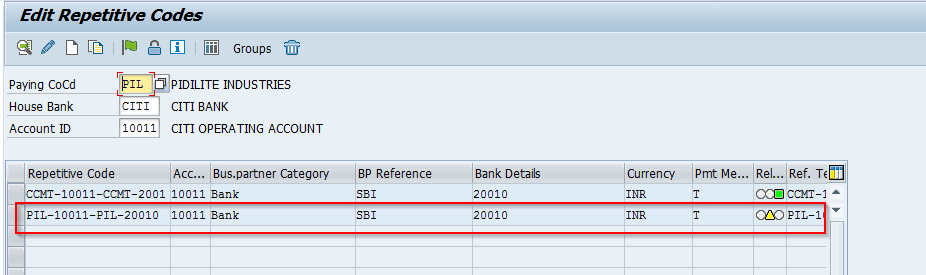

Click on back arrow, select Repetitive code “PIL-10011-PIL-20011” and click on Release icon (Green flag).

Save. Release status color changes from red to yellow.

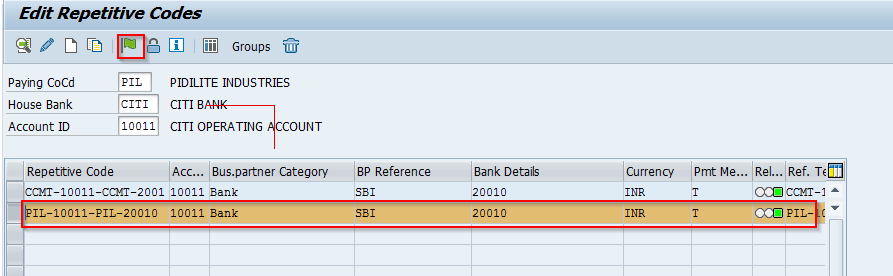

Final approver will select Repetitive code, Release (click on green flag) and then save it.

Release status change from yellow to green. You can not use repetitive code unless it is green.

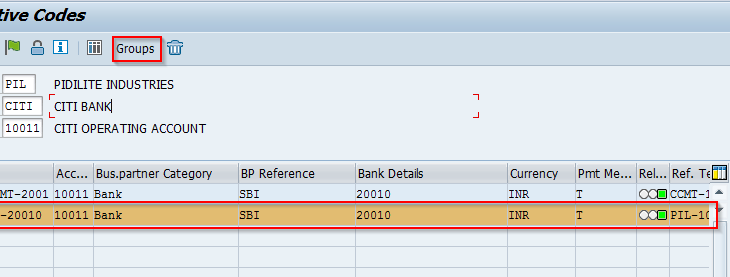

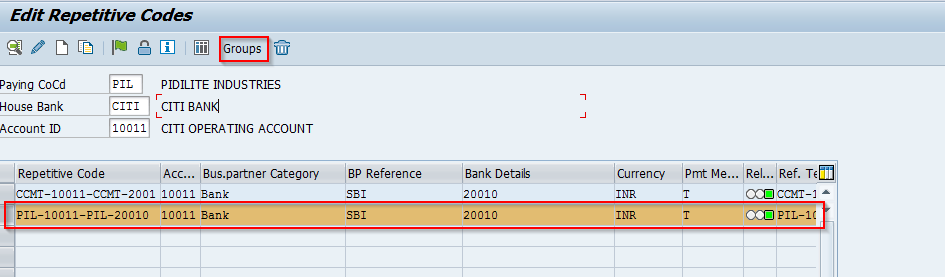

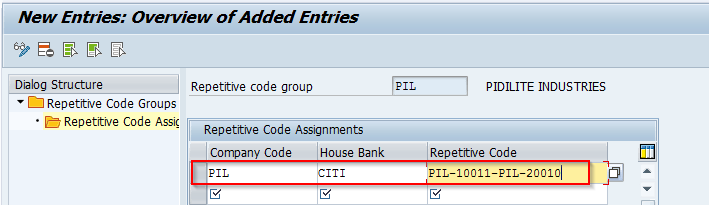

Select your Repetitive code and click on Groups button

Select the Respective Repetitive group (PIL) and double click on Respective Code Assignment folder

Click on new entries, ENTER Your company code, House bank (sending company code related), and your Repetitive Code. Enter and save.

I have created the below repetitive codes to represent the different scenarios. The above process will be continued for the below repetitive codes.

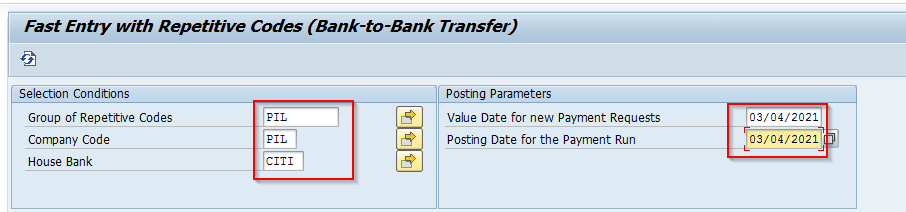

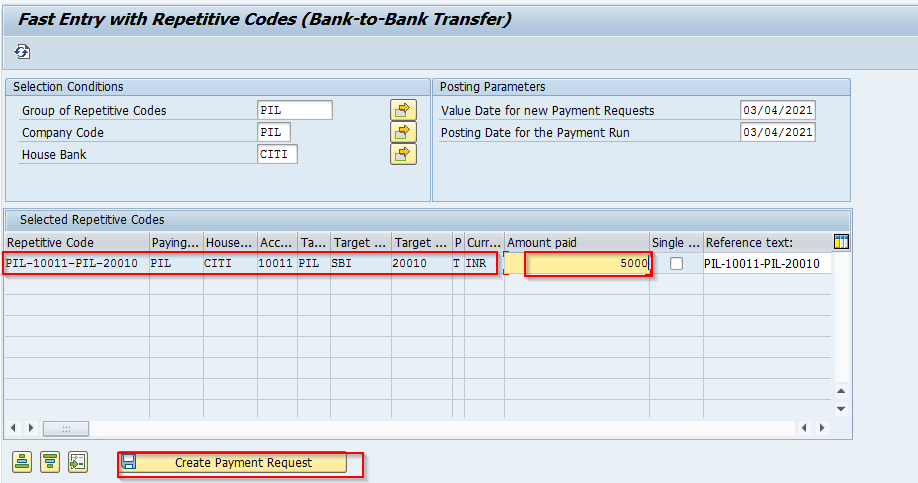

3) Create Bank to Bank Transfer (FRFT_B):

Accounting – Financial accounting – Banks – Outgoing – payments with Respective codes – FRFT_B – Carry Forward Bank Accounts

Select Group of repetitive codes if you have created Repetitive code group, enter your paying or sending company code and House bank and then click on enter.

It shows Relevant Repetitive codes. Enter the amount paid against to your Repetitive code (PIL-10011-PIL-20010) Then click on enter.

Click on Create Payment Request.

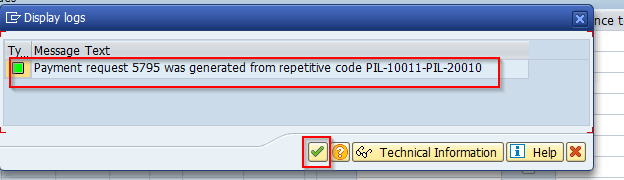

System shows the popup window. System will generate a Payment request number xxxx and then enter.

Payment request number is showing under the open payment request.

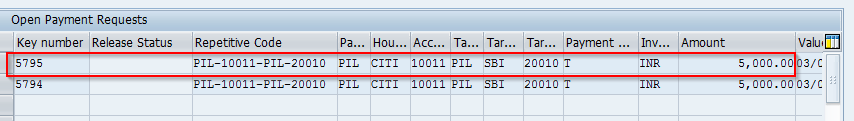

4) Approve Bank to Bank Transfer (FRFT-B):

Accounting – Financial accounting – Banks – Outgoing – payments with Respective codes – FRFT_B – Carry Forward Bank Accounts

Approver will approve the payment request. Enter the Group of repetitive codes or co. code and enter. It shows all open payment requests.

Select open payment request and then click on “Pay”

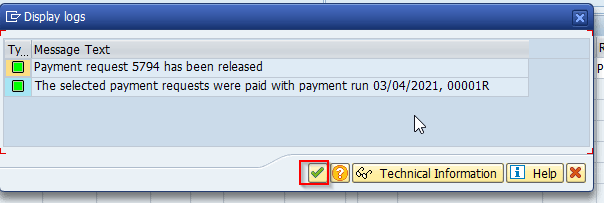

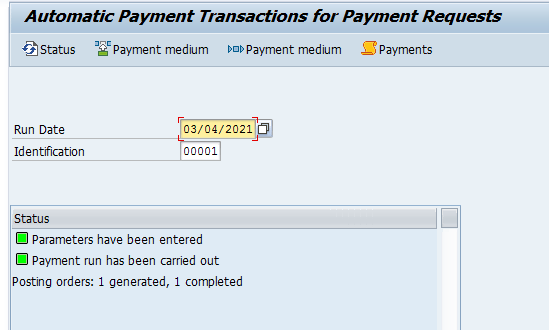

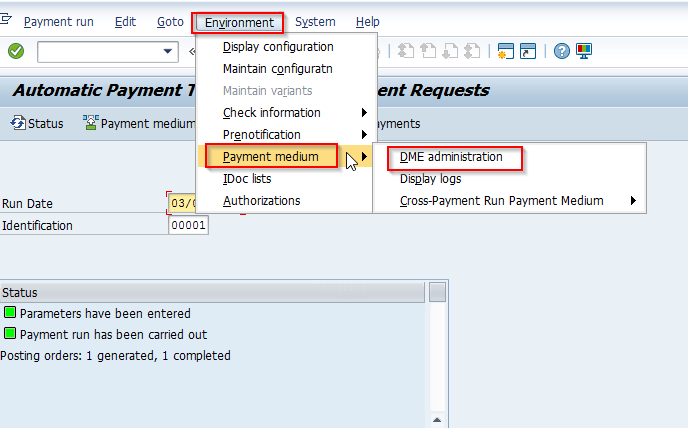

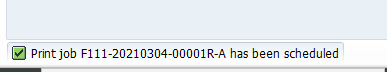

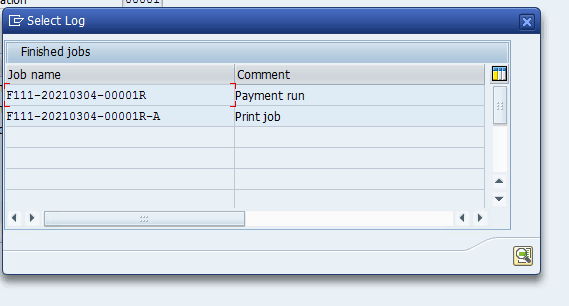

It shows the popup window and gives the information that the Payment request xxxx has been released and Proposal has been created. It can be verified in t. code-F111.

Enter the T-code F111 in the command box

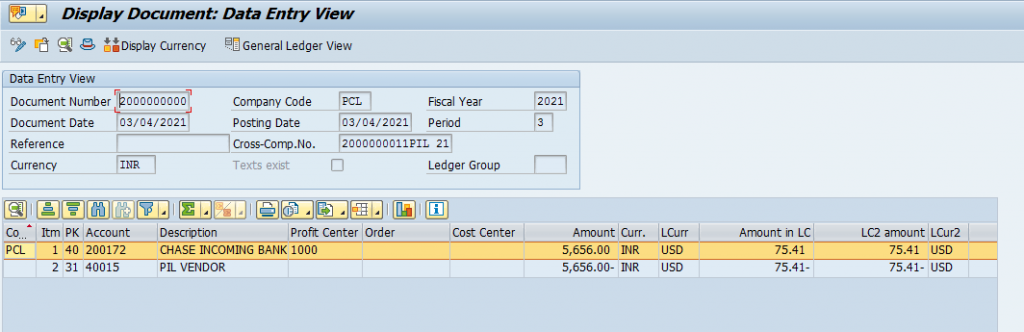

5) Verify Accounting Documents FB03: